Downsizer Contributions: Unlocking Superannuation Opportunities for Over 55s

Selling the family home can mark a significant life transition. For many Australians aged 55 and over, it is not just about a lifestyle change. It is also an opportunity to boost retirement savings in a tax-effective way. Introduced by the Federal Government, downsizer contributions allow eligible individuals to contribute proceeds from the sale of their home directly into superannuation. This can help improve financial flexibility and build retirement confidence. The strategy has grown in popularity since its launch and, as at 2025, remains a valuable tool for retirement planning, provided the rules are understood and followed carefully.

What is a Downsizer Contribution?

A downsizer contribution allows eligible individuals aged 55 and over to make a one-off, after-tax contribution of up to $300,000 per person ($600,000 per couple) into their superannuation using proceeds from the sale of their primary residence. These contributions are not counted against the concessional or non-concessional caps, offering a powerful way to boost retirement savings.

This initiative is particularly valuable for Australians seeking to unlock equity in the family home, simplify their lifestyle, or strengthen their financial position in retirement.

Key Features and Benefits

Maximum Contribution: Up to $300,000 per person, or $600,000 per couple.

No Age Limit: Available to individuals aged 55 and over, with no upper age limit and no work test required.

No Total Super Balance Restrictions: You can contribute even if your total super balance exceeds $2 million.

Tax-Effective: Downsizer contributions are not taxed on entry to the fund and can be invested in the tax-advantaged super environment.

Preservation Rules Apply: Once contributed, funds are preserved until a condition of release is met (typically retirement or age 65).

Who is Eligible?

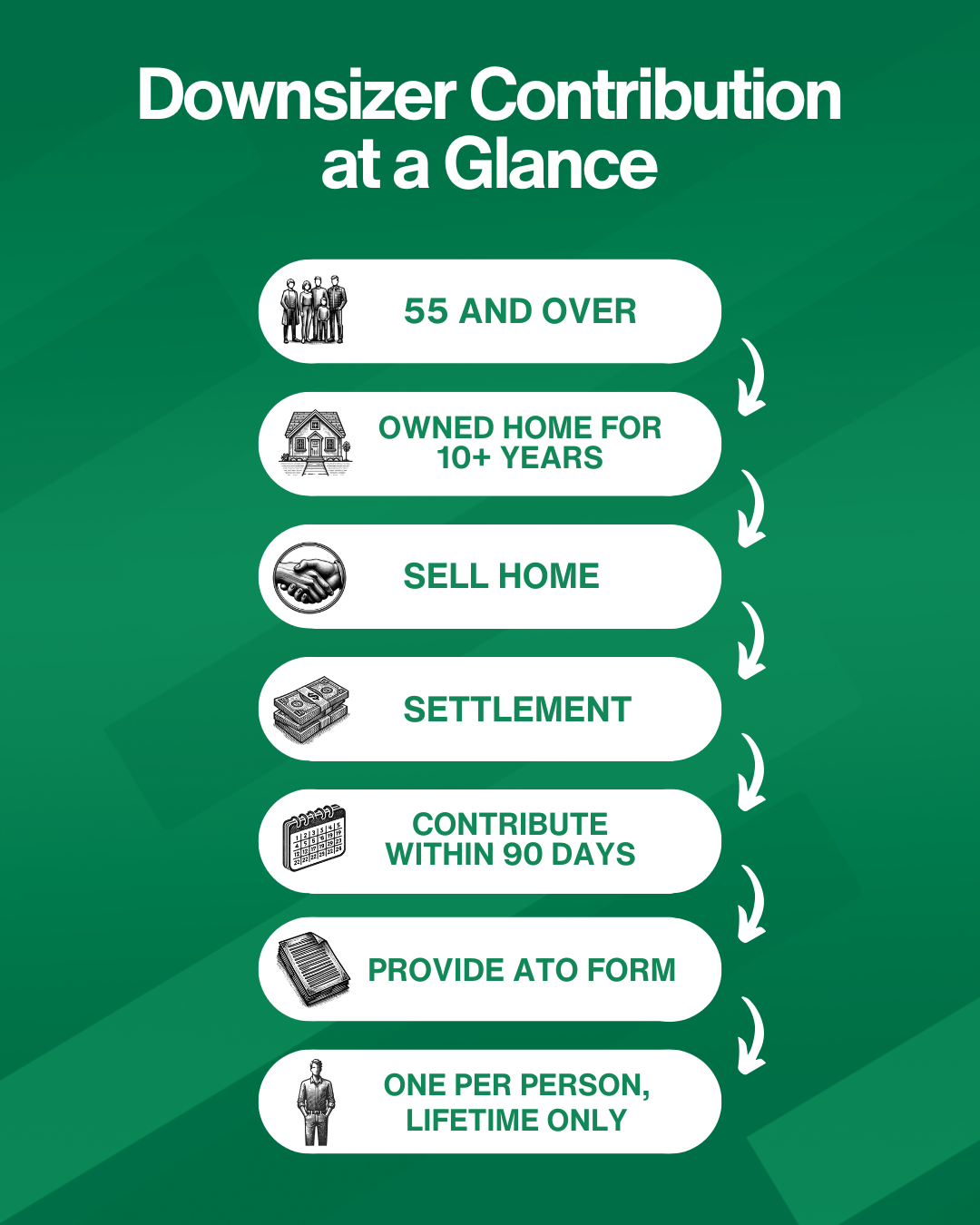

To qualify, you must:

Be aged 55 or older at the time of making the contribution.

Sell a dwelling in Australia that has been your (or your spouse’s) main residence at some point in time.

Have owned the property for at least 10 years prior to sale.

Make the contribution within 90 days of receiving the sale proceeds (usually settlement).

Provide your super fund with the ATO-approved Downsizer Contribution form before or when making the contribution.

Have not previously made a downsizer contribution from an earlier sale.

Note: While the property must have been your main residence, it does not need to be your main residence at the time of sale.

Strategic Opportunities

Boost Super Without Impacting Contribution Caps

Downsizer contributions sit outside the usual concessional and non-concessional caps, making them particularly attractive for those who may have otherwise reached their limits or are unable to contribute due to age or work test restrictions.Estate Planning and Centrelink Considerations

Downsizer contributions move capital from the home (exempt from the Age Pension assets test) into super (which is assessable once you reach Age Pension age). This can affect your Age Pension entitlements, so careful planning is essential.\

Contributions into tax-free retirement phase income streams can also reduce ongoing tax in your estate.

Couples Can Maximise Contributions

Couples can each contribute $300,000, even if only one partner owned the home. This allows up to $600,000 to be added to super, potentially equalising balances between spouses and increasing overall tax efficiency.Combining with Other Contributions

If eligible, a person could potentially use a combination of strategies in the same financial year:$360,000 via the bring-forward non-concessional rule (if under the relevant thresholds), and

$300,000 via a downsizer contribution,

This enables up to $660,000 to be added to super in one year by a single person, or $1.32 million for a couple (subject to eligibility and timing).

Important Reminders

Only one downsizer contribution per person is allowed in your lifetime.

You must have held an ownership interest in the property for at least 10 years. It doesn’t need to be solely in your name.

Proceeds from the sale must be exempt or partially exempt from CGT under the main residence rules.

Contributions must be made within 90 days of settlement. Extensions can be requested from the ATO in limited circumstances.

Is a Downsizer Contribution Right for You?

Whether you're downsizing for lifestyle reasons or simply want to unlock equity in your home to bolster your retirement, this strategy can offer meaningful advantages — but it may also affect Centrelink entitlements, tax positions, or estate outcomes.

We recommend seeking personalised advice to:

Coordinate with other contribution strategies;

Assess the impact on social security;

Plan for the use of funds in retirement.

How We Can Help

As financial advisers, we are in a privileged position to help you navigate these decisions, especially during major transitions such as selling the family home. Our team is well-equipped to guide you through the superannuation rules and structure a retirement strategy that supports your goals.

General Advice Warning:

Any general advice on this page does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. Information contained on this page was correct at the time of posting.