Market Summary | August 2017

MARKET OVERVIEW

The traditionally quieter August period was rudely interrupted by an upsurge in political risk, led by mounting US and North Korea tensions and terrorist attacks in Spain. That triggered investor nerves, boosting volatility and pushing some market returns into negative territory. However, macroeconomic data was very positive, with stronger-than-expected growth registered in many countries including Europe, UK, Japan and Brazil, confirming that the global recovery remains solid.

Also in August, we saw Kim Jong-un threaten to bomb Guam, the US territory in the Western Pacific, and by the end of the month air raid sirens were sounding on Japan’s Hokkaido Island. Japan’s Prime Minister Shinzo Abe described North Korea firing the missile as an “unprecedented” threat to his country. Wall Street’s ‘fear index’ unsurprisingly jumped during the month as President Trump intimated that talking to Kim Jong-un wasn’t his first option.

CHINA

China had to take some action in response to North Korea’s continued missile tests and in the middle of the month it announced it would stop importing coal, iron and seafood from the country, as it implemented UN sanctions. This should have a dramatic effect on North Korea’s economy, which has grown significantly of late on the back of exports to China.

China also had other problems in August as the International Monetary Fund warned (again) about the country’s credit boom, saying that China’s credit growth was on “a dangerous trajectory.” Chinese consumers certainly seem to be spending with online retail giant Alibaba, posting a 56% rise in quarterly revenue (in sharp contrast to the traditional US retailer Walmart, which saw a 23% fall in net income).

EUROPE

In Brexit news, Jean-Claude Juncker, the President of the European Commission, said that none of the UK’s position papers were “satisfactory” and warned that there would be no discussions of a free trade deal until progress was made on the so-called Brexit bill, the border with Ireland and the rights of EU citizens.

Back in the UK, the war of words continued, with a group of pro-Brexit economists arguing that removing all trade tariffs and barriers would generate an annual £135bn boost to the UK economy. Those in favour of a ‘soft’ Brexit continued to push for membership of the single market as a transitional arrangement after Brexit, which is scheduled for March 29th 2019.

Also in Europe, the euro hit an 18 month high against the dollar and French voters were expressing fierce opposition to new President Emmanuel Macron’s proposed reform of the labour laws.

UNITED STATES

Donald Trump’s month had begun by imposing new trade sanctions on Russia (described as a “full scale trade war” by Russian Prime Minister Dmitry Medvedev) and it ended with him visiting Houston after it had been hit by Hurricane Harvey, with estimates putting the cost of the clean-up operation at $100bn.

There were also Reports that President Trump’s son and key advisors met with a Russia-linked lawyer. This kept the ongoing Russia investigation in the headlines. Whilst, the Republican Party’s ongoing challenges in enacting the administration’s policy agenda were also highlighted again when the U.S. Senate voted against the repeal of the healthcare law known as Obamacare.

AUSTRALIA

The Australian market outperformed global developed markets over August thanks to rising commodity prices and the higher weight towards miners. This was despite a largely underwhelming reporting season and more companies missing earnings forecasts than beating them. The net result was a downgrade to earnings growth for the coming year.

There are weak patches in the Australian economy. The prolonged downturn in mining investment may be all but over, but the downturn in residential construction is only just starting. Household debt levels are extremely high and wages growth remains very weak. The RBA left the cash rate unchanged at 1.50% at its early August policy meeting. In various commentaries, the RBA indicated that it is in no hurry to move the cash rate but that eventually the next move is more likely to be up than down.

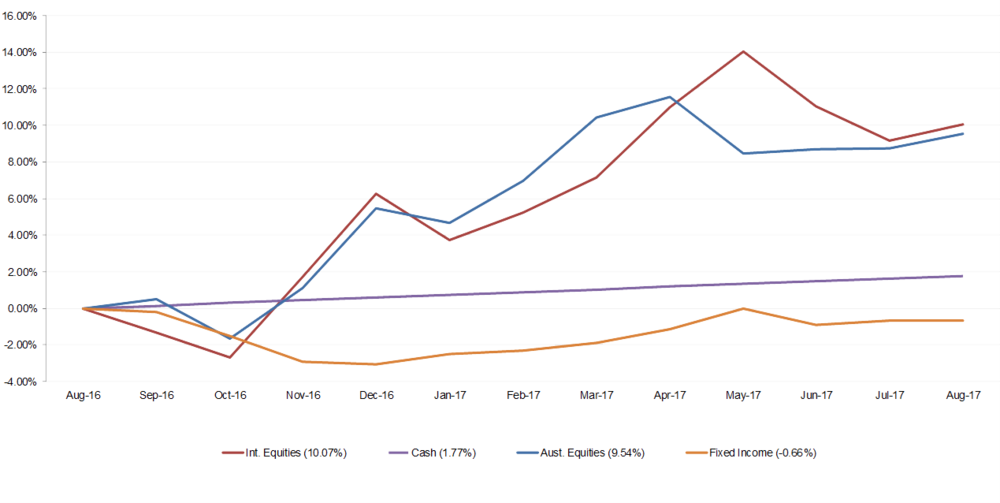

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of August provided mainly positive returns across the asset classes.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.