Market Summary | June 2018

MARKET OVERVIEW

In spite of concerning headlines of late, the global economy has still showed it has positive momentum with the healthy state of the US economy supporting economic growth around the world. That said, potential geopolitical risks are increasing, despite the successful completion of the summit between the US and North Korea towards the beginning of June.

In June we saw emerging equity markets face headwinds from the US Federal Reserve raising interest rates and signalling that it expected two further increases this year. Alongside this was a growing concern over trade protectionism. Developed Markets also continued their out-performance of Emerging Markets for the third month in a row, supported by the strength of the US markets (one of only a handful of exchanges to record a monthly gain).

The out-performance of the Australian share market during June came down to a strong performance by resource stocks, on the back of higher commodity prices. Weakness in the German share market in June was mostly due to growing concern that higher US tariffs aimed at a wider range of European exports, could harm major exporter Germany more than most.

UNITED STATES

As had been expected, the US Federal Reserve announced a rise in interest rates, moving the target rate up from 1.75% to 2%. Hey also indicated that there could be a further two rate rises this year, reflecting the strength of the US economy. It is the seventh time that rates have been increased since 2015 and takes them to their highest level since 2008.

Trade tensions ramped up over June as steel and aluminium tariffs were imposed on Europe, Canada & Mexico and met with retaliatory tariffs on sensitive U.S. exports. A tariff of 25% will be applied to USD 34 billion of Chinese imports from 6 July, and Chinese authorities are expected to implement tariffs on an equivalent value of goods imported from the U.S.

ASIA

China seems well on course to become the world’s most influential economy as the One Belt, One Road infrastructure project continues to extend its influence through Africa and towards Europe. Chinese leader Xi Jinping committed to creating a paradigm of globalisation that favours China. The country is now the world’s second largest consumer of crude oil, with 25% of the imports coming from Sudan and the Gulf of Guinea.

Despite weak sentiment, the Japanese equity market showed a positive return for June as the Japanese yen lost ground against a generally stronger US dollar. Economic indicators seem to be pointing towards a recovery from the short-term GDP decline seen in the first quarter. Data released at the end of June has provided some positive surprises, with industrial production and inflation data both ahead of expectations.

EUROPE

The Italian coalition government has survived its first month in office, even giving an impression of normality as new finance minister Giovanni Tria said that the government was clear and unanimous in its decision to remain in the Eurozone.

The main news out of Europe was the decision of the European Central Bank (ECB) to end its huge programme of bond-buying, which was initially introduced in a bid to stimulate the economy of the Eurozone. In a statement, the ECB said that as long the data remained favourable, it would halve the current scheme (worth €30bn a month) after September and end it completely in December. ECB President Mario Draghi acknowledged that Eurozone growth had stuttered recently but was adamant that underlying growth remained strong.

In Turkey, Recep Erdogan won a new five-year term as president, with some commentators arguing that it effectively spelled the end of the country as a democracy.

AUSTRALIA

The Reserve Bank of Australia left the cash rate anchored at 1.5% at its early June meeting, and judging by the most recent Statement on Monetary Policy, it is unlikely to change course any time soon. Ongoing low wages growth, uncertainty over the extent and impact of the recent tightening in home lending conditions and inflation barely in the bottom of the RBA’s target range, suggest that it would be premature to begin exiting current accommodative policy settings.

The signs from monthly Australian economic readings are pointing to the likelihood that GDP growth will be relatively strong again in Q2. Indications of household consumption spending are running noticeably firmer, with the national unemployment rate down to 5.4%.

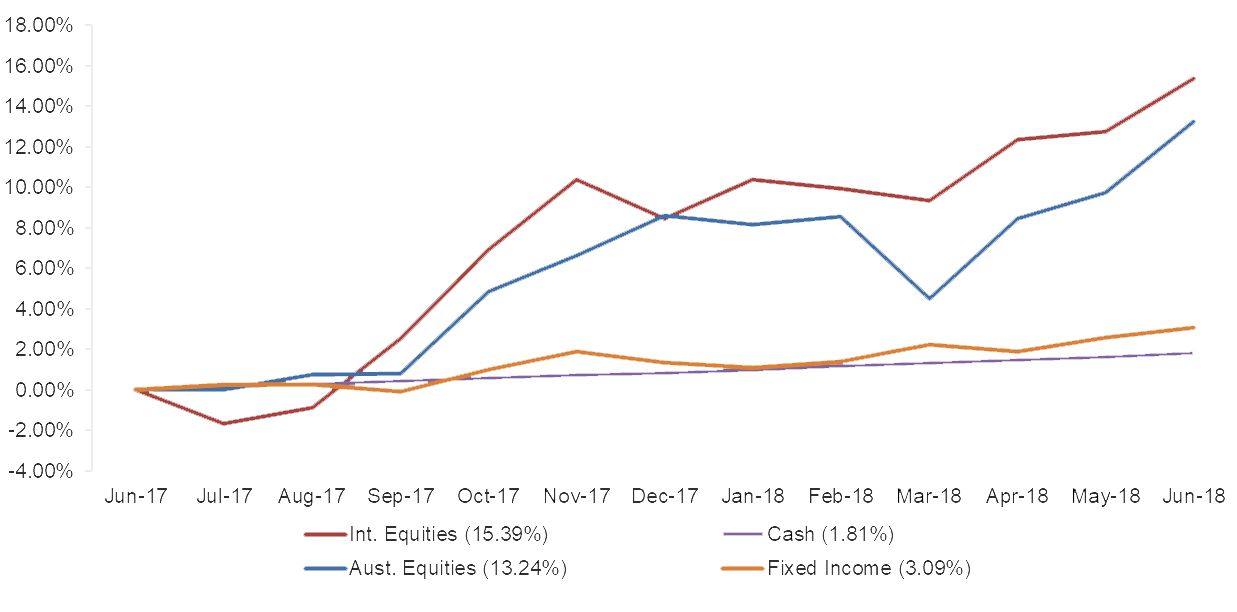

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of June provided positive returns across the asset classes with stronger performance coming from International & Australian Equities.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.