Q4 2025 Investment Market Update

Investment portfolios edged higher over the final quarter of the year, rounding out another solid period of strong outcomes across portfolios. Compared with the previous quarter, markets were a little bumpier, with some pullbacks along the way, but overall momentum remained intact.

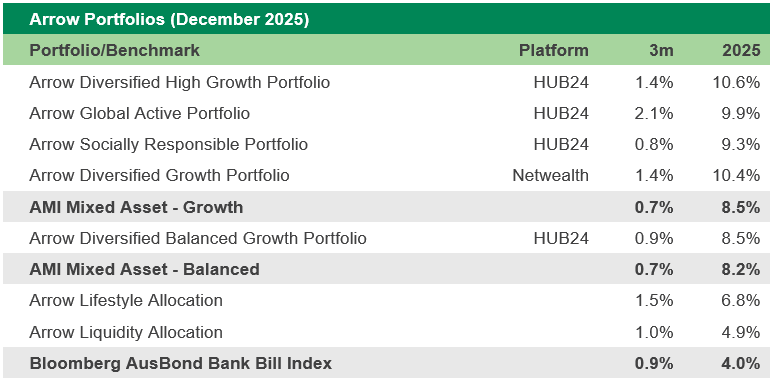

Performance varied month to month throughout the quarter. Strong returns in October were enough to offset market weakness in November, while December was relatively subdued, with portfolios largely flat over the month. For the quarter as a whole, returns ranged between 0.8% and 2.1%, depending on the strategy.

Looking across the full year, 2025 was another strong year for investment performance. Returns were generated across a broad range of asset classes, with portfolios delivering between 8.5% and 10.6% depending on strategy. Performance was also attractive on a relative basis, with all portfolios outperforming their respective peer groups over the year.

During the quarter, the Investment Committee made a small number of portfolio adjustments. These included a manager change within the global equity allocation, along with ongoing rebalancing actions which included taking profits from strongly performing holdings and reallocating capital toward new opportunities.

By quarter-end, portfolios continued to hold a measured underweight to higher-risk assets, maintaining a deliberate tilt toward investments offering more stable and predictable total return profiles. This positioning reflects our disciplined and risk-aware approach, managing valuation risks in an environment of elevated asset prices while remaining focused on long-term objectives. Our priority remains unchanged: preserving capital and delivering consistent outcomes through thoughtful diversification and disciplined asset selection.

International Equities

International equities delivered a solid result in the fourth quarter, returning 2.74% to Australian investors. While our international equity allocation slightly underperformed the broader benchmark over the quarter, outcomes for the full year were strong. Over 2025, international equities delivered a return of 14.08%, providing attractive results for investors.

The artificial intelligence arms race continues to dominate market narratives, as it has for the past couple of years. The capital expenditure cycle remains firmly underway, though traditional sources of funding are beginning to shift. Until recently, AI hyperscalers largely relied on the free cash flow generated by their highly profitable core businesses to fund AI-related investment. We are now starting to see a greater reliance on debt markets.

In late October 2025, Meta Platforms issued a record-breaking US$30 billion in investment-grade bonds, the largest high-grade corporate bond issuance of the year, primarily to fund significant investment in AI infrastructure and data centres. Earlier in the year, Alphabet had also raised approximately US$25 billion across US and European bond markets, and other hyperscalers are expected to follow a similar path into 2026.

In the context of these companies’ overall financial positions, the bond issuance is relatively inconsequential at this stage. Alphabet alone generated around US$35 billion in earnings during the September quarter. That said, the increasing involvement of debt investors introduces a new dynamic. Bond investors tend to approach capital allocation with a more conservative lens, focused on downside protection and returns on invested capital rather than the blue-sky scenarios that equity investors often emphasise. Over time, this may result in greater scrutiny of AI investment economics and impose a higher level of discipline on capital expenditure decisions. It will be interesting to watch how this dynamic evolves through 2026.

From a geopolitical perspective, 2026 has already started on a volatile footing. The United States launched military strikes in Venezuela, resulting in the capture of then-President Nicolás Maduro, while social unrest has escalated in Iran. While events such as these tend to dominate headlines and stir emotion, history suggests they often have limited direct impact on corporate earnings. In Venezuela’s case, the local equity market has surged more than 130% since Maduro’s removal, and a number of Western oil companies have also benefited.

The oil sector more broadly presents an interesting investment case. For much of the past decade, the industry has effectively been in wind-down mode, prioritising shareholder returns and limiting capital expenditure on new exploration and development. Any renewed investment in Venezuela would likely require substantial capital commitments over timelines that extend well beyond political cycles, raising questions about whether the risks outweigh the potential rewards for some participants.

During the quarter, the Investment Committee made a change within the global equity allocation, replacing one of our global small-cap managers. This adjustment was made in response to underwhelming performance from the legacy position and is expected to improve overall outcomes while also reducing overall investment costs.

Australian Equities

Australian equities declined by 1.01% over the quarter but finished 2025 up 10.32%. Our portfolio’s Australian equity allocation performed broadly in line with the benchmark over the year. Performance within the allocation was mixed, with strong contributions from mid- and small-cap positions, which outpaced the broader market, while both of our core managers underperformed the benchmark in what proved to be a challenging year for Australian equity managers more broadly.

Despite this, our Australian equity allocation has performed very strongly over the past two to three years, even while maintaining an underweight position in the major banks. Outperformance has been driven primarily by mid- and small-cap exposures. We continue to believe this segment represents the “sweet spot” of the Australian market, offering access to high-quality businesses with the potential to grow earnings at a rate above the broader economy. Interestingly, there has been fairly widespread weakness across Australian technology stocks in recent months, including names such as Xero and REA, which have traded materially lower. This is an area of the market we are watching with interest.

A positive backdrop for Australian equities has been the steady improvement in the domestic economic cycle. We have seen gradual improvement in household conditions as real wage growth and savings rates have lifted, translating into better GDP outcomes, albeit from a low base. This has been a consistent theme playing out over the course of 2025.

Sector performance across the market was highly uneven over the year. Materials led the way with a strong gain of 36.2%, supported by elevated commodity prices and the appreciation in the gold price, which was a dominant investment theme. Industrials and Utilities also delivered solid returns of 14.0% and 13.2% respectively, underpinned by infrastructure spending and stable cash flows. Financials, led by the Australian banks, posted a respectable return of 12.1%, despite a sell-off in the market’s largest constituent, Commonwealth Bank, over the final few months of the year.

In contrast, more defensive and growth-oriented sectors lagged. Consumer Discretionary returned a modest 4.1%, while Energy added just 3.2%. Consumer Staples eked out a small gain of 2.0%, reflecting tougher conditions across the supermarket sector. The weakest results came from Information Technology and Health Care, which declined sharply by 20.8% and 23.7% respectively.

In November, we made a small adjustment within the Australian equity allocation, taking profits from both our small- and mid-cap positions. These allocations have benefited from a very strong period of performance, returning 102% and 58% respectively since the start of 2023, and required rebalancing to bring them back in line with target weights. Proceeds were used to rebalance global equity exposures and add to selected defensive holdings.

Property & Infrastructure

Property and infrastructure both delivered slightly negative returns over the quarter. Listed infrastructure was relatively flat, declining by 0.1%, while Australian listed property fell by 1.4%. Despite the softer quarter, both asset classes generated solid outcomes over the full year, returning 8.5% and 9.24% respectively.

From a portfolio perspective, infrastructure was a strong contributor over the year. This reflected two factors: we maintained an overweight position to the asset class throughout the period, and our underlying manager, Atlas, substantially outperformed the benchmark, delivering a return of 23.2% over 2025 on a currency-hedged basis. Underlying performance within the strategy was driven by high-quality infrastructure assets in the UK and Europe, which performed strongly relative to other regions. Utilities, water and renewable energy holdings were key contributors, benefiting from stable regulation, ongoing investment programs and improving earnings visibility.

We do not currently hold an allocation to Australian REITs within portfolios. The domestic listed property index has been difficult to access in a meaningful way due to the heavy concentration in Goodman Group, which dominates the benchmark and limits diversification. We do, however, hold an allocation to global listed real estate. While this exposure delivered positive returns over 2025, it lagged stronger-performing asset classes and therefore detracted modestly from relative portfolio performance.

Looking ahead into 2026, we are increasingly constructive on real estate, particularly within local commercial property markets. The sector has experienced a prolonged period of valuation adjustment over recent years, and more recently has benefited from some relief through lower interest rates, improving the cost of leverage. Encouragingly, several subsectors, including industrial and convenience retail, have demonstrated an ability to grow rents and we expect this trend to continue.

There were no changes to the property and infrastructure allocation within the portfolio during the quarter.

Private Equity & Venture Capital

Private equity strategies delivered quieter over the quarter. Core buyout strategies returned between -0.08% and +2.13%, depending on the fund, while our venture strategy delivered a +23.5% return. We’re still awaiting end-of-December valuations for some underlying strategies, which may adjust results once received. Over the year core buyout strategies returned between +3.3% and +10.4%, depending on the fund, while our venture strategy delivered a +26.2% return.

The outlook for the 2026 IPO market is improving, building on the reopening seen in 2025 as market volatility eases and valuation expectations continue to normalise. A substantial backlog of high-quality, late-stage private companies is now approaching public-market readiness, with issuance expected to be led by technology, artificial intelligence, fintech, cybersecurity and next-generation industrials. Importantly, many prospective issuers are larger, better capitalised and closer to profitability than in prior cycles, supporting expectations of a more durable and selective IPO environment. Notable candidates frequently cited by market participants include Canva, Anthropic, SpaceX, Revolut & Stripe.

While we don’t typically include a separate “Alternatives” section in these updates, it’s worth noting the remarkable run in gold this year. The metal has gained over 50% across 2025, and gold miners, whose profits are leveraged to gold prices, have performed even more impressively, more than doubling in value over the same period. With any currency or commodity, it can be hard to pinpoint a single driver of gold’s rally. However, rising geopolitical tensions, higher US debt levels, and a weaker US dollar have all played a part in strengthening the investment case.

Although we don’t hold a dedicated allocation to gold, our commodities exposure has included gold as one of its largest underlying positions. This fund was the portfolios top performing in 2025, returning +59.9% and +12.4% over Q4, supported by broad contributions from several commodities.

Given the magnitude of the performance across a short window the position had grown well beyond its intended portfolio weight, so we trimmed it back recently to lock in gains and reallocate capital to other opportunities.

Enhanced Income

Australian bonds delivered a return of -0.90% over the quarter, detracting slightly from overall portfolio performance, though our exposure to the asset class remains relatively modest. Over the full year, bonds underperformed cash, returning 3.35% compared with 3.97%. In contrast, floating-rate strategies continued to perform well, providing an attractive margin above cash and delivering stable, consistent income across client portfolios.

During the quarter, expectations for monetary policy shifted materially. Reserve Bank of Australia forecasts moved from anticipating two rate cuts over the next 12 months to pricing in the possibility of two rate hikes, as inflation pushed back above the RBA’s target band, with core CPI reaching 3.3% in October. At the post-December Board meeting press conference, RBA Governor Michele Bullock noted that if inflation does not appear to be moving sustainably back into the target range, the Board would be prepared to take further action.

We continue to believe the outlook for defensive assets, particularly floating-rate strategies, remains compelling. These assets play an important role in portfolios, especially in an environment where equity market valuations remain elevated. Floating-rate exposures offer highly attractive risk-adjusted returns, with the potential to generate high single-digit outcomes without taking on anything like the level of risk associated with equities. The prospect of further interest rate hikes would only strengthen the return outlook for these strategies, as higher base rates flow directly through to income.

To put this into perspective, the three-year return to the end of December from the Mutual High Yield Fund, which is widely used across our portfolios, was 10.67%. Over the same period, Australian equities returned 11.39%, only marginally higher despite significantly greater volatility.

During the quarter, we modestly increased defensive allocations using proceeds from profit-taking across Australian equities and alternative investments. This capital is expected to earn an attractive return while preserving flexibility to deploy into new opportunities as they arise.

Portfolio performance continues to hold up very favourably on both an absolute and relative basis, as shown below. Over the past quarter and calendar year, our portfolios have performed in line with or ahead of their respective peer groups, despite maintaining an underweight position in risk assets throughout the period.

Reflecting on what did and didn’t work over the year, outcomes were varied, as you would expect within a well-diversified portfolio. Around 40% of the portfolio performed exceptionally well, which we would define as asset classes that generated outsized returns during the year, such as commodities, or active managers that materially outperformed their benchmarks. A further 40% of the portfolio performed broadly in line with expectations, including asset classes that delivered fair, steady results and passive strategies that tracked benchmarks closely. The remaining 20% underperformed expectations, largely driven by a small number of active managers that failed to meet their benchmarks rather than broad asset class weakness.

In addition, while not a formal asset class, currency positioning contributed positively to performance over the year. The US dollar depreciated by 7.15% against the Australian dollar, although much of this movement was mitigated through portfolio-level hedging.

Portfolio performance and investor outcomes have been very strong over the past three years, effectively delivering three consecutive years of double-digit returns. Performance has likely tracked ahead of expectations and continues to benefit from positive momentum, which is encouraging to see. That said, it remains important to taper expectations looking forward. Strong markets can make it easy to become complacent, something we are mindful to avoid. If we were to model forward-looking portfolio projections based on current capital market assumptions, we would expect outcomes to be below the strong returns realised over the past few years.

While portfolios have enjoyed considerable success in 2025, there is still plenty of work to do as the investment landscape continues to evolve. Our focus remains on maintaining a measured and cautious outlook, managing valuation risks while continuing to support our clients’ long-term return objectives.

Should you have any questions about the information in this letter, please don’t hesitate to get in touch.

Kind Regards,

Ryan Synnot

Head of Investment Management

Arrow Private Wealth

Similar Insights

Latest Insights

General Advice Warning:

Any general advice in this email does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.