Market Summary | March 2018

MARKET OVERVIEW

Russia went to the polls to elect a new President and in the least surprising result of the year, Vladimir Putin won another six-year term, winning 76% of the vote, with his main rival, Alexei Navalny, barred from contesting the election. With the Chinese Communist Party removing the rules limiting Xi Jinping to two terms in office, two of the world’s three superpowers now effectively have presidents for life.

Talk of sanctions and trade tariffs brings us to Donald Trump, who kept one of his pre-election pledges as he imposed a 25% import tariff on foreign steel and a 10% tariff on aluminium. The world may be worrying about a trade war between the US and China – and China has recently hit back with tariffs on US imports – but Trump is sticking to his ‘America first’ policy.

In the UK, we had Chancellor Philip Hammond’s first Spring Statement, and agreement was finally reached on the transition agreement with the European Union, which will last until New Year’s Eve 2020.

UNITED STATES

Donald Trump imposed tariffs on imports of steel and aluminium, with China responding over Easter by imposing tariffs on a number of US imports, including wine. There has been much wailing in the California wine regions – but the state is staunchly Democratic and the President is teetotal, so he is unlikely to lose any sleep. With 313,000 new jobs added, there are plenty of Americans who approve of what the President is doing.

Trump’s ‘America First’ policy and concerns for national security were further evidenced as he blocked the takeover of chipmaker Qualcomm by Singapore-based rival Broadcom. At $140bn US, the deal would have been the biggest technology sector takeover on record, but there was credible evidence that it threatened US security, with fears that it could have put China ahead in the development of 5G wireless technology.

ASIA

After the death of Mao Zedong in 1976, the Chinese Communist Party introduced a two-term limit, intended to ensure that a cult of personality could not re-emerge and that no-one could rule for life. But in March the two sessions (the annual meetings of the national legislature and the top political advisory body) did what had widely been expected and scrapped the rule, effectively opening the way for Xi Jinping to rule indefinitely.

One of the first appointments the new ruler-for-life would have rubber-stamped was that of a US-educated economist, Yi Gang, as the next governor of China’s central bank. It is an appointment seen as an attempt to ensure continuity, as China continues to try and rein in growing debt and risky financial practices.

EUROPE

Now, it seems we might finally be getting somewhere, with the UK and EU reaching an agreement over the ‘transition deal’ (the relationship and arrangement the UK will have with the EU after they leave), which is currently less than a year away on March 29th, 2019.

The beginning of March brought the Italian election and (to no-one’s surprise) no clear result. The Eurosceptic, populist Five Star Movement was the biggest single party with a third of the vote, but Matteo Salvini, leader of the anti-immigrant League was also claiming the right to run the country as part of a right-wing coalition with former Prime Minister Silvio Berlusconi’s Forza Italia party. Inevitably, forming a coalition could take weeks of negotiation and horse-trading.

Much of the attention elsewhere in Europe focused on the Brexit deal, although French leader Emmanuel Macron will see his resolve tested this week by a series of rail and airline strikes as the transport unions begin a series of planned strikes in protest at his reform agenda.

AUSTRALIA

Australian economic growth is slowly improving but economic prospects are still challenging with uncertainty surrounding spending by the heavily-indebted household sector compounded by a softer outlook for housing activity and still soft wages growth. There are strong points in the economy too. Commodity prices have mostly been firmer than expected improving incomes for the farming and mining sectors. Business investment spending is starting to rise and government infrastructure spending is lifting. Jobs growth has been very strong with more than 400,000 jobs added over the past 12 months, providing a boost to household disposable income even while wages growth has languished.

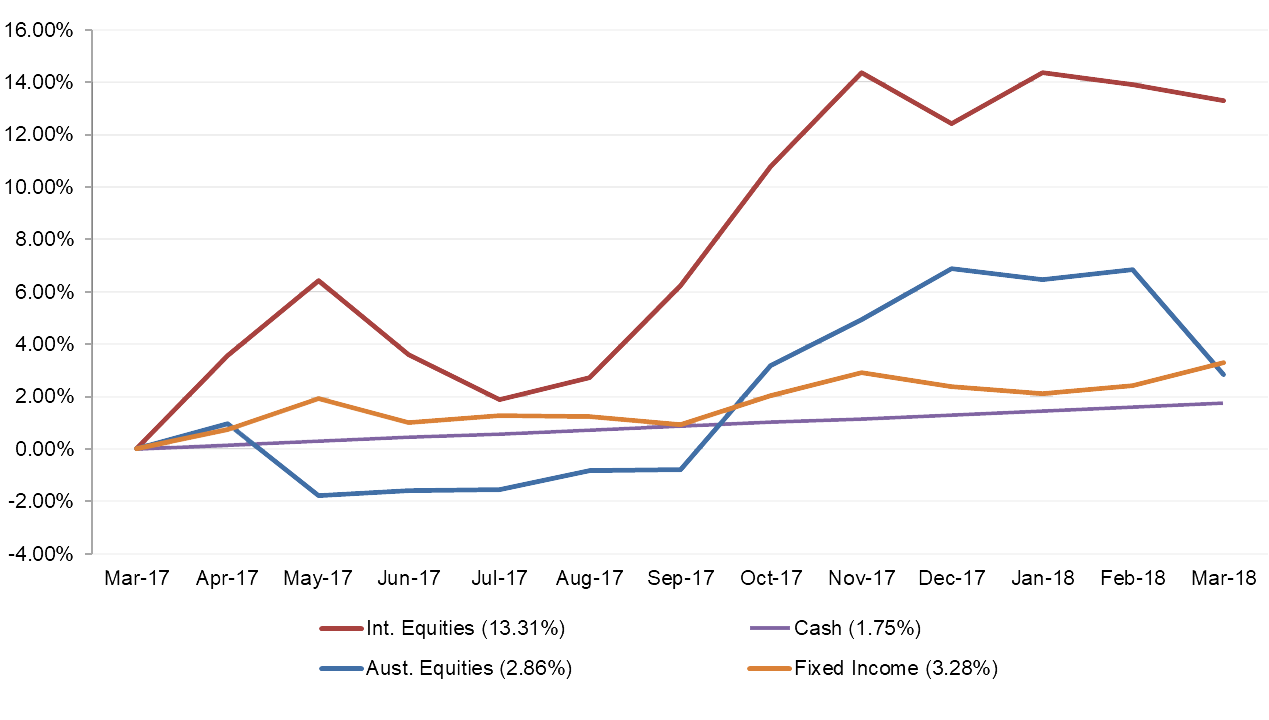

MARKET RETURNS

Markets have had a positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of March provided mixed returns across the asset classes with stronger performance coming from Fixed Income.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.