Q3 2025 Investment Market Update

The third quarter of 2025 delivered another period of positive investment outcomes across our portfolios. Compared with the prior quarter, it was a quieter few months from a headlines perspective, as markets continued their steady upward trend.

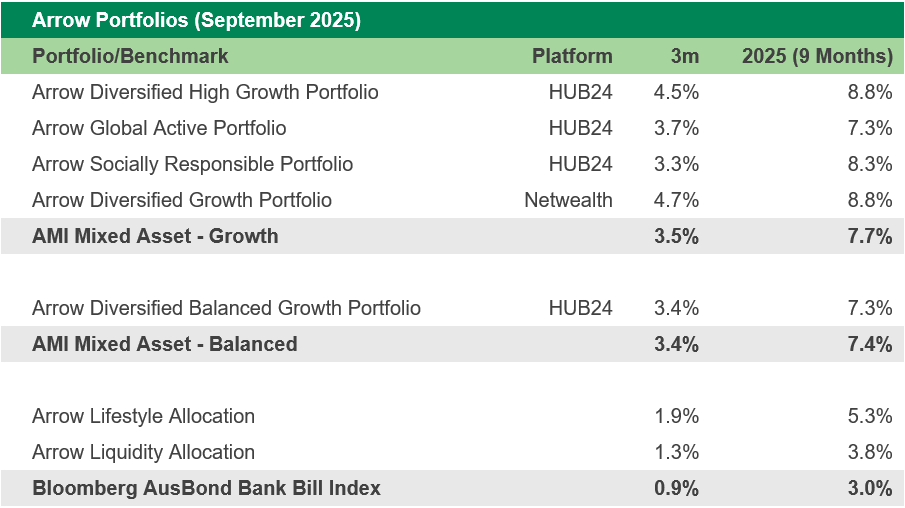

Portfolio performance was consistent throughout the quarter, with returns ranging between 3.4% and 4.5%, depending on strategy. Results across July, August, and September were notably steady, as returns were positive each month.

During the quarter, the Investment Committee made a small number of portfolio adjustments. These changes were primarily rebalancing actions, recycling profits from strongly performing holdings into new opportunities, ensuring portfolios remain aligned with our intended positioning and risk parameters.

By quarter-end, portfolios continued to hold a measured underweight to higher-risk assets, maintaining a deliberate tilt toward investments that offer more stable and predictable total return profiles. This positioning reflects our disciplined and risk-aware outlook: managing valuation risks in an environment of elevated asset prices while remaining focused on long-term return objectives. Our priority remains clear, preserving capital and delivering consistent outcomes through thoughtful diversification and disciplined asset selection.

International Equities

International equities delivered a strong result in the third quarter, returning 6.9% to Australian investors. While our international equity allocation slightly underperformed the broader benchmark, it still produced attractive total returns. The US dollar depreciated over the period, which reduced gains for Australian investors, though part of this currency impact was hedged at the portfolio level.

The continuation of the artificial intelligence (AI) theme remained the key driver of global markets. The world’s largest technology companies, the so-called AI hyperscalers like Microsoft, Google, Amazon, and Meta, continued to invest heavily in AI infrastructure. This investment has become one of the most powerful forces behind the strength of the US economy and equity markets given the sheer magnitude and velocity of this cap-ex.

Despite some signs of softness in other parts of the economy, AI-related capital expenditure has proven remarkably resilient. For these firms, AI is viewed as an existential race that will define leadership in the coming decades. They see AI as potentially the most transformative technology in history, and are determined to lead, regardless of near-term costs or profitability concerns. Taking a Field of Dreams, “build it and they will come” approach to capital allocation.

This momentum is being reinforced by a favourable funding environment and strong demand. Financing isn’t yet a constraint; many hyperscalers are still returning more capital to shareholders than they raise, and their cost of debt remains low relative to the returns they generate. Meanwhile, corporate America is diving headfirst into AI with boardrooms across the country pushing management teams to “buy now, figure it out later.” This enthusiasm is driving strong revenue and earnings growth for Big Tech, validating their ambitions and fuelling a self-reinforcing cycle of cash flow and reinvestment.

While much of the world’s attention remains on AI and US technology stocks, another story has been unfolding elsewhere and it’s catching investors by surprise. China, after some difficult years, has staged a notable recovery in 2025. Following three recent years of double-digit declines, the market has rebounded sharply this year, outperforming the S&P 500 year-to-date. Political tensions remain, and many investors had labelled the region “uninvestable,” but sentiment has shifted quickly as performance has improved. Our portfolios benefited from this turnaround through our Asian equity exposure, which was among the top contributors to performance in Q3 2025.

During the quarter, the Investment Committee made a change within the global equity allocation, replacing a higher tracking error strategy with a lower tracking error strategy. This adjustment is designed to improve consistency, reduce concentration risk, and lower overall investment costs. It also provided an opportunity to take profits on our currency hedging program as part of the transition.

Australian Equities

Australian equities rallied 4.7% over the quarter, and our portfolio’s allocation significantly outperformed this benchmark. Strong contributions came from mid and small-cap companies, which outpaced the broader market and reinforced the value of our diversified exposure beyond the large-cap names.

Sector performance was mixed over the quarter. Energy led the way with a strong gain of 20.7%, supported by rising commodity prices and resilient global demand. Consumer Discretionary and Information Technology also performed well, rising 19.9% and 10.4% respectively, helped by easing inflation and renewed optimism toward growth-oriented companies. Industrials and Financials delivered solid returns of 9.6% and 9.2%, underpinned by steady earnings and a more confident consumer backdrop. In contrast, the more defensively positioned sectors lagged, with Health Care falling 1.3% due to a weaker result from CSL, and Consumer Staples slipping 1.4% as major retailer Woolworths reported a disappointing update.

A particularly notable move came from Commonwealth Bank (CBA), the market’s largest constituent, which fell 8.3% during a quarter when the broader index advanced. This was significant, as CBA has long been a challenge for active managers given its size in the index and historically elevated valuation. The stock had been trading at a substantial premium to both its domestic peers and global banking counterparts, making it a difficult name to avoid, even for managers cautious about its lofty pricing.

Our Australian equity allocation has performed strongly over the past two to three years, despite maintaining an underweight position in the major banks. Outperformance has been driven by mid- and small-cap exposures, where our specialist managers continue to generate strong levels of alpha. We continue to believe this mid-cap segment represents the “sweet spot” in the Australian market, offering exposure to high-quality businesses with the potential for earnings growth above the broader economy’s pace.

During the quarter, the Reserve Bank of Australia (RBA) cut the cash rate by 0.25% to 3.60%, citing continued moderation in inflation, now close to the midpoint of its 2–3% target range. While the economy is gradually recovering and labour market conditions are easing, productivity remains subdued and global uncertainty persists. The Board judged that a modest rate cut was appropriate to support growth while maintaining price stability, reaffirming its commitment to sustainable inflation and full employment.

Finally, there was a minor rebalance within our Australian equity allocation following end-of-financial-year distributions paid in July, returning portfolios to their intended target weights.

Property & Infrastructure

Property and infrastructure both delivered positive returns over the quarter, albeit with differing dynamics. Listed infrastructure posted a modest +0.8%, marking a relatively quiet six months for the asset class following a strong start to the year, passing on the crown as the best-performing asset class year to date. In contrast, Australian-listed property performed well, returning +4.6% for the quarter.

During the period, we caught up with our global REIT manager for an update on listed real estate markets. After a prolonged stretch of subdued performance, conditions appear to be improving as the sector transitions into the next phase of its cycle. Property values have largely stabilised, and early signs of rental growth are beginning to contribute to total returns. A more supportive interest rate environment is helping to underpin valuations, while limited new supply, constrained by high construction and replacement costs, which should continue to support rental growth across most sectors.

Although REITs are now trading around their long-term average valuations, rather than at deep discounts, the combination of improving fundamentals, disciplined capital management, and solid sectoral growth drivers, particularly in areas such as healthcare, data centres, and self-storage, supports a constructive medium-term outlook.

Importantly, REITs also offer exposure to an area of the market that has not experienced the same valuation pressures seen in many other asset classes. They provide investors with defensive characteristics, underpinned by tangible real estate assets, which can add valuable stability and diversification within portfolios.

There were no changes to the property and infrastructure allocation within the portfolio during the quarter.

Private Equity & Venture Capital

Private equity strategies were quieter over the quarter. Core buyout strategies returned between -1.5% and +0.3%, depending on the fund, while our venture strategy delivered a +2.3% return. We’re still awaiting end-of-September valuations for some underlying strategies, which may adjust results once received.

The private equity secondaries market continues to offer attractive opportunities as investors seek liquidity and managers extend ownership of high-quality assets. Activity in transactions remains healthy, characterised by disciplined pricing and strong competition for quality deals. After a period of slower activity through 2023, the market has found a more sustainable balance between buyers and sellers, supporting steady and consistent deal flow.

Recent months have also seen strong performance from our private equity secondaries exposure, with mark-ups of +4.36% in June and +1.41% in July, reflecting the ongoing progress and underlying value of portfolio companies. We remain optimistic that this position will continue to contribute positively through to year-end.

While we don’t typically include a separate “Alternatives” section in these updates, it’s worth noting the remarkable run in gold this year. The metal has gained close to 40% year-to-date to the end of September, and gold miners, whose profits are leveraged to gold prices, have performed even more impressively, more than doubling in value over the same period.

Like any currency or commodity, it can be hard to pinpoint a single driver of gold’s rally. However, rising geopolitical tensions, higher US debt levels, and a weaker US dollar have all played a part in strengthening the investment case.

Although we don’t hold a dedicated allocation to gold, our commodities exposure has long included gold as one of its largest underlying holdings. This position has performed exceptionally well, returning +42% year-to-date and +28% over Q3, supported by broad contributions from several commodities. Following this strong performance, the position had grown well beyond its intended portfolio weight, so we trimmed it back recently to lock in gains and reallocate capital to other opportunities.

There were no changes to the Private Equity or Venture Capital allocations during the quarter.

Enhanced Income

Australian bonds delivered a 0.6% return over the quarter, contributing positively to overall portfolio performance, though results were slightly below cash returns for the period. Floating-rate strategies continued to perform well, providing an attractive margin above cash and generating stable, consistent income across client portfolios.

Bond market outcomes have improved substantially since 2022, which was a difficult period for the asset class. That year saw a sharp repricing in bond yields as resurgent inflationary pressures triggered significant market adjustments, leading to a -8.7% return, one of the worst years on record for fixed income. However, this reset in yields has significantly improved the forward-looking prospects for bonds. With higher starting yields and a more balanced inflation outlook, the asset class has since rebounded strongly, delivering a three-year annualised return of 4.4%, now exceeding the return from cash.

Private credit has come under increased scrutiny in recent months as journalists and regulators, including ASIC, focus on practices within the asset class. The sector has grown rapidly since the Global Financial Crisis, as banks stepped back from traditional lending and new investors moved in to fill the gap. Broadly speaking, private credit continues to offer attractive, consistent, and cash-generative returns, and it remains an important part of diversified portfolios. However, the significant inflows of capital and the influx of new managers have made careful selection increasingly important as a race for capital will inevitably attract bad actors.

As investors in the space, we welcome the prospect of stronger oversight. Improved regulation should help lift overall standards and consolidate weaker operators, ultimately strengthening the long-term sustainability of the asset class. At Arrow, we’ve been highly selective, partnering only with a small number of established managers who have demonstrated discipline, experience, and alignment with investors.

When assessing managers in this sector, I thought it might be valuable to focus on several key factors and areas we consider:

Size and Scale – Larger, well-resourced managers are better positioned to build diversified loan books that aim to diversify away idiosyncratic risk effectively.

Workout Capability – Defaults are an inevitable part of credit investing. (Despite what the media may be led to believe) The crucial question is how experienced a manager is in managing and recovering value from stressed loans. Does the manager have evidence of this and are they resourced to undertake workouts.

Investor Alignment and Transparency – Understanding who the other investors are, how much they have invested, and the ownership structure of the manager provides insight into alignment and governance quality.

Track Record and Experience – We place strong emphasis on long-term performance, team stability, and the ability to manage through past credit cycles. Also, the experience of key individuals within the team.

Alignment of Interests – We look for managers with meaningful personal investment alongside clients and fair, transparent fee structures that reward long-term value creation over short-term risk-taking or a high velocity of deals. There are many fees that aren’t clearly disclosed to investors that can worsen net returns and create poor incentives for managers.

Overall, while the asset class faces greater scrutiny, these developments are healthy and necessary. With disciplined selection and appropriate diversification, private credit remains a valuable source of stable income and risk-adjusted return potential within client portfolios.

There were no changes to the Enhanced Income allocation of the portfolio during the quarter.

Investment performance continues to hold up very favourably on both an absolute and relative basis, as shown below. Over the past quarter and calendar year, our portfolios have performed in line with or ahead of the peer group, despite maintaining an underweight position in risk assets throughout the period.

It’s worth noting that these are interim results only. Approximately 15–20% of the HUB24 managed account allocations are yet to report performance to the end of September. Given the positive momentum across markets, we expect this remaining data to further improve the overall results once received.

On the defensive side, our strategies targeting cash plus 1% and cash plus 3% over one- and three-year horizons respectively continue to deliver stable, consistent returns. These allocations are designed to provide reliability for clients with shorter investment horizons or lower risk appetites and continue to play an important stabilising role within diversified portfolios.

Early October has seen continued momentum, pushing several portfolios into double-digit territory, which always a welcome sight for investors. For context, double-digit annualised returns imply the potential to double an investment within roughly seven years.

Portfolio performance has likely tracked ahead of expectations and continues to ride a strong wave of positive momentum, which is great to see. That said, it’s also a time to remain disciplined. Strong markets can make it easy to become complacent, something we’re careful to avoid. If we were to model forward-looking portfolio projections based on current capital-market assumptions, we would expect outcomes to be below the strong returns realised so far this calendar year.

While our portfolios have enjoyed considerable success this year, there is still plenty of work to do as the investment landscape continues to evolve. Our focus remains on maintaining a measured and cautious outlook, managing valuation risks while continuing to support our clients’ long-term return objectives.

Should you have any questions about the information in this letter, please don’t hesitate to get in touch.

More Insights

Latest Insights

General Advice Warning:

Any general advice in this email does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.