Q3 2024 Investment Market Update

The third quarter of 2024 delivered strong performance across portfolios, with solid contributions from various asset classes. It was a volatile quarter, marked by sharp declines in early August, followed by a steady recovery through the remainder of the period. The quarter was eventful, with significant developments such as the Federal Reserve’s first expansionary move since 2020 and policy tightening from the Bank of Japan, which pushed equity market volatility to its highest level since March 2020.

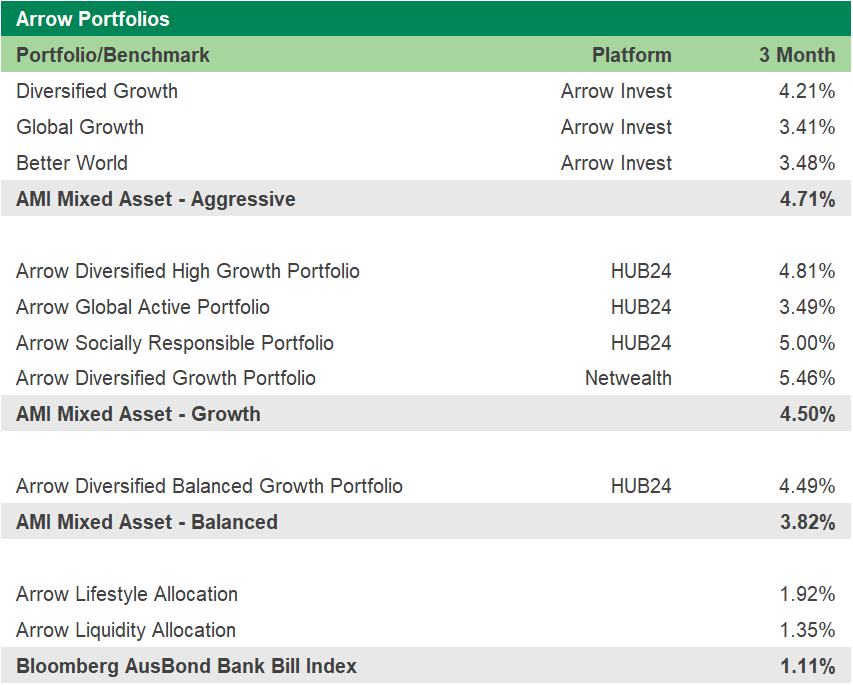

Despite the turbulence in August, portfolios finished the quarter positively, buoyed by strong returns in July and September. Depending on the strategy, portfolios generated returns ranging from 3.4% to 5.5%. During this time, the investment committee made several adjustments to the portfolio. By the end of the quarter, the portfolios were positioned with an underweight allocation to higher-risk assets and an overweight focus on assets designed to deliver stable total return outcomes. This positioning reflects a more cautious outlook, aimed at managing risk while capturing growth opportunities.

International Equities

During the third quarter, international equities returned 2.07% to local investors, with currency movements playing a significant role in performance. The U.S. dollar fell over 4.1% against the Australian dollar, but our currency positioning, targeting a 60% hedge ratio, helped protect investors from the depreciating USD. Emerging market equities outperformed developed markets for the second consecutive quarter, driven largely by China's late-quarter stimulus measures. This contributed to the outperformance of our international equity allocation, benefiting from both currency hedging and strong exposure to emerging markets.

There were several significant global events throughout the quarter that rattled markets, yet despite the volatility, the quarter finished with strong returns, reinforcing key investment principles. This outcome reminds me of one of my favourite quotes from legendary investor Howard Marks: "You get paid for two things (in investing): the ability to withstand and endure volatility and the ability to identify mispricings." Enduring volatility requires temperament and long-term focus to navigate market swings without reacting impulsively. A well-diversified portfolio plays a vital role in this process, allowing investors to stay the course during turbulent times while capturing long-term growth opportunities. This aligns perfectly with Marks' emphasis on maintaining resilience through market fluctuations.

August was particularly volatile, with sharp sell-offs triggered by the Bank of Japan's decision to tighten monetary policy after years of ultra-loose measures. The unwinding of the carry trade—a strategy where investors borrow in low-interest currencies like the yen to invest in higher-yielding assets—led to widespread capital outflows and significant declines in Japanese equities, which fell nearly 20% in a few sessions. This move had a contagion effect, contributing to global market drawdowns. Meanwhile, the Federal Reserve cut interest rates by 50 basis points, a significant policy shift to support the U.S. economy amid slowing growth and moderating inflation. The rate cut boosted equity markets, particularly in growth sectors like technology, though it also raised concerns about the broader economic outlook.

In September, China introduced a series of stimulus measures to address weak consumer demand, a sluggish property market, and declining exports. These included fiscal spending, tax cuts, and easier monetary policy, which provided a short-term lift to Chinese equities, particularly in the infrastructure, real estate, and consumer goods sectors. Chinese equities rallied 27% by quarter’s end, benefiting from the increased government spending.

On the portfolio side, we decided to introduce exposure to UK equities (yet to be implemented) to enhance diversification. At the time, UK equities were trading at a forward P/E ratio of 11.2x, below their long-term average of 13.8x, indicating potential undervaluation. The UK market offers greater diversification relative to global benchmarks and our local market, with defensive sectors like healthcare, consumer staples, and utilities making up over 34% of its market capitalisation. This exposure strengthens portfolio stability, particularly during economic downturns, adding resilience to our overall strategy.

*Source: JPMorgan

Australian Equities

During the third quarter, Australian equities rallied 8.02%, recovering from early August losses to post a strong overall performance. Our portfolio's allocation to Australian equities outperformed, with every position exceeding the benchmark. Small and mid-cap companies were key contributors, delivering strong attribution throughout the period.

As expected, the Reserve Bank of Australia (RBA) held interest rates steady at its September meeting. In August, Governor Bullock dismissed the possibility of near-term rate cuts, and without new quarterly CPI data, the RBA remained firm on its current stance. Attention is on the RBA's approach, particularly as other major central banks continue easing. With slow progress on inflation, a still-tight labour market, and weak economic growth, the RBA is expected to hold rates for now. With only one more quarterly inflation report due in 2024, Q1 2025 appears the most likely timeframe for potential rate cuts. Economic data, including Q2 GDP growth of 0.2% and stable unemployment at 4.2%, align with RBA forecasts, supporting their current policy.

However, the Australian market faces challenges in both earnings growth and valuation. Consensus forecasts indicate only low single-digit earnings per share (EPS) growth, limiting upside potential. Valuations, particularly in the banking sector, appear stretched, with high price-to-earnings ratios that could restrain future price appreciation unless earnings growth improves significantly.

Source: JPMorgan

A key driver for the Australian market will be China's fiscal stimulus, as Australia relies heavily on commodity exports to China. Late-quarter stimulus measures from China provided a short-term boost to market sentiment, particularly in resource-export sectors. However, the sustainability of these gains will depend on China's continued rollout of stimulus and whether these actions lead to a tangible increase in demand.

We reduced our exposure to Australian equities during the quarter to manage valuation risk and seek better opportunities. Specifically, we redeemed portions of our core Australian equity allocation to fund a new position in UK equities, which offer a more favourable valuation outlook and the potential for outperformance over the medium term.

Property & Infrastructure

The third quarter delivered exceptionally strong performance for listed property and infrastructure. Listed infrastructure posted a return of 11.51%, while Australian-listed property delivered a 14.47% return. Our portfolios were well-positioned to capitalise on this upside, benefiting from our overweight allocation to listed infrastructure.

Both sectors saw significant gains due to shifting market consensus regarding central bank policy direction, with many central banks worldwide easing their stance. Long-duration assets, property, and infrastructure offer stable, annuity-like cash flows due to their long asset lifespans. This makes them particularly sensitive to interest rate movements. During the quarter, these sectors became increasingly attractive to investors as expectations for lower interest rates over the medium term grew. Lower rates tend to reduce the cost of capital and increase the appeal of assets with predictable income streams, making property and infrastructure prime targets during this period of monetary easing. This favourable environment was a key factor driving their strong performance.

We also see a broader rotation in investor behaviour as market participants increasingly shift into more defensive sectors. Concerns over overstretched valuations, particularly in mega-cap tech and growth stocks, drive this move. After a prolonged period of outperformance, these sectors may now be facing headwinds.

There were no changes to the property and infrastructure allocation of the portfolio.

Private Equity & Venture Capital

Private equity strategies produced a range of outcomes this quarter. Core buyout strategies returned between +0.57% and +2.43%, depending on the fund, while our venture strategy returned -0.34%. We are still awaiting end-of-June valuations for some strategies.

We received an update from Preqin on the Australian private equity (PE) and venture capital (VC) landscape. The sector remains robust despite economic challenges. As of June 2023, PE and VC combined had $65.5 billion in AUM, which has grown by 30% since late 2021. Fundraising has slowed from record highs, but investor confidence remains strong, with consolidation driving larger funds. Private equity is focusing on secondary buyouts and businesses with stable earnings, driven by higher interest rates and cautious investor sentiment. While experiencing a decline in deal flow, venture capital remains active, especially in the IT sector, which accounts for half of VC deals. Early-stage investments are prioritised due to reduced exit opportunities. Australia's tech ecosystem, supported by successful unicorns like Canva and Airwallex, continues to attract attention from domestic and international investors.

During the quarter, the investment committee approved a private equity secondaries fund for use by investors and clients. This strategy offers exposure to mid-market private equity through the secondaries market within an evergreen structure. The fund’s global network and access to a wide range of general partners allow it to source high-quality investments diversified across sectors, stages, and geographies. With a proven track record of navigating volatile markets and delivering consistent returns, the fund presents a compelling investment opportunity. Given the pull-to-par effect and investor-friendly terms, we believe the fund is well-positioned to generate attractive investor returns, making it an attractive addition to a portfolio's private equity allocation. If you’re interested in receiving a recommendation, please contact your adviser.

There were no changes to the private equity allocation of the portfolios during the quarter.

Enhanced Income

Australian bonds performed well throughout the quarter, delivering a return of 2.83%. Fixed-rate investments outperformed floating-rate instruments as exposure to duration benefited from the favourable interest rate environment.

Significant changes are underway in Australia’s debt market, following the Australian Prudential Regulation Authority's (APRA) announcement to phase out $43 billion worth of Additional Tier 1 (AT1) hybrid capital instruments by 2032. These hybrid securities, commonly issued by banks to raise capital, occupy a middle ground between equity and debt, offering investors a blend of both. Their popularity, particularly among stockbrokers and retail investors, stems from this “hybrid” exposure. However, APRA’s decision to replace them with simpler, more reliable instruments such as corporate bonds and common equity is driven by concerns over the complexity of hybrids and their limitations in absorbing losses during financial stress. Large banks will begin transitioning a portion of their hybrid holdings to corporate bonds or equity capital starting in 2027, with a complete phase-out by 2032. This gradual approach provides investors ample time to adjust their portfolios and adapt to the new regulatory framework.

In response to these evolving market dynamics, we have continued to increase our allocation to enhanced income assets, which are currently providing attractive total returns in the range of 7-11%. Enhanced income assets also offer the added advantage of shorter durations, acting as a potential hedge against economic downturns or recessions, ensuring stability in uncertain times. These allocations are further reinforced by robust cash yields, which provide a significant buffer against price volatility. This helps to protect portfolios from adverse re-pricing in the market, creating a strategic composition that balances resilience with growth potential across different market conditions.

The third quarter of 2024 delivered robust performance across asset classes despite a backdrop of heightened volatility. We successfully navigated sharp market declines in early August, followed by a steady recovery that persisted through the remainder of the quarter. While the portfolios generated impressive returns, it was particularly gratifying to see outperformance relative to the peer group, even with a more conservative positioning that maintained an underweight allocation to higher-risk assets. This underscores the strength of our strategy in balancing risk management with capturing growth opportunities.

Key contributors to this success included overweight positions in infrastructure, listed global real estate, and strong outperformance within the Australian equity allocation. Furthermore, allocations to commodities and Chinese markets, which are typically absent from many multi-asset strategies, provided additional diversification and boosted performance.

Looking ahead, we remain cautious about stretched valuations in some sectors and continue to manage risks by skewing portfolios toward defensive and income-generating assets. We made selective adjustments, such as increasing our allocation to enhanced income and introducing UK equities, which offer better valuation opportunities and a more favourable risk-return profile over the medium term.

As always, our primary focus is managing risk while seeking opportunities to enhance long-term portfolio performance. We encourage you to contact your adviser if you would like to discuss any of the topics in more detail or explore further investment recommendations tailored to your needs.

Ryan Synnot

Associate Director, Investment Research & Solutions

Arrow Private Wealth

More Insights

Latest Insights

General Advice Warning:

Any general advice in this email does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.