Lessons from the Rule of 72

A simple way to understand how investments grow over time

The Rule of 72 is a simple and powerful tool that helps investors understand how long it takes for an investment to double. To estimate this, simply divide 72 by the annual return. For example, if an investment earns a 10% annual return, it will double in 7.2 years. While this is a useful rule of thumb, there are important nuances to consider when applying it to real-world investing.

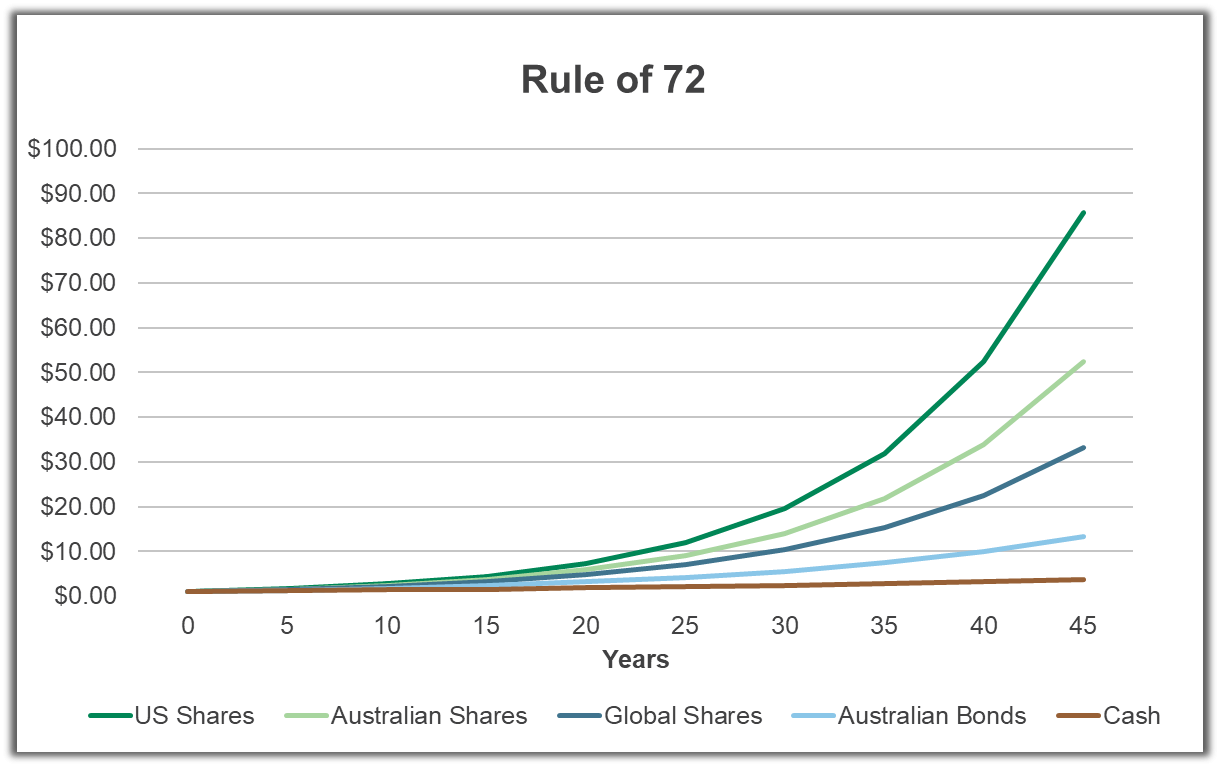

Asset Allocation Drives Wealth Growth

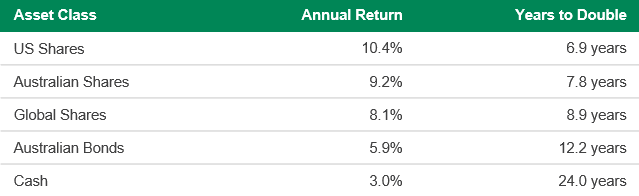

One of the biggest factors influencing how quickly an investment doubles is asset allocation—how a portfolio is divided among different investment types. Based on historical data, here’s how long it would take for an investment in each asset class to double:

This demonstrates that asset allocation is more important than picking individual stocks. The mix of investments in a portfolio has a greater impact on long-term returns than trying to select the best-performing individual companies.

A University of Queensland study found that the average Australian works for 45 years. Assuming past returns continue, an investor in US shares could double their portfolio nearly seven times over their working life, while someone holding only cash would double their portfolio just 2.6 times.

The Impact of Inflation

One critical factor that investors often overlook is inflation. The goal of investing isn’t just to grow your money—it’s to increase your purchasing power. Inflation reduces the real value of returns, meaning that even if your portfolio is growing, it may not be keeping up with the rising cost of living.

Here’s how inflation-adjusted (real) returns change the doubling time for different assets:

This table illustrates a key reality: holding too many defensive assets can make wealth accumulation almost impossible. For example, investing in cash takes over 65 years to double in real terms, meaning that your money barely grows relative to inflation.

Security vs Perceived Safety

Investors often perceive defensive assets like cash and bonds as safe because they are less volatile in the short term. However, when considering long-term financial security, relying too heavily on defensive assets can be a major risk. The real trade-off is not between volatility and stability, but between short-term comfort and long-term financial security.

The Key Takeaway

The Rule of 72 is a great way to visualise the long-term impact of investment choices. To achieve financial independence, most investors need to double their assets multiple times over their lifetime. While saving money is important, investing in growth assets (like shares) is essential to achieving meaningful long-term wealth growth.

More Insights

Latest Insights

General Advice Warning:

Any general advice on this page does not take account of your personal objectives, financial situation and needs, and because of that, you should, before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. Information contained on this page was correct at the time of posting.