Market Summary | October 2017

MARKET OVERVIEW

Global equities made further progress in October as several major indices set new record highs, while volatility reached an historic low.

US equities were supported by economic data that remained positive despite the disruption caused by hurricanes Harvey and Irma. The technology sector was buoyed by strong results.

Emerging markets posted strong returns with ongoing strength in global growth proving supportive. South Korea and Taiwan performed well with technology stocks registering robust gains.

Eurozone equities gained. The economic backdrop remained encouraging and the central bank announced that quantitative easing will be extended to September 2018 but the pace of purchases would be reduced.

In the UK, resources sectors led the market higher as Chinese macroeconomic data remained supportive and crude oil prices continued to rebound.

UNITED STATES

On the US political front, the chances of the Trump Administration delivering tax cuts seemed to improve after the Budget for the current financial year was approved by Congress. The Federal Reserve remains committed to winding down the size of its balance sheet and delivering further rate hikes.

Donald Trump’s choice of Jerome Powell to take over the Fed reins from Janet Yellen is widely viewed as providing the best option for continuity of Fed policy-making. The power behind the current US economic recovery and the risk that US annual inflation will lift well above 2% in 2018 implies that the current Fed forecasts of three more 25bps rate hikes in 2018 is likely to be the least that they will do.

FAR EAST

China held its 19th National Party Congress (NPC), at which a change in sentiment was observed. More infrastructure spending in the regions; less emphasis on residential construction and industrial production; more emphasis on consumer spending and delivery of services. These messages were all reinforced in President Xi’s address to the Party Conference marking the start of his second five-year term in office. China will continue to follow its own growth model, in large part orchestrated by strong government direction with a strong leader. The predominant theme of the model is ‘growth on China’s terms with the rest of the world accommodating’.

In Japan, the elections were a focus for markets. Voters handed a majority to incumbent Japanese Prime Minister Shinzo Abe’s Liberal Democratic Party in Japan's snap election. During the campaign, Prime Minister Abe made several promises about fiscal policy to voters, including using part of the revenue from the upcoming consumption tax hike to increase labour force participation and to invest in improving Japan’s human capital.

EUROPE

Catalonia held a referendum on independence on 1 October, which caused Spanish equities to weaken moderately. However, as increasing political uncertainty unfolded over the month, the Catalan regional parliament unilaterally declared independence from Spain after a secret vote. This move led the Spanish authorities to trigger Article 155 of the Constitution and assume direct control of the region.

Following her speech in Florence at the end of September, Theresa May went to Brussels to meet other European leaders. There were plenty of warm words with both Angela Merkel and Emmanuel Macron making appeasing noises, but the message from the EU remains the same. The divorce bill must be resolved before any talks on trade can begin. Whilst, millions of homeowners face higher mortgage payments after the Bank of England said it could no longer tolerate the inflation level and announced the first increase in interest rates in more than 10 years.

AUSTRALIA

In Australia, economic growth prospects are more mixed than elsewhere. Parts of the economy are strengthening. Employment growth in 2017 so far is the best it has been in more than 15 years and the unemployment rate is down to a 4-year low of 5.5%. Exports of goods and services are rising strongly. There are pockets of big infrastructure building under way, especially in the eastern states and the long slump in business investment spending appears to be over. However, wages growth remains very weak, which combined with very high household debt is resulting in subdued retail spending.

The RBA left the cash rate unchanged at 1.50% at its early October policy meeting. In various commentaries the RBA has indicated that it is in no hurry to move the cash rate, but that eventually the next move is more likely to be upwards.

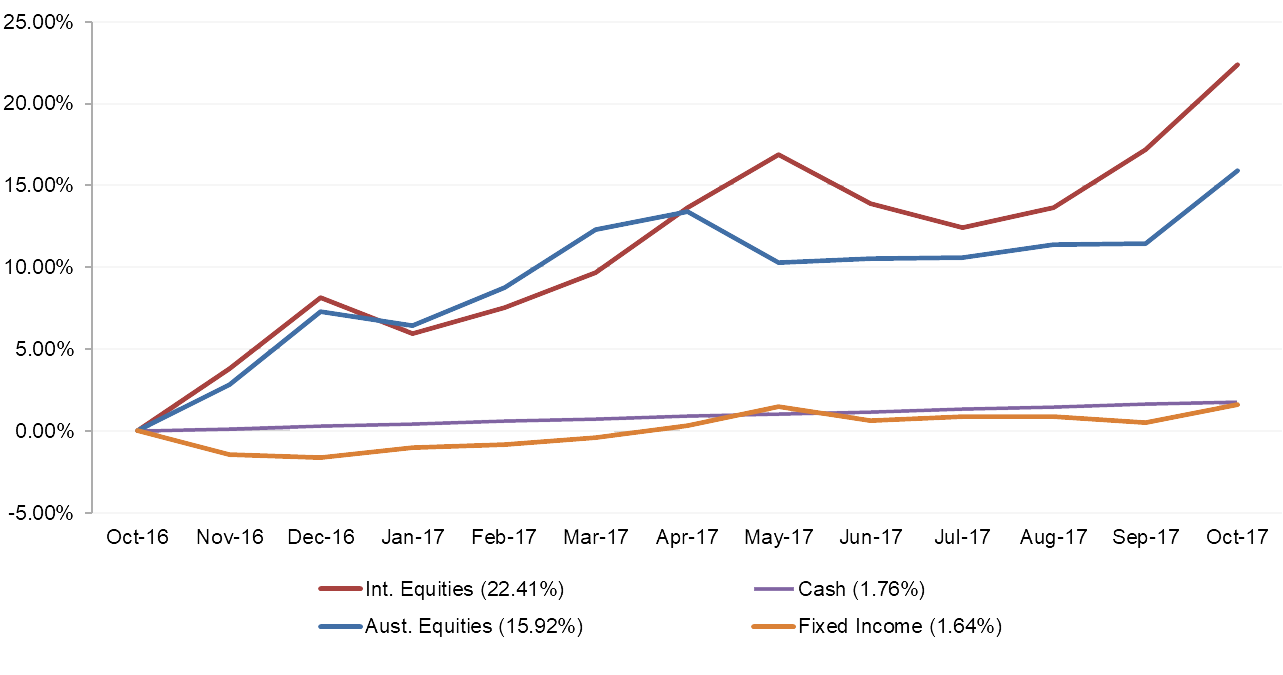

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a mostly positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of October provided mainly positive returns across the asset classes with strong performances from both International and Australian equities.

Note: The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.