Q2 2024 Investment Market Update

The second quarter of 2024 yielded mixed market results, with rallies from the first quarter losing momentum. It was a relatively quiet period as markets generally trended steadily. While investor sentiment remains positive, the overall feeling is that the pace has slowed.

Although portfolios were subdued, there is still plenty to discuss at the asset class level, as the overarching narrative has likely shifted slightly. Inflation remains a concern for central bankers, but we've experienced a continued period of disinflation over the past 12 months. Investors have shifted their focus to economic risks, policy decisions, and geopolitical events, which have dominated headlines and are likely to remain topical through the end of the year.

In terms of portfolio performance, the quarter was quite volatile. Our portfolios declined in April but recovered in May and June, generating returns ranging from -0.69% to 0.92%, depending on the strategy. Throughout this period, the investment committee made several strategic adjustments to the portfolios. By the end of the quarter, the portfolios were positioned with an underweight allocation to risk assets and an overweight allocation to assets focused on delivering total return outcomes.

International Equities

During the second quarter, the pace of the rally across international equities slowed, marginally increasing with a return of 0.63% in Australian dollar terms. Currency movements detracted from performance as the U.S. dollar fell over 2% against the Australian dollar. For the first time since September 2023, emerging markets outperformed their developed world counterparts, returning 2.68% over the period. Our international equity allocation outperformed the benchmark, benefiting from both currency hedging and positive attribution from India.

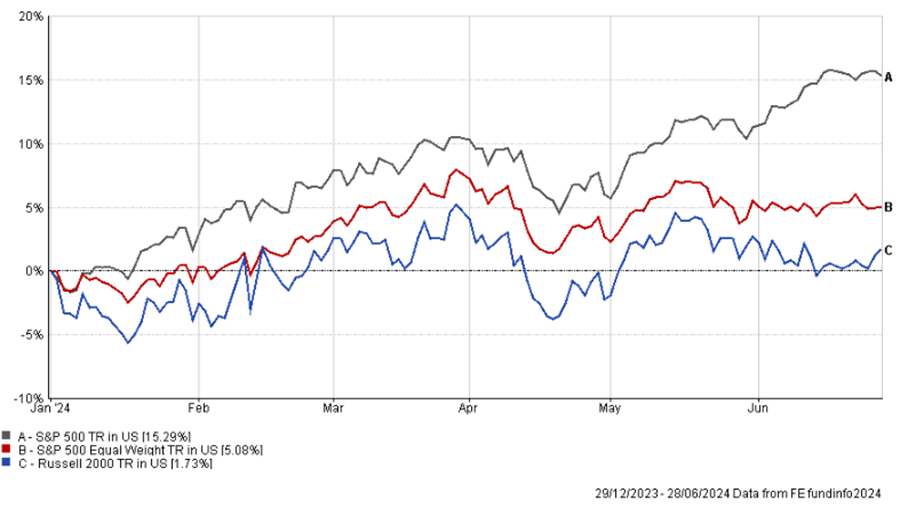

Market performance continues steadily, with the S&P 500 reaching a new high in June and rising roughly 15% over the first half of the year. However, this rally has become increasingly narrow, with the largest constituents of the benchmark driving most of the returns. Broader indicators of market participation, such as the equally-weighted S&P 500 and the small-cap Russell 2000, returned 5.08% and 1.73% by comparison. This period has been undeniably strong for investors mirroring or tracking the index but less so for active managers who inherently try to differentiate from the index.

*Source: FE Analytics

June also marked a significant moment for Nvidia, as it briefly became the most valuable company in the world. This milestone was driven by strong investor enthusiasm and the company's leadership in the AI and semiconductor sectors. However, by the time of writing, Nvidia's stock price has pulled back and remains roughly 10% below its all-time highs. This volatility reflects broader market trends and investor sentiment, as well as the inherent risks and rewards associated with high-growth technology stocks. Despite this slight decline, Nvidia's position as a key player in the tech industry remains robust, and its future performance will be closely watched by investors and analysts alike.

When breaking down sources of equity market returns year to date (charted below), a common theme across many markets is that multiple expansions have been the dominant driver of returns. This indicates that markets have been pushing higher by becoming more expensive, rather than companies significantly growing their earnings. While this can sustain short-term gains, market valuations have a limit before they become overextended, potentially leading to a reversal. Currently, many markets globally are already on the expensive side of average, signalling caution & selectiveness.

*Source: JPMorgan

There was some rebalancing within the global equity allocation across the quarter to ensure our splits across global core, emerging markets and small/mid caps were in line with our desired levels.

Australian Equities

During the second quarter, Australian equities declined by -1.05%, as the ASX200 struggled to advance after hitting record highs. Our portfolio's allocation to Australian equities marginally outperformed, generating a positive return.

On the policy front, the Reserve Bank of Australia (RBA) has kept the cash rate steady at 4.35% since the last adjustment in November 2023. The market's narrative shifted, with the timing of the first expected RBA rate cut being pushed out due to a challenging mix of economic data. The consensus is now that a rate cut will not occur until mid-2025. In June, the monthly CPI indicator rose to 3.6% year-on-year (up from March's 3.5%), while retail sales slightly missed expectations, growing by only 0.1% month-on-month. Additionally, the Q1 GDP release confirmed a soft economy, with GDP growth at 0.1% quarter-on-quarter, bringing the year-on-year rate to 1.1%. Real household income remained flat for the quarter and continued to lag behind population growth over the year, highlighting struggles in rate-sensitive sectors and an ongoing per capita recession.

The budget, released during the quarter, is expected to show a surplus of $9.3 billion due to a continuing revenue windfall but is anticipated to slip back into larger deficits from 2024-25. Key measures include broader cost-of-living support and "Future Made in Australia" initiatives. However, significant extra spending poses a risk of adding to inflation. Structural budget deficits are projected to persist in the medium term as the revenue windfall fades and spending remains high, indicating a trend towards a larger, more entrenched government.

The most notable market event during the quarter was the initial public offering (IPO) of Guzman y Gomez, to which we had some pre-IPO exposure via one of our Australian equity positions. After several lean years since the end of the COVID-19 pandemic, with few big companies listing on the local exchange, bankers and investors hope its success will spur more activity. Guzman y Gomez’s debut marks the largest float since APM Human Services hit the ASX in December 2021 with a market value of $3.3 billion. The company listed well and remains at a premium to its issue price. On a lighter note, I was fortunate enough to win a free lunch (GYG, of course) from a colleague who had a less optimistic view of the float.

There were no changes to the Australian equity allocation during the second quarter of 2024.

Property & Infrastructure

The second quarter yielded mixed results for property and infrastructure. Listed infrastructure returned 0.35%, while Australian listed property saw a decline of -5.63%. Listed infrastructure assets generated marginally positive returns for the portfolio.

We continue to believe that infrastructure assets are well-positioned as we move into 2024, assuming the forward-looking yield and rate outlook doesn’t surprise on the upside. This sector's resilience is evident as most companies have succeeded in maintaining their earnings and cash flows, partly due to mechanisms allowing for the pass-through of inflation. The regulatory and contractual mechanisms these companies use to adjust for inflation and interest rates often exhibit a significant lag, sometimes up to 18 months. This delay means that the effects of higher inflation in 2022 and 2023 should continue to manifest in price and earnings increases for infrastructure assets well into 2024. Additionally, given the long-duration nature of the asset class, it is well-positioned to benefit from a period of declining rates and yields that align with consensus views.

The Australian Real Estate Investment Trust (AREIT) sector has seen notable benefits from adopting AI, particularly within Goodman Group. The sector has been one of the best-performing positions in the portfolio over the last twelve months, with the benchmark returning in excess of 24%. As the benchmark's largest constituent (currently ~40%), Goodman Group's share price surge of 75% in the last 12 months has driven much of this performance.

Due to the incredibly strong performance of our local listed property market and the concentration risk around Goodman Group, the investment committee decided to exit Australian listed real estate and rotate to global listed property. This move allows investors to access a more diverse portfolio and global opportunity set. The global market has not experienced the same level of euphoric performance and has yet to recover from declines over the past few years.

Private Equity & Venture Capital

Private equity strategies produced a range of outcomes this quarter. Core buyout strategies returned between -1.13% and +1.74%, depending on the fund, while our venture strategy returned 2.19%. We are still awaiting end-of-June valuations for some strategies.

Activity across private equity remained muted. Transactions were difficult to complete as current prices did not match those of 2019, though this was not reflected in median EV/EBITDA ratios due to only the best assets being for sale. The largest funds continued to raise capital, while middle-market and lower-middle-market fundraising activity decreased. Venture capital experienced a similar but more severe downturn, with deal values plummeting due to the high volumes in 2021. AI deals provided some buffer, and there is optimism that the broader venture market will recover, with increased deal values and volumes expected. An IPO window could potentially drive further activity, as evidenced by Reddit's 76% increase from its listing price. In the secondaries market, fundraising has been substantial, aimed at addressing the liquidity issue, and a significant year for the deployment of continuation funds and GP-led secondaries is anticipated.

There were no changes to the private equity allocation of the portfolios during the quarter.

Enhanced Income

Australian bonds detracted from portfolio performance, declining by -0.61% over the quarter. Notably, several floating rate solutions generated sound outcomes and were among the best-performing assets across portfolios.

In our portfolio strategy, we have increased our allocation to enhanced income assets, which are currently offering attractive total returns between 7-11%. This shift is driven by significant improvements in forward-looking returns for lower-risk investments, influenced by recent movements in cash rates. Consequently, investors are no longer compelled to take on higher levels of risk to meet their return objectives. Additionally, the duration of these investments provides a potential hedge against recession.

We maintain a positive outlook on quality debt, which is poised to deliver robust performance across various economic scenarios. The widening of credit spreads, now aligned with historical averages, reflects a normalised risk environment. Despite market volatility, corporations are well-positioned to navigate these conditions effectively.

These allocations are further fortified by cash yields, which should act as a substantial buffer against price volatility, offering protection should asset prices be unfavourably re-priced. This strategic composition ensures resilience and potential for growth across different market conditions.

While this sounds promising on paper, visualising some outcomes in a chart effectively underscores the message. The chart below highlights the performance of Australian equities over the first half of the year against three floating rate-oriented investments we regularly use within client accounts (Metrics & Realm) and the Mutual High Yield Fund, which is included in our managed accounts. The chart demonstrates that both investments have delivered similar return outcomes over the course of 2024, albeit with Australian equities exhibiting a much higher level of volatility.

*Source: FE Analytics

No changes were made within this allocation of the portfolio during the quarter.

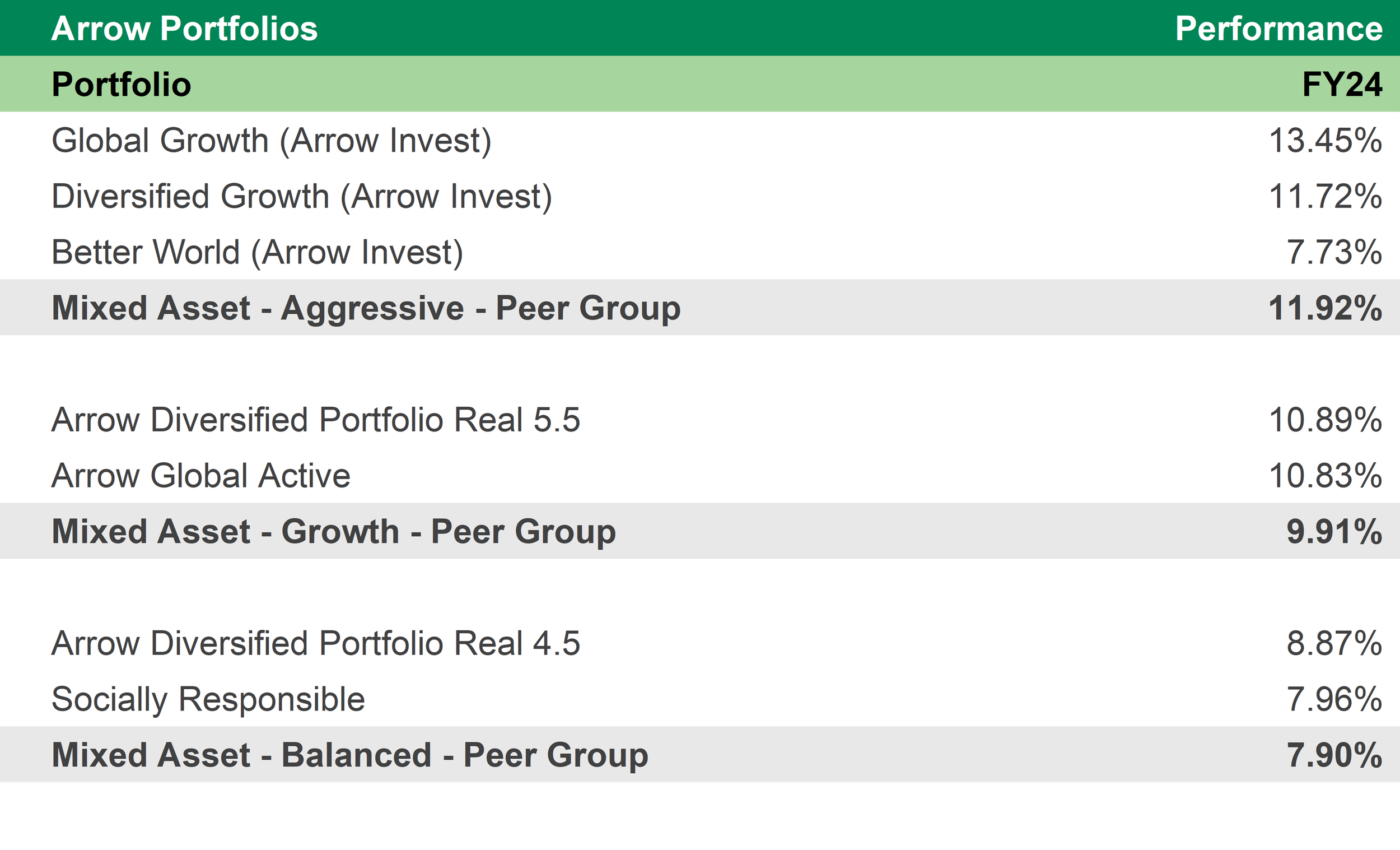

The end of June marks a good time to assess our work. While I prefer calendar year numbers, the industry funds follow the financial year, and I'm pleased to report that our investment portfolios delivered strong returns across the board.

The data below highlights performance at the portfolio level prior to any changes, both on an absolute level and relative to a set of peer groups based upon a level of risk defined by a portfolio's exposure to equities. Pleasingly most models were able to provide both an attractive total return and a level of excess return over the peer group.

As we move into a new financial year, we reflect on the annual super fund performance comparison. According to measures by SuperRatings and Chant West, industry super fund balanced or growth investment options delivered average returns between 8.8% and 10%. Notably, the best-performing growth option for the financial year was Mine Super, returning an impressive 10.7%.

We are pleased to report that Arrow’s portfolios have been performing well.

*Source: Chant West

Attribution within our portfolios was broad, with many opportunities contributing to returns. No portfolio is perfect over any 12-month period, but I would say roughly 40% performed exceptionally well, 30% passed, and the remaining 30% underperformed. Specifically, our Australian equity allocation outperformed the benchmark, with significant contributions from mid and small-cap companies. Conversely, our global equity allocation faced challenges, with performance narrowly confined to mega-cap businesses where we were underweight.

The superannuation reports also underscore the importance of reviewing your situation and seeking financial advice. The “default” balanced options substantially underperformed each fund’s growth-oriented investment option. Given the long time horizon of most investors' superannuation nest eggs, a higher-risk approach is likely appropriate for the majority.

While our portfolios have had a good period, there is still plenty of work to do as the investment landscape evolves. Should you have any queries about the material in this letter, please do not hesitate to contact me.

Ryan Synnot

Associate Director, Investment Research & Solutions

Arrow Private Wealth

General Advice Warning:

Any general advice in this email does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.