Q2 2025 Investment Market Update

The second quarter of 2025 delivered strong investment outcomes across our portfolios, despite what could only be described as an overwhelming backdrop of global noise. In many respects, it was a quarter where staying on holiday, or at least tuned out from the relentless 24-hour news cycle, may have been the optimal approach. From political upheaval and shifting tariff regimes, to election results, evolving economic policy, and geopolitical tensions including missile strikes, the headlines were relentless. Yet markets remained remarkably resilient, underscoring the importance of staying disciplined and focused on long-term fundamentals in the face of short-term uncertainty.

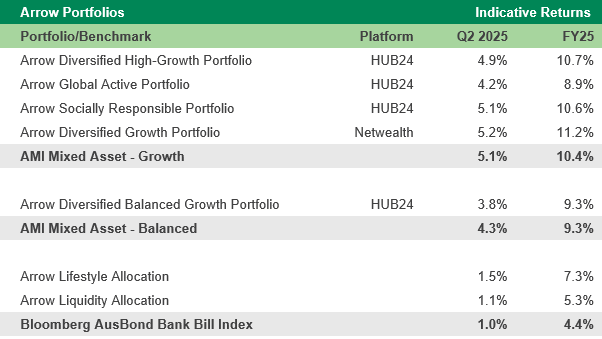

Despite the noise, portfolios finished the quarter on a strong footing. Following a volatile start to April, driven largely by uncertainty surrounding US tariff policy, markets rebounded sharply, and our portfolios participated meaningfully in that recovery. Over the course of the quarter, returns ranged from 3.8% to 5.2%, depending on the strategy.

During the quarter, the Investment Committee implemented a select number of portfolio adjustments, while maintaining a broadly consistent positioning framework. Portfolios remained underweight higher-risk assets, with a deliberate tilt toward investments offering more stable and predictable total return profiles. This approach reflects a measured and risk-aware outlook, designed to manage valuation risks in the current environment of elevated asset prices, while still aiming to deliver on long-term return objectives. Our focus remains on preserving capital and achieving performance outcomes through thoughtful diversification and disciplined asset selection.

International Equities

International equities delivered a strong result in the second quarter, returning 6.1% to Australian investors, despite experiencing a sharp drawdown in early April. Our international equity allocation marginally underperformed the broader benchmark; however, this was largely offset by effective currency positioning. Currency markets were notably volatile during the quarter, with the US dollar depreciating 4.57%. Fortunately, the majority of this movement was hedged at the portfolio level, cushioning the impact for Australian investors.

Markets were unsettled by the introduction of broad-based tariff measures by President Trump, including a proposed 10% blanket tariff on imports, which reignited concerns around global trade disruption, inflationary pressure, and the potential for retaliatory measures. However, investor sentiment improved meaningfully over the remainder of the quarter, as many of the proposed tariffs were either postponed, watered down, or walked back, a pattern that gained traction under what’s now colloquially referred to as the “TACO” trade (Trump Always Chickens Out). This shift helped risk assets recover strongly through May and June.

That said, a core challenge remains the elevated valuation levels across major equity markets. The ASX 200 and S&P 500, which represent approximately 30% and 24% of our neutral asset allocation respectively, continue to trade at historically high multiples. While this does not rule out the potential for further gains in the short to medium term, it does temper long-term return expectations and increases sensitivity to potential market corrections. Our asset allocation and risk management strategies remain focused on balancing opportunity with caution in this context.

*Source: JPMorgan

To address elevated valuation risks and diversify sources of return, we’ve implemented a series of deliberate portfolio adjustments:

Rotating toward more attractively valued markets: We reduced exposure to Australian equities in favour of UK equities, where valuations are more compelling and better aligned with underlying economic fundamentals. The UK also offers superior forward-looking growth prospects relative to the local market, making it an attractive destination for capital allocation.

Expanding private market exposure: Realised gains from listed equities were redeployed into our private equity allocation, introducing a differentiated return stream with lower correlation to public markets. This move is part of a broader strategy to reduce reliance on listed equities and enhance the portfolio's structural resilience and return potential.

Re-engaging with defensive asset classes: The normalisation of interest rates has significantly reshaped the investment landscape. Defensive exposures which offered limited value in the prior low-rate environment, now provide compelling forward-looking characteristics. We continue to see these as essential components of a well-diversified, risk-conscious portfolio.

In line with this thinking, we also reduced global equity exposure during the quarter to fund an additional allocation to private equity. This decision allowed us to realise gains after a period of strong performance and rebalance away from stretched valuations, particularly in the US, where equity markets remain well above historical valuation norms. The move reflects our broader effort to preserve capital, enhance diversification, and position portfolios for more sustainable long-term outcomes.

In April we increased the currency hedge ratio to 65%, following a sharp sell-off in the Australian dollar. This adjustment was made on an opportunistic basis, with the view that the AUD would likely recover once market volatility subsides.

Australian Equities

Australian equities rallied by 8.4% over the quarter & our portfolio's allocation marginally underperformed the broader benchmark across the quarter.

Sector performance was varied. Information Technology led the way with a standout +28.4%, driven by a sharp rebound in growth names as risk appetite returned. Financials also performed strongly, rising +15.8%, supported by solid earnings and easing concerns around credit quality. Communication Services followed closely, up +14.1%. In contrast, defensively positioned and interest rate-sensitive sectors lagged: Consumer Staples fell -3.27%, while Materials and Health Care declined -0.65% and -1.05%, respectively. This rotation toward cyclical and growth sectors suggests growing investor confidence in the outlook.

Supporting this sentiment shift was the RBA’s decision to cut the cash rate by 0.25% to 3.85%, citing signs of easing inflation, now within the 2–3% target band. Although the domestic economy is recovering and financial conditions have improved, the central bank acknowledged ongoing concerns, including global uncertainty and sluggish productivity. The policy move is intended to reinforce growth without jeopardising inflation control, providing a constructive backdrop for risk assets.

Following the 2025 federal election, which delivered a majority victory for the Australian Labor Party under Prime Minister Anthony Albanese. The outcome offered few surprises and reinforced a sense of policy continuity, particularly in key areas such as taxation, housing, and superannuation. As largely expected, markets didn’t bat an eye, play on as far as they’re concerned.

Investor sentiment was buoyed by a resurgence in local capital market activity, highlighted by the dual IPOs of Greatland Resources and Virgin Australia on June 24. Both companies debuted with multi-billion-dollar valuations, signalling renewed appetite for primary equity issuance. The strong reception to these listings may act as a catalyst for a broader revival in the local IPO market, particularly as ASIC introduces reforms to streamline and expedite the listing process.

No changes were made to the Australian equity allocation of the portfolio during the quarter.

Property & Infrastructure

Property and infrastructure delivered positive returns over the quarter, albeit with differing dynamics. Listed infrastructure posted a modest +0.6%, consolidating gains after a particularly strong start to the year. In contrast, Australian-listed property rebounded sharply, returning +13.7% and recovering ground lost in the first quarter. On a year-to-date basis, infrastructure remains the top-performing asset class at the headline level with a return of +7.7%, while property has delivered a solid +6.0%.

While listed assets have shown resilience, unlisted real estate continues to bear the impact of the broader valuation reset stemming from the end of the ultra-low interest rate environment. Over the past two years, it has been the most challenged segment within portfolios, with office assets particularly affected, some experiencing declines of more than 20%. However, this story is not uniform across the sector. Industrial real estate has demonstrated relative strength, underpinned by healthy rental growth and operational performance, which has helped buffer valuation pressures.

Encouragingly, the RBA’s recent pivot toward monetary easing is expected to act as a tailwind for unlisted property markets, potentially supporting capitalisation rates and improving sentiment across the asset class. With the environment now shifting, we are actively reviewing both existing exposures and prospective opportunities, to ensure client can be well positioned for the next phase of the cycle.

There were no changes to the property and infrastructure allocation of the portfolio.

Private Equity & Venture Capital

Private equity strategies were quieter over the quarter. Core buyout strategies returned between 0.29% and +2.39%, depending on the fund, while our venture strategy returned 1.31%. We are still awaiting end-of-June valuations for some strategies.

During the quarter, our venture strategy reached a significant milestone, recording its first IPO exit with Voyager Technologies, a US-based space infrastructure company. Voyager’s public listing marked a successful debut, validating our approach of targeting high-quality, late-stage private businesses through the secondary market. Since the Fund’s inception in 2022, the broader IPO landscape has faced notable headwinds. However, the strategy has remained disciplined, selectively building exposure to businesses nearing maturity. Encouragingly, a recent pickup in capital markets activity has brought several portfolio companies closer to potential liquidity events, including Kraken, Discord, Cerebras Systems, Databricks, and xAI, as the environment for exits begins to improve.

The Investment Committee initiated a new private equity allocation within portfolios. This strategy is structurally distinct from our existing private market exposure, with a dedicated focus on secondary market opportunities. In today’s environment, marked by reduced exit activity and limited capital distributions, many investors are seeking liquidity by selling fund interests at discounted valuations. This dislocation presents a compelling entry point for secondary investors, enabling access to private equity exposures at attractive pricing.

The increased allocation to this position was funded through profits harvested from international equities allocation, reflecting our ongoing effort to rotate capital from fully valued listed markets into longer-term, less correlated opportunities. The inclusion of this secondary strategy adds another lever of return while enhancing the portfolio’s overall diversification and return asymmetry. We continue to see the private markets as a powerful tool for generating long-term value, particularly when accessed with the right partners and through disciplined, opportunistic entry points.

Enhanced Income

Australian bonds delivered a solid return of 2.4% over the quarter, contributing positively to portfolio outcomes and reinforcing their defensive role. Encouragingly, fixed income has now posted gains in both quarters of 2025, helping to offset some of the volatility observed across growth-oriented assets. Performance was supported by a backdrop of rising economic uncertainty and evolving monetary policy expectations. Heightened geopolitical tensions and signs of slowing global growth prompted a renewed flight to quality, driving demand for sovereign bonds and underpinning their appeal as a portfolio stabiliser.

Floating rate credit strategies also continued to perform well, offering attractive income and stability. However, looking ahead, we anticipate forward-looking returns to moderate, particularly if the RBA continues to ease policy settings, as expected. Despite this, these exposures have served an important role within portfolios. For example, since the beginning of 2024, when we began meaningfully allocating to the Mutual High Yield Fund, performance has been strong and notably more stable than Australian equities, which experienced periods of drawdown during the first half of the year.

This contrast illustrates the value of incorporating high-quality floating rate credit as a ballast against market volatility and elevated equity valuations. These exposures have helped to deliver smoother, more resilient return profiles, aligning with our objective of constructing well-diversified portfolios that can navigate a broad range of market conditions.

Source: FE Analytics

During the quarter, we increased the portfolio’s exposure to duration, reflecting our view that interest rates are likely near their peak and that longer-dated fixed income now offers attractive risk-adjusted return potential, particularly in the event of an economic slowdown or further rate cuts.

The end of June presents an opportune moment to assess portfolio outcomes. The data below compares performance against peer groups segmented by similar levels of risk, as defined by each portfolio’s equity exposure. Pleasingly, most models delivered strong total returns and outperformed their respective peer benchmarks. It’s also worth noting that approximately 20% of underlying investments have yet to report performance to the end of June, meaning final figures may be further enhanced as remaining data is incorporated.

Pleasingly, over the financial year, our portfolios,with the exception of the Arrow Global Active Portfolio, delivered returns that were either in line with or slightly ahead of their broader peer groups. This represents a strong outcome for the team and builds on the positive momentum established over recent years.

The liquidity and lifestyle allocations performed also delivered good outcomes for investors over the period offering attractive total reutns for 1 & 3 year investment horizons.

Below we have compared the performance of our investment solutions with the top 10 superannuation funds as ranked by Chant West over the last decade. We're proud to report that our portfolios have delivered returns that are closely aligned with those of the leading, highly rated funds in the market. While Legal Super was a strong performer in FY25, achieving notably higher returns, the consistent alignment of our results with top-tier peers reinforces good outcomes.

Attribution across our portfolios was broad-based, with a number of positions contributing positively to returns. As is typical over any 12-month period, not every asset class performs in tandem, and some inevitably experience periods of relative weakness.

At the position level, approximately 40% of the portfolio outperformed, with particularly strong results from Australian equities, notably our mid- and small-cap exposures, as well as our allocations to the UK and commodities. Listed infrastructure was also a standout performer over the period.

Around 35% of the portfolio delivered in line with expectations, including passive index exposures, which tracked their respective benchmarks, along with emerging markets and private equity, both of which performed solidly within their expected ranges.

The remaining 25% underperformed their benchmarks or experienced softer conditions. This was most evident within our global equity allocation, where both active core managers lagged, and Indian equities went through a weaker stretch. In addition, listed global real estate had a relatively muted year and detracted modestly from overall portfolio performance.

From an asset allocation perspective, our positioning was a minor detractor from portfolio returns when assessed purely through a performance lens. We maintained a deliberate underweight to risk assets during a 12-month stretch in which equities and other risk markets delivered strong results. However, it's important to emphasise that portfolio management involves more than chasing returns. Managing risk exposure and volatility relative to prevailing market conditions is a critical part of our approach, particularly in an environment characterised by elevated valuations and persistent macroeconomic uncertainty. While this more conservative stance may have tempered upside over the period, it also helped ensure portfolios remained resilient and well balanced, positioned not only to participate in strong market upside, but also to withstand future periods of disruption. This reflects our broader commitment to delivering consistent, risk-adjusted outcomes over the long term, rather than reacting to short-term market noise.

While our portfolios have had a good period, there is still plenty of work to do as the investment landscape evolves. Should you have any queries about the material in this letter, please do not hesitate to contact me.

Ryan Synnot

Associate Director, Investment Research & Solutions

Arrow Private Wealth

More Insights

Latest Insights

General Advice Warning:

Any general advice in this email does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.