Market Summary | September 2017

MARKET OVERVIEW

Global equity markets turned in another strong quarter led by emerging markets as the global growth backdrop has overwhelmed any near-term geopolitical concerns.

September saw unrest in Spain, with Catalonia voting for independence. Whilst further damage was done to the Caribbean and the southern states in the United States as the hurricane season continued. One estimate now puts the repair bill in Texas at $180bn following Hurricane Harvey.

UNITED STATES

US financial markets were more volatile through September due to the disturbing news flow on the developing crisis in North Korea and severe weather events in the US. However, there was more positive news that the US economy continues to recover and that the President was starting to find a way to negotiate with Democrats in Congress to potentially revitalise tax cuts.

The US states of Texas and Louisiana were hit by Hurricane Harvey in early September, with severe flooding particularly affecting Houston, the fourth-largest US city and the capital of the country’s energy industry. In the aftermath, as many as a third of US oil refineries, many of which are located in the area around Houston, were estimated to have been impacted by flooding or supply disruptions. While the immediate impact was evident in higher wholesale gasoline prices, the overall effect on US economic growth appeared likely to be limited. Past experience suggested any short-term setback could be offset by increased expenditure in the months ahead, as infrastructure is rebuilt and economic activity rebounds.

CHINA

China is being asked by the United States and its allies to play a greater role in influencing the rogue North Korean regime to achieve a potential regime change in North Korea – that China views as adverse to its interests. This diplomatic pressure is being linked to the willingness of the United States and others to trade freely with China. It is becoming increasingly hard to see how China’s international trade will not suffer from the North Korean impasse.

The battle to batten down excessive investment demand for housing continued through September with local authorities in China’s bigger cities imposing stricter limits on multiple home ownership. In other news, bike sharing apps have been banned in Beijing thanks to traffic chaos and safety concerns, and the government is also planning a ban on both petrol and diesel cars in the near future as China looks to curb pollution and boost its electric cars industry.

EUROPE

The big news in Europe was the German elections, held on the last Sunday in September. They were largely seen as rubber-stamping another four years as Chancellor for Angela Merkel.

Global economic recovery is helping to lift demand in Europe. There are signs that internal demand in Europe is lifting, with relatively strong household spending aided by an unemployment rate that has fallen over the past two years from well above 10% to currently around 9%. Moreover, Italy, a country that has lagged the growth of its European peers, is now showing encouraging signs and is expected to grow GDP by over 1% this year for the first time since 2010.

AUSTRALIA

At its September meeting the RBA left the cash rate on hold at 1.50%, where it has remained since the most recent downward move in rates more than one year ago. The RBA noted the continued improvement in non-mining business investment, as well as positive business sentiment that has led to higher levels of capacity utilisation. However, the household side of the economy remains a challenge, with consumers unable to shake their pessimism, and wage and consumer price growth still stubbornly low.

Strong employment growth in September points towards stronger household spending, and a possible lift in wages growth may add momentum to the Australian economy. Australian exports should benefit from stronger global growth, however, the changing shape of Australia’s biggest market, China, as it seeks a cleaner future may count against some of Australia’s biggest commodity exports.

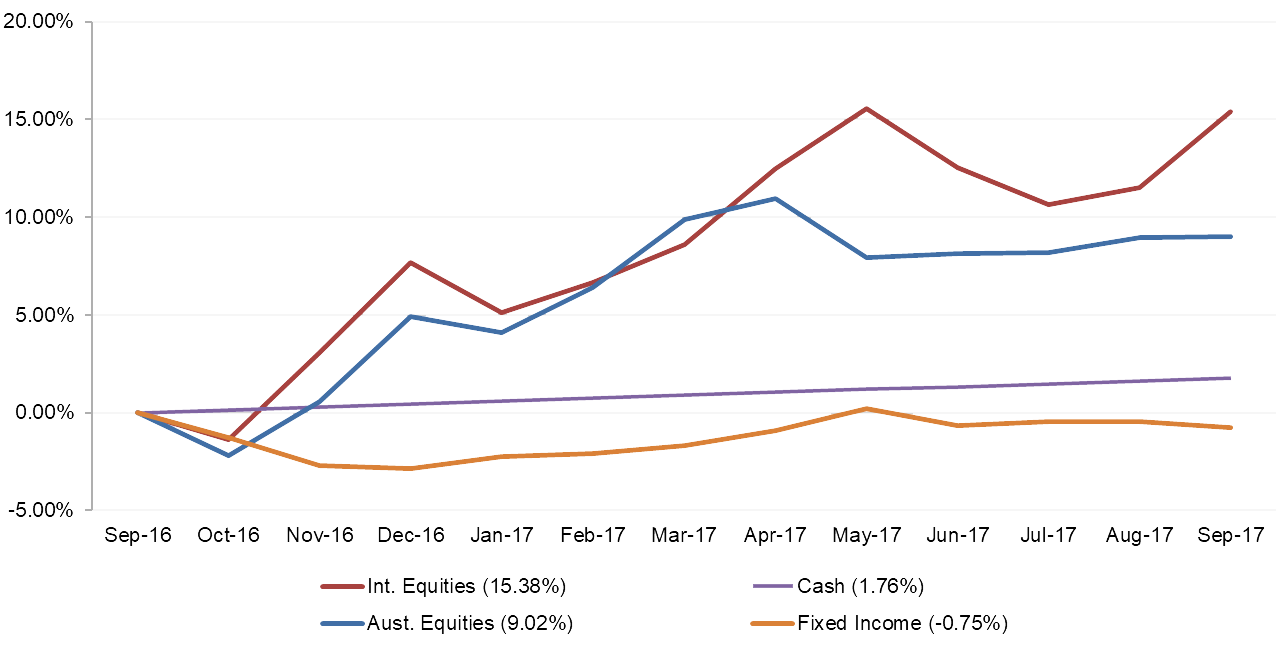

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a mostly positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of September provided mainly flat returns across the asset classes with the exception of international equities which had a particularly strong month.

Note: The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.