Market Summary | July 2023

Australia

The Australian equity market slightly underperformed global equities once again, rising 2.9 per cent in the month, taking the year to date gain to 7.5 per cent. Eight of the eleven sectors rose during the month with banks up 4.9 per cent following sideways performance over the first half of 2023. Energy stocks rose 8.4 per cent on higher oil prices, IT 4.8 per cent and REITs 3.8 per cent while the healthcare sector declined 1.5 per cent, still reeling from weaker earnings guidance from heavyweight CSL. The small cap index managed to outperform, rising 3.5 per cent.

To the surprise of many, the RBA chose not to lift cash rates in early July, providing relief to the equity market. The RBA viewed this as a pause, as did markets, with the expectation that there would be another hike in August. However, the June quarter CPI came in below consensus expectations at 6.0 per cent for the headline rate of inflation and 5.9% for the core (trimmed mean) figure. The RBA, under the leadership of Governor Philip Lowe for the last time before Michelle Bullock takes over in September, ultimately chose to hold cash rates at 4.1 per cent in early August.

In other data, the Australian unemployment rate was 3.5 per cent in June while a larger than expected 32,000 jobs were added in the month. With the labour market very tight, the RBA still has a modest tightening bias. The housing sector, at least in terms of prices, continues to lift with prices up more than 4 per cent after a 9 per cent decline to February this year. Dwelling approvals and housing finance remain weak. Business conditions continue to ease. Retail spending, in real terms, declined a further 0.5 per cent in the June quarter, making it three consecutive declines, a feat last seen in 2008.

On the earnings front, consensus expects growth of around 2 per cent for the next 12 months following a small decline over the past 12 months. Bank sector forward EPS growth sits at -4 per cent while materials EPS growth expectations are close to 10 per cent.

United States & Developed Markets

Global equity markets continued to rally in July, up a further 3.4 per cent, taking the year to date gain to 19.2 per cent in USD terms. The broadening out of the rally continued with value, small caps and cyclicals leading the way during the month while banks, energy, REITs, and materials also posted reasonable gains. For the year, the MSCI World ex-Australia index was up 13.6 per cent while in AUD terms the index was 17.6 per cent higher.

The rise in equity markets reflects the pricing of a higher probability of a “soft-landing” with inflation continuing to decline while growth has remained above trend. Market expectations for the peak Fed funds rate did not change much over the month (around 5.4 per cent) although the market continued to remove the prospect of easing in light of better than expected growth. US bond yields reflected the changing Fed funds outlook, rising to 4.06 per cent at one stage, before ending the month at 3.97 per cent.

However, equity markets continued to absorb the impact of higher bond yields, cushioned by better than expected economic and earnings data. The US economy grew by 2.4 per cent in the June quarter while nominal GDP, despite slowing, was still more than 6 per cent higher on a year ago, one of the reasons behind the more resilient earnings backdrop. Second quarter earnings data so far point to an annual decline of 7.3 per cent according to FactSet data, the largest decline since 2020 and the third straight negative quarter. The earnings decline is, nevertheless, much less than recession averages of negative 15-20 per cent and consensus projects a lift over the remainder of 2023 and into 2024.

Despite the rise in real yields, PE multiples have risen. In the case of the US, since March the forward PE has risen from 18 times to almost 20 times, despite 10 year TIPs yields rising 50 basis points to 1.72 per cent, a divergence that perhaps speaks to the frothiness in AI-related stocks and the narrowness in the market rally up until June. As noted above, the rally did broaden out in June-July to incorporate more cyclical, risk-on assets, and sectors.

The decline in inflation has been a key factor behind the equity market rally, while low volatility has encouraged momentum and volatility driven strategies. US inflation dropped to 3.1 per cent while in Europe inflation fell to 5.3 per cent. Core inflation is higher, and stickier, 4.1 per cent for the core PCE price index in the US, but even here, there has been improvement.

EMERGING MARKETS

Emerging markets enjoyed a strong month, rising 6.2 per cent in USD terms in July, taking the year to date gain to 11.4 per cent. In AUD terms emerging markets were up 4.9 per cent for the month.

The improvement reflected a strong showing from Chinese equities. The MSCI China index rose 10.8 per cent, its best return since January, and came on the back of the promise of more policy stimulus. The July Politburo meeting, which typically sets the tone for China’s economic policies for the second half of the year, acknowledged the weakness in the economy and pledged to respond to the “major changes” in the demand-supply dynamics in the property market. Leaders also pledged to “actively expand domestic demand” and to “expand consumption by raising income levels.” The meeting also pointed to the need to resolve the problem of local government debt.

While light on details and unlikely to involve any large-scale stimulus measures, the meeting at least provided some basis for the containment of risks in the property sector and the broader economy.

The MSCI Asia index rose 6.2 per cent, Europe 10 per cent while Latin America was up 5.2 per cent. While China and Korea led the way in July, Poland and Mexico have been the big performers in 2023.

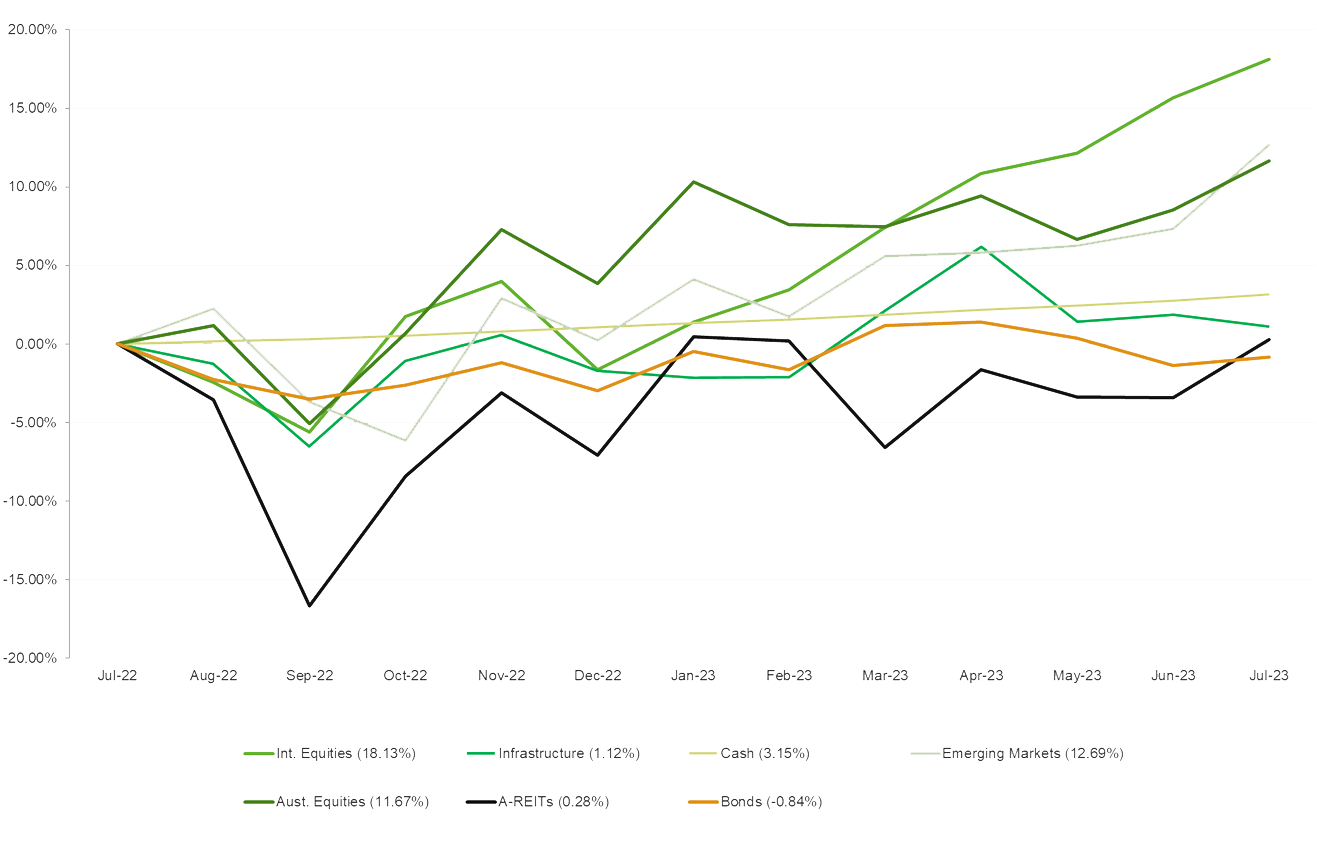

Asset Class Returns (last 12 months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners