Understanding the Vacant Residential Land Tax (VRLT) in Victoria

The Vacant Residential Land Tax (VRLT) is a Victorian state-based land tax designed to address housing supply issues by discouraging property owners from leaving residential land or homes unused for long periods. By increasing the holding costs of underutilised property, the tax aims to encourage development and leasing, particularly in areas experiencing housing shortages.

Originally limited to inner and middle Melbourne, VRLT is now undergoing a significant expansion, both in geographic scope and property type coverage. This article outlines the purpose of the tax, how it works, who it applies to, and what exemptions are available.

What Is the Vacant Residential Land Tax?

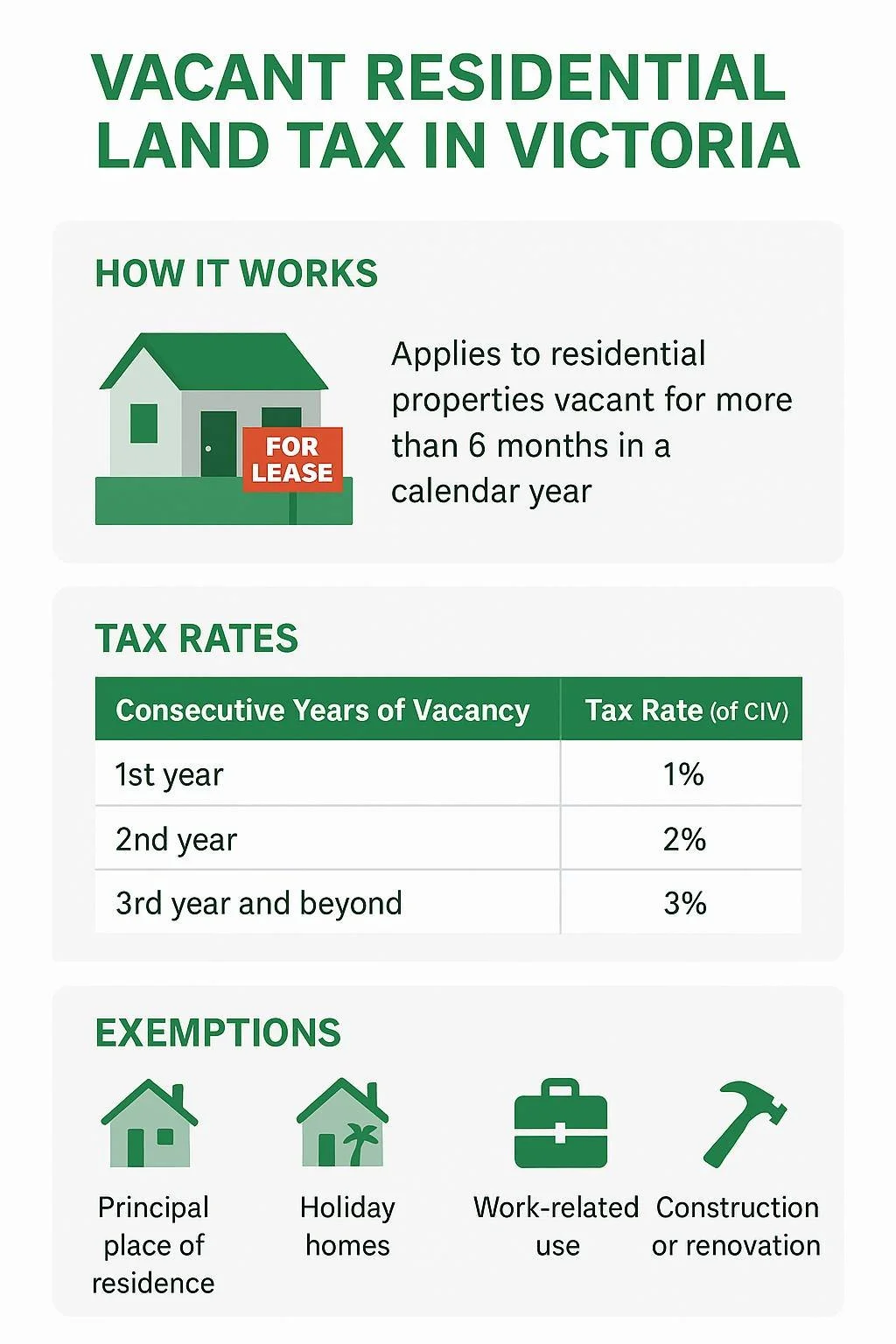

VRLT is a tax levied by the Victorian State Revenue Office (SRO) on residential land that remains vacant for more than six months in a calendar year. The tax is calculated on the Capital Improved Value (CIV) of the land, which includes both the land and any dwellings or improvements on it.

The tax applies in addition to standard land tax and is assessed based on property status as at 31 December each year.

Why Was VRLT Introduced?

The primary goal of the VRLT is to increase the supply of housing in Victoria. In areas with strong demand for housing, particularly metropolitan Melbourne, the government identified a growing number of homes and land parcels sitting empty - either as speculative investments or due to prolonged inaction.

By financially penalising owners who leave properties vacant, the VRLT encourages them to:

Rent out unused homes

Commence development on idle residential-zoned land

Sell properties to someone who will use them

The tax forms part of a broader strategy to unlock underused housing stock and reduce pressure on the housing market.

How Does the VRLT Work?

Who It Applies To

The VRLT applies to residential land in Victoria that has been vacant for more than six months in a calendar year. It affects:

Homes or apartments that are unoccupied

Vacant residential land where construction has not yet commenced

Unimproved residential-zoned land that has been undeveloped for more than five years (from 2026 onward)

This includes properties held in personal names, trusts, companies, and superannuation funds.

Vacancy Test

A property is considered "vacant" if it is not used or occupied for more than six months cumulatively in a calendar year by:

The owner

The owner’s permitted occupant

A tenant under a genuine lease

Short-term guests (e.g. Airbnb), subject to minimum usage thresholds

The six-month threshold does not need to be continuous — it is measured across the year.

Tax Rates

The VRLT is assessed at progressive rates based on how long the property has remained vacant:

Consecutive Years of VacancyTax Rate (of CIV)

1st year1%

2nd year2%

3rd year and beyond3%

For unimproved residential-zoned land (from 2026), a flat 1% rate applies if the land has been undeveloped for at least five years.

How the Tax Is Calculated

The tax is based on the Capital Improved Value (CIV) of the property, as shown on the council rate notice. For example, if the CIV is $800,000 and the property has been vacant for two consecutive years, the VRLT would be 2% × $800,000 = $16,000.

Important Dates

31 December: Property status on this date determines whether the tax applies for the following year.

15 January: Deadline for owners to self-notify the SRO if their property was vacant during the previous calendar year.

Early calendar year: SRO issues assessment notices based on disclosures, third-party data, and audit activities.

Exemptions and Special Cases

The VRLT legislation allows for certain exemptions, subject to conditions.

Principal Place of Residence (PPR)

A property used as your main home is exempt, even if unoccupied for periods during the year.

Holiday Homes

A property used as a genuine holiday home by the owner or their close relatives for at least four weeks per year may be exempt, provided:

The owner has a separate principal residence in Australia.

The holiday home is not owned through a trust, company or SMSF.

Work-Related Use

A home occupied by the owner for at least 140 days per year for work purposes may qualify for an exemption, if they have another principal residence elsewhere.

Construction and Renovation

Land or buildings may be exempt if:

Substantial construction is in progress, or

The property is uninhabitable due to renovations

These exemptions are generally limited to two years.

Contiguous Land

Vacant land directly adjoining the owner's principal place of residence may be exempt in some cases.

Compliance and Penalties

Owners must self-assess and notify the SRO if their property was vacant. The SRO may also independently identify liable properties through:

Water and electricity usage data

Rental platform activity

Site visits

Penalties apply for:

Failing to notify the SRO

Providing false or misleading information

Failing to pay tax owed

Final Thoughts

As Victoria tightens its approach to housing supply and land use, the Vacant Residential Land Tax has become an important lever in housing policy. Whether you own an investment property, vacant land, or a holiday home, it's crucial to understand how the VRLT could affect your financial position - now and into the future.

Property owners should review their occupancy patterns, seek professional tax advice, and ensure they meet all notification and exemption criteria to avoid unnecessary penalties.

General Advice Warning:

Any general advice on this page does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. Information contained on this page was correct at the time of posting.