Market Summary | August 2023

In August, the Australian equity market underperformed global markets, while the Reserve Bank of Australia maintained steady interest rates. Global equities faced challenges due to rising bond yields, and US earnings declined. In emerging markets, China's policy stimulus disappointed, and other economies struggled amid global trade uncertainties and weak economic data.

AUSTRALIA

The Australian equity market lost 0.7 per cent in the month, taking the year to date gain to 6.7 per cent, significantly underperforming global equities. The bank sector lost ground in August, down 0.8 per cent, while the materials sector was impacted by concerns over Chinese growth, ending the month down 2 per cent. Retailers gained almost 10 per cent, possibly reflecting hope that the rate hiking cycle is over while REITs rose 2.3 per cent.

The RBA chose not to lift cash rates in early August, although in its Statement on Monetary Policy noted that the board did consider the option of raising rates. RBA governor Philip Lowe said the central bank needed more time to assess the impact of the 4 per cent of interest rate rises delivered since May 2022. The lower than expected June quarter CPI would have helped sway the decision, with the RBA lowering its end-2023 inflation projection to 4.1 per cent. The July CPI result has helped cement the view that interest rates are now on hold, confirmed in the early September meeting.

In other data June quarter wages growth was slightly lower than expected, supporting the case for a pause in policy tightening. Wages grew by 0.8 per cent in the quarter with the annual rate at 3.6 per cent. The employment data for July was also softer, with 14,600 jobs lost and the unemployment rate rising to 3.7 per cent.

On the earnings front, the June reporting season showed companies surpassing downgraded expectations although themes of cost pressures and a tougher consumer outlook were widespread. Consensus expects a small decline in earnings over the year ahead.

UNITED STATES & DEVELOPED MARKETS

Global equity markets declined 2.3% per cent in August after rising close to 10 per cent in the previous two months. Year to date, the MSCI World ex-Australia index in USD terms is up 16.4 per cent. With the AUD falling more than 3 per cent, the return in AUD terms was positive in the month, taking the year to date return to 21.9 per cent, highlighting the diversifying properties of unhedged global equities.

By mid-August the S&P 500 has lost close to 5 per cent from its end-July high but recovered ground over the remainder of the month. The key driver of the decline in equities was the surge in bond yields, particularly real yields. The US 10 year bond yield rose from below 4 per cent to a high of 4.34 per cent before rallying at the close of August following a more dovish tone from the Fed. 10-year TIPs yields jumped 40 basis points to 2 per cent, the highest level since early 2009.

More broadly, however, the rise in bond yields reflected an economy continuing to perform better than expected, supporting the “soft-landing” scenario. The fact that this was occurring against the backdrop of declining inflation meant that although the markets did not build in any further tightening, they did factor in “higher rates for longer”. This fed into longer dated real bond yields while implied inflation expectations remained subdued. The relationship between real yields and PE multiples, which had diverged over recent months, reasserted itself during the month as real yields rose and PE’s contracted.

According to FactSet data, US earnings declined 4.1 per cent over the year, making that three quarters of negative growth. After what can be considered to be a very shallow earnings “recession”, consensus estimates are for almost 12 per cent growth in EPS in 2024. Earnings revisions are now modestly positive in anticipation of an imminent trough in the earnings cycle, and in turn, the economic cycle. However, that still appears at odds with expectations that the global economy will continue to struggle under the weight of relatively restrictive policy settings.

Meanwhile, in Europe, growth continues to disappoint and inflation remains well above ECB targets. The German economy continues to struggle given weakness in the manufacturing sector, in turn a reflection of lower Chinese growth.

The US market was the best performing major index, down 1.7 per cent while Japan was down 2.4 per cent and Europe ex-UK, down 4 per cent. For the year to date the US is up 18.7 per cent, Europe 13.9 per cent and Japan 13.6 per cent. During August the markets of Singapore, Hong Kong, New Zealand, and the Netherlands were all off at least 8 per cent while Denmark was the standout with a gain of 4.6 per cent.

EMERGING MARKETS

Emerging markets reversed July’s gain, falling 6.2 per cent in USD terms in August, taking the year to date gain to just 4.6 per cent, lagging developed markets by more than 12 per cent. In AUD terms emerging markets were down 2.4 per cent for the month.

While the Chinese equity market rebounded in July on the back of the promise of policy stimulus, the 9 per cent loss in August reflected disappointment in the size and scope of measures announced in the aftermath of the July Politburo meeting. Among the measures announced to date, the Bank of China cut interest rates by a further 10 basis points, the amount of foreign currency deposits banks are required to hold as reserves has been trimmed while the authorities moved to allow the largest cities to cut down payments for homebuyers and encouraged lenders to lower rates on existing mortgages. On the tax front, China unveiled steps to increase personal income tax deductions for childcare, parental care and children’s education spending. Although these measures are not the “bazooka” scale stimulus of 2008-09 and 2015, they are nevertheless designed to support the ailing property and household sectors.

Korea and Taiwan declined by 7.6 per cent and 4.5 per cent, respectively, highlighting the problems in global trade and weaker semiconductor demand outside of AI-related products. Although India avoided heavy losses, MSCI EM Asia dropped 6.2 per cent while Latin America dropped 7.3 per cent led by an 8.3 per decline in Brazil.

In terms of the economic data, the PMI readings for China were weak with the manufacturing PMI index still sub-50 while the service sector PMI continued its six month slide. On the inflation front, the Chinese CPI data showed mild deflation while the PPI index was down 4.4 per cent, contrasting with the high inflation rates in the developed world. PMI readings improved in Brazil and India (which remains the standout) while activity remained soft in South Korea and Taiwan.

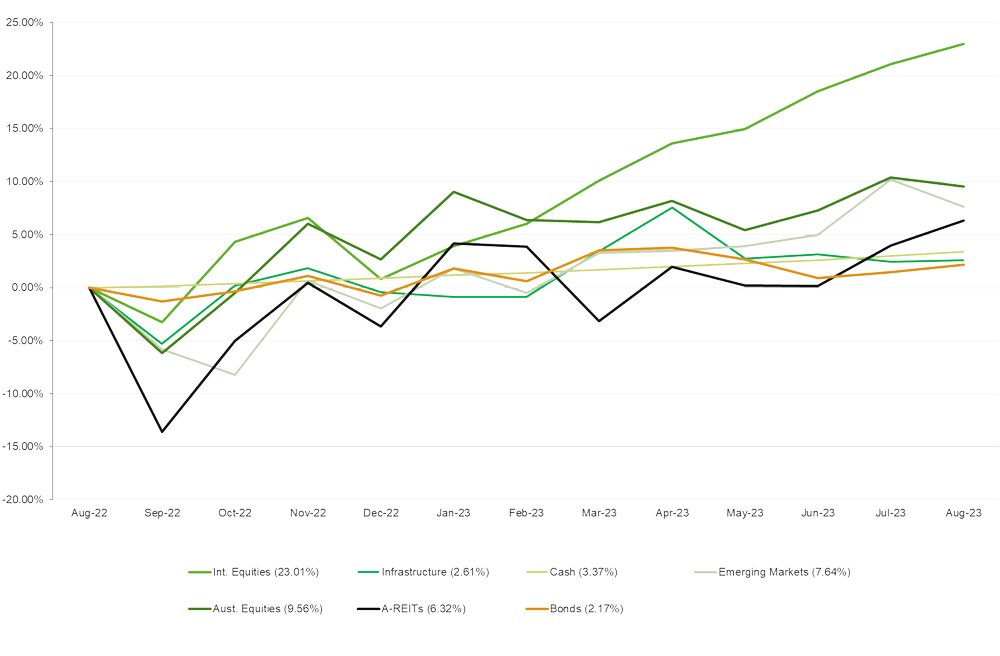

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners