Q4 2024 Investment Market Update

The final quarter of 2024 delivered tamer performance across portfolios, rounding out a strong year for investment performance. It was a choppy quarter, as strong returns in November offset declines and flat returns in December and October. The quarter was eventful, with significant developments such as the US Presidential election and interest rate cuts from the Federal Reserve.

Despite the turbulence, portfolios finished the quarter positively, buoyed by strong returns in November. Depending on the strategy, portfolios generated returns ranging from 0.6% to 1.9%. During the quarter, the investment committee made some adjustments to the portfolios. By the end of the quarter, the portfolios were positioned with an underweight allocation to higher-risk assets and an overweight focus on assets designed to deliver stable & attractive total return outcomes. This positioning reflects a more cautious outlook aimed at managing valuation risk within the portfolio whilst still managing to return targets.

International Equities

During the fourth quarter, international equities returned 11.05% to local investors, with currency movements driving the entirety of the performance. The U.S. dollar rallied over 12% against the Australian dollar, meaning international equities declined on a local currency basis. Our international equity allocation underperformed the benchmark, impacted by currency and emerging market exposure.

The biggest event in markets was the US election in early November. The election resulted in a significant comeback for Donald Trump. He defeated incumbent Vice President Kamala Harris, securing 312 electoral votes to Harris's 226, and won the popular vote with 49.8% compared to Harris's 48.3%. Trump's victory marked him as the second president in U.S. history, after Grover Cleveland, to serve two non-consecutive terms. His campaign capitalised on voter concerns over the economy and immigration, leading to wins in key swing states such as Pennsylvania, Wisconsin, and Michigan.

Following Donald Trump's presidential election victory, financial markets experienced significant movements. Major indices surged, and investors engaged in "Trump trades," reallocating portfolios to benefit from expected policy changes. This included increased investments in energy and financial sectors, anticipated to benefit from deregulation, and a shift towards assets poised to gain from proposed tariffs and infrastructure spending. Cryptocurrency also performed well, driven by investor optimism regarding potential crypto-friendly policies under the Trump administration.

Emerging markets faced a challenging environment in the fourth quarter, with the prospect of higher tariffs, a stronger USD, and political uncertainties weighing on sentiment. However, we closed out our underweight position to emerging markets during the quarter, driven by an improved outlook for key regions. China, as the largest emerging market constituent, demonstrated a willingness to address economic challenges through targeted stimulus measures to boost credit availability and reduce borrowing costs. While these actions fell short of some investors’ expectations, we viewed them as a positive signal of the government’s intention to stabilise growth. Additionally, Chinese equities remain attractively valued, trading at deep discounts to historical averages, further supporting our decision. Overall, the diversified nature of emerging markets and the potential for recovery in undervalued assets position this segment as an increasingly compelling investment opportunity heading into the future.

Australian Equities

Australian equities declined by 0.80% during the fourth quarter. However, our portfolio's allocation to Australian equities outperformed, with every position exceeding the benchmark. Small and mid-cap companies were key contributors, delivering strong attribution throughout the period & the year.

The RBA kept the cash rate steady at 4.35% during its December meeting, with a more dovish policy statement. The board expressed growing confidence that inflation is sustainably moving toward its target and omitted the symbolic phrase “not ruling anything in or out.” Wage growth easing more than anticipated was also seen as dovish, though the labour market's description emphasised stabilisation following gradual easing. Notably, Governor Bullock refrained from pushing back against market expectations, anticipating around two rate cuts by May, coinciding with the lead-up to the general election.

In December, we saw Australia's largest IPO in six years as DigiCo Infrastructure REIT (ASX: DGT), specialising in data centres, raised $2.7 billion, exceeding its $2 billion target. Despite strong demand, shares debuted below the $5 offer price, closing at $4.55 on the first day, and continued to decline, sparking concerns about its valuation and fee structure. DigiCo's portfolio includes 13 data centres across Australia and North America, positioned to benefit from AI and cloud computing growth, yet Morningstar valued its shares at $3.40, citing industry competition. The IPO's mixed performance highlights challenges for asset-backed floats reliant on retail investors and casts doubt on the sector's perceived growth momentum.

There were no changes to the Australian Equity allocation of the portfolio during the quarter.

Property & Infrastructure

Property and infrastructure gave back some of their strong Q3 performance over the final few months. Listed infrastructure posted a return of -4.61% in US dollar terms, while Australian-listed property delivered a -6.04% return.

Global REITs and infrastructure sectors faced a challenging fourth quarter of 2024, with significant sell-offs in December after strong performance in the third quarter. The rise in bond yields, driven by robust U.S. economic growth and a pro-growth policy agenda under the Trump administration, placed considerable pressure on these sectors. This pullback dampened the annual gains for Global REITs, highlighting the impact of rising yields on income-focused investments. Similarly, global infrastructure recorded losses during the quarter for many of the same reasons.

There were no changes to the property and infrastructure allocation of the portfolio.

Private Equity & Venture Capital

Private equity strategies produced a range of outcomes this quarter. Core buyout strategies returned between +0.78% and +2.87%, depending on the fund, while our venture strategy returned 16.17%. We are still awaiting end-of-December valuations for some strategies.

A renewed sense of optimism and animal spirits is sweeping across markets, laying a solid foundation for increased IPO activity in 2025. This resurgence in market confidence, fueled by improving macroeconomic conditions and stabilising interest rate expectations, has created an environment conducive to capital raising and growth opportunities. A significant backlog of venture-backed companies seeking liquidity is poised to benefit from this renewed sentiment, with many businesses ready to capitalise on public market access to fuel their next growth phase.

This wave of potential IPOs spans a variety of sectors, including technology, healthcare, and renewable energy, which have historically attracted strong investor interest. The robust pipeline reflects years of innovation and private market investment, now maturing into opportunities for public market participation. We continue to position ourselves to capture this theme through our venture managers, whose portfolios are strategically aligned with sectors and companies likely to benefit from this IPO renaissance. We see this as one of the most compelling upside opportunities for the year, with the potential for significant value creation as these businesses enter public markets.

During the quarter, the portfolio increased its allocation to the Perennial Natural Strategic Resources Fund, driven by long-term tailwinds from the global electrification. The fund has reached sufficient scale, allowing Arrow to expand its position and capitalise on structural growth opportunities in the resources sector.

Enhanced Income

Australian bonds declined slightly, delivering a return of -0.13%. Floating-rate investments outperformed fixed over the period and continue to generate attractive returns.

The bond markets in 2024 experienced notable volatility. Early in the year, expectations were for significant interest rate cuts by central banks, but these shifted to a “higher for longer” scenario by mid-year as recession fears eased. Bond yields have climbed significantly since September, ending the year at close to their highs. This rise was attributed to stubborn inflation, a resilient economy, and political developments favouring pro-growth policies. Globally, inflation expectations and the neutral interest rate were revised, with markets concluding that the US economy could handle elevated rates.

Delays in interest rate cuts and reduced expectations for future cuts have benefitted local investors, particularly those exposed to floating-rate investments. The persistence of higher interest rates has provided an environment where floating-rate options, such as floating-rate bonds and credit, continue to deliver attractive risk-adjusted total returns. These instruments benefit directly from the elevated rate environment as their yields adjust in line with benchmark rates, offering investors enhanced income potential while managing interest rate risk. We continue to lean into this part of the portfolio.

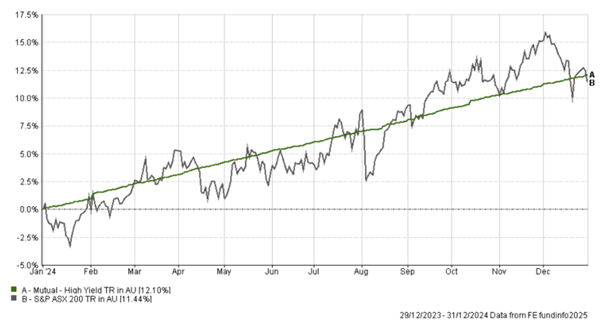

The chart below highlights the performance of Australian equities over the 2024 against the Mutual High Yield Fund, which is included in our Managed Accounts. The chart demonstrates that both investments have delivered similar return outcomes over the course of 2024, albeit with Australian equities exhibiting a much higher level of volatility.

There were no changes to the enhanced income allocation of the portfolio.

The year ahead poses significant challenges for investors, marked by heightened uncertainty and volatility. Stocks are trading at historically high valuations which lowers forward looking expected returns and likely increases the severity of any potential pullbacks. Political developments such as potential trade wars, deregulation, tax cuts, and fiscal spending under Trump’s administration are expected to create economic turbulence, while global risks remain pronounced. As always, our primary focus is managing risk while seeking opportunities to enhance long-term portfolio performance

More Insights

Latest Insights

General Advice Warning:

Any general advice in this email does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs.