Strategy Talk | April 2018

Daylight savings is over, the days are getting shorter and cooler. It's the perfect time to get active outdoors or in the garden before winter sets in. It's also the perfect time to make your end of financial year planning considerations. More on that and more, in this month's Strategy Talk.

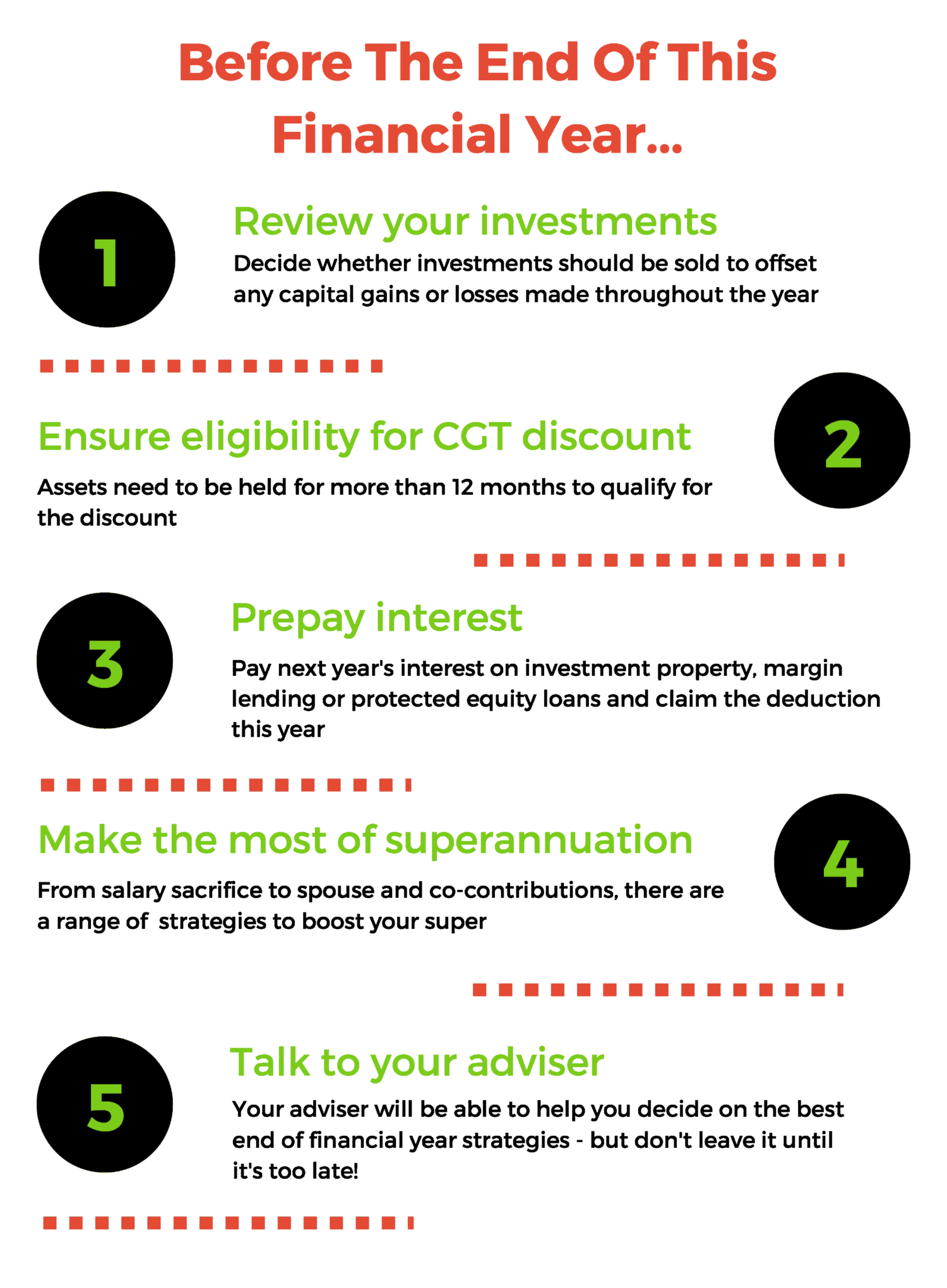

END OF FINANCIAL YEAR TAX TIPS

The end of the tax year is edging closer. If you haven’t planned how you will maximise your income and save some tax, take note! The most effective strategies are often the simplest and can be applied before 30 June this year whilst others should be considered for next year. Here are some from both categories to consider:

Pre June 30

Defer non-essential income until the new financial year.

Review your investment portfolio prior to 30 June to determine whether investments should be sold to offset any capital gains or losses made throughout the year.

Ensure you are eligible for capital gains tax concessions by holding assets for more than 12 months.

Maximise tax deductions through super contributions. Alternatively, make a contribution into super for your spouse – this could provide you with a tax offset.

Prepay next year's interest on investment property, margin loans, or protected equity loans, and claim the deduction this year.

Ensure you review income distributions from family trusts. You can lose franking credits in some circumstances if a family trust election is not made.

End of Financial Year

Make sure you hold assets in the most appropriate tax structure. Individuals, companies, trusts and super funds are all taxed differently on their capital gains and income.

Use franking credits to reduce tax on lower taxed entities like super funds and lower income earners. Remember that excess franking credits are refundable.

Split income wherever possible to take advantage of the progressive tax system.

In an ever-changing and complex world, seeking professional advice can help you through the maze. We invite you to contact us to explore your individual tax planning opportunities further... but please don’t leave it until the last minute.

FAST FINANCIAL FACT:

MORE EQUITY = LOWER INTEREST

Ever wondered why some people get better interest rate deals than others? Perhaps you’ve had a chat at a barbecue and discovered your host is paying a lesser rate than you?

This could be the reason…

Lenders reward borrowers who hold more equity in their property. A lower rate will be offered if you have 70% equity compared to 20%. Why? Because it reduces their lending risk and the related saving can be passed onto the borrower.

This also means that as you build up equity in your property, your lender could be more amenable to negotiating a lower rate.

WHICH IS THE MORE PRECIOUS...?

It’s the middle of the night and you’re jolted awake by extreme pain in your chest. You feel like the life is being crushed out of you and immediately realise you’re having a heart attack. Your partner frantically calls 000 and as you lay clutching your chest waiting for the ambulance to arrive all you can think about is how your family will be supported if you die.

The pain intensifies.

Hopefully this will never happen to you, but what if it did? Take a moment to think about how your family's living expenses would be met if your income stopped tomorrow.

The average Australian household spends up to one-third of its gross income on mortgage repayments. Most of us would rely on our regular income continuing indefinitely in order to meet such an expense. And at this point we haven’t even put food on the table.

Income protection (or "salary continuance") insurance usually provides up to 75% of your salary or business income in the event that you cannot work due to illness or injury. Of course, you might have sick leave, other compensation arrangements or perhaps a cash reserve to rely on for a while, but what will happen when these run out?

Transfer the Risk

Just like any other insurance, protecting your income is about transferring risk to someone else. By paying a monthly premium, you have the security of knowing that should anything happen - your car is stolen, your home damaged by fire, or you suffer a serious illness or accident - your financial loss will be minimised.

Ask Yourself…

If you have your car fully insured but don’t have adequate (or any) personal risk cover, ask yourself this question – why is my car more precious than my life and health?

If your answer puts this into better perspective, do something about it now. Once you have appropriate insurance in place, you can get on with enjoying life, and if you do get sick or badly injured, money will be one less thing for you and your family to worry about.