2025 Residential Aged Care Reforms

From 1 July 2025, new rules under the Aged Care Act will significantly impact the cost of residential aged care in Australia. These reforms aim to create a sustainable aged care system while ensuring that government support is directed to those with the greatest financial need. While these changes address long-standing funding issues, they also introduce complexities for families planning aged care for themselves or loved ones.

Below, we outline the major changes, including adjustments to resident contributions, new accommodation costs, and fees such as the Non-Clinical Care Contribution (NCCC) and Hotelling Contribution (HC). We’ll also explore strategies to minimise the financial burden of aged care and prepare for these changes.

Whether you’re planning ahead or need immediate advice, understanding the new system will empower you to make informed choices.

Key Changes to Aged Care Costs

Refundable Accommodation Deposit (RAD)

The Refundable Accommodation Deposit (RAD), a lump sum payment for aged care accommodation, is set to undergo major changes:

Maximum Limit Increase: From 1 January 2025, the maximum RAD a facility can charge without approval will rise from $550,000 to $750,000, with annual indexation based on CPI.

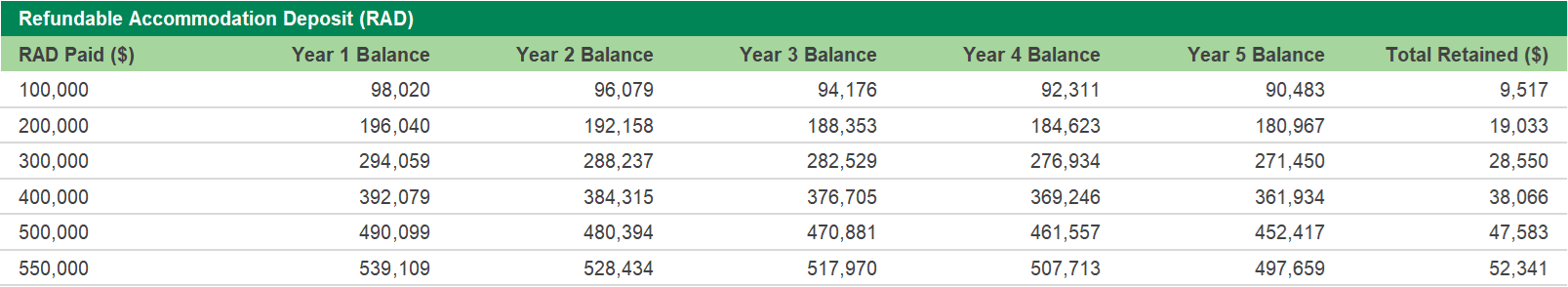

Retention Amount: A 2% annual retention amount, capped over five years, will now apply to RADs paid by partially supported residents. This measure aims to address the financial strain on providers while promoting better facilities and services.

For example, a resident paying a $300,000 RAD will see $28,550 retained over five years. This retention makes lump-sum RAD payments less attractive compared to Daily Accommodation Payments (DAPs), which will also be indexed annually.

Retention Amount on RADs Over 5 Years

Non-Clinical Care Contribution (NCCC)

Replacing the current Means-Tested Fee (MTF), the NCCC represents a means-tested contribution toward non-clinical care services, such as bathing, mobility assistance, and activities. This contribution is calculated based on income and assets and capped at $101.16 per day. Key features include:

Thresholds: Only residents with assets exceeding $502,981 or income above $131,279 will pay the NCCC.

Caps: The NCCC has a lifetime cap of $130,000 or four years of payments, whichever occurs first.

This new system simplifies contributions while ensuring equity. However, those with higher means will likely pay more under the new rules than under the current MTF.

Hotelling Contribution (HC)

The Hotelling Contribution is a new cost that applies to residents with higher financial capacity. It covers essential daily living expenses, such as meals, cleaning, and utilities, which were previously funded entirely by the government.

Thresholds: Residents with more than $238,000 in assets or $95,400 in income will contribute up to $11.24/day.

Targeting Government Funding: This ensures government resources are directed towards residents who genuinely need financial support.

Liability for Hotelling Contribution

Impact on Accommodation Costs

The RAD/DAP trade-off has long been a significant decision for families entering aged care. Under the new rules, DAP payments will be indexed annually to CPI, meaning their costs will rise over time. This indexation makes RAD retention costs an important factor to consider when planning.

Additionally, the government will conduct an independent review in 2029 to assess the sector's readiness to phase out RADs entirely by 2035, signalling a shift towards daily payments in the long term.

Planning Strategies for Families

Navigating these changes will require careful planning and expert advice. Here are some strategies to consider:

Enter Early: Families should evaluate whether entering care before 1 July 2025 may result in lower costs, particularly for those with higher means.

Understand the New Contributions: Use a financial adviser to assess your liability under the NCCC and HC, as these fees could significantly impact cash flow.

Evaluate RAD vs. DAP: While lump sums are subject to retention, daily payments will be indexed, making the choice between these options highly situation-dependent.

Asset Structuring: Consider financial strategies to optimise income and asset thresholds to reduce contributions under the new means-testing system.

The upcoming aged care reforms are the most significant in years and represent a step towards a more equitable system. However, they also increase complexity for families, particularly those with higher means.

We are here to help you navigate these changes. Whether you're planning for aged care soon or years down the line, we can provide tailored advice to help you minimise costs and ensure the best care for you or your loved ones.

More Insights

Latest Insights

General Advice Warning:

Any general advice on this page does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. Information contained on this page was correct at the time of posting.