Market Summary | March 2023

MARKET OVERVIEW

Global equity markets rose in March to seal a strong first quarter for the year. While markets were roiled by the collapse of Silicon Valley Bank (SVB) and Signature Bank in the early part of March, the key theme during the quarter was one of peak inflation, a potential peak in Fed funds and, perhaps most importantly, the combination of weaker (but not recessionary) growth data and lower bond yields.

UNITED STATES & DEVELOPED MARKETS

In the early part of March, following another strong US payrolls result, the markets had been pricing in a 5.5 per cent Fed funds rate peak. By month-end, the market was barely factoring in a further Fed hike and had slashed almost 100 basis points of Fed funds projections for 2023-24. This prompted a 45 basis point decline in the US 10-year yield and a similar move in TIPs yields. Growth stocks, led by the big US tech firms, benefited from the decline in real bond yields, jumping 6.9 per cent in March and 15.1 per cent for the quarter, outperforming Value which returned -0.7 per cent and 0.9 per cent, respectively. Quality stocks and stocks with higher EM exposure also fared well, while Momentum stocks lagged.

Silicon Valley Bank, the 16th largest bank in the US, was unique in that as the banker for many venture capital backed start-ups, it’s depositor base was highly concentrated, with deposit sizes larger than the average size for larger banks and less “sticky” than typical depositors. On the asset side, SVB had a larger weighting to US treasuries and MBS’s. With bond yields surging over the past 12 months, mark to market valuations had deteriorated significantly. Furthermore, with tech sector start-ups increasingly struggling and having to access deposits for working capital, SVB was forced to seek additional capital. This unsettled markets and depositors, sparking a bank run. Signature Bank failed soon after, while in Europe, Credit Suisse finally succumbed to years of difficulty, forced into the arms of UBS.

In AUD terms the MSCI World ex-Australia index rose 3.9 per cent in March, 9.2 per cent for the quarter and 13.9 per cent in the financial year to date. The solid performance was even across markets although Germany, Denmark, Ireland and Netherlands have outperformed in recent months. Europe ex-UK was up 11.9 per cent for quarter compared with the US at 7.6 per cent and Japan 6.2 per cent. Commodity and energy heavy markets have lagged, particularly Norway, down 4.7 per cent in March and - 7.2 per cent for the quarter, and Canada to a lesser extent.

At the sector level, the decline in bond yields and perceived “safety” saw the IT sector surge 10 per cent for a 21.1 per cent gain in the December quarter while communications rose 9 per cent and utilities and consumer staples around 4 per cent. Banks, the big gainers in 2022, dropped 7.3 per cent in the month reflecting the collapse of several smaller, regional banks and concerns over contagion. Energy, another “winner” in 2022, lost 1.7 per cent as oil prices weakened.

EMERGING MARKETS

The MSCI Emerging markets index rose 3 per cent in USD terms in March, taking the March quarter gain to 4 per cent and the financial year to date advance to just 0.8 per cent. In AUD terms, emerging markets were 3.7 per cent higher in March and 5.3 per cent in the quarter.

MSCI EM Asia was up 3.6 per cent with China rising 4.5 per cent. For the quarter EM Asia was 4.8 per cent higher with strong gains in Taiwan and Korea being partly offset by a drop in India of 6.4 per cent. Latin American stocks have been constrained by recent poor performance from Brazil.

The growth and inflation backdrop in emerging markets is arguably more favourable than that of the developed markets, particularly in China. PMI activity readings in China have surged since the end of lockdowns while inflation remains low. Policy is being eased as reflected in the modest cut in the bank reserve requirement ratio during the month.

AUSTRALIA

The Australian equity market was off 0.2 per cent in March taking the quarter’s advance to 3.5 per cent, the first quarterly underperformance of global equities since the June quarter 2022, For the financial year to date, Australian equities have returned 13.6 per cent, broadly in line with unhedged global markets.

The miners, telcos and healthcare led the way in March, all up at least 4.5 per cent while REITs were dumped in response to concerns over commercial property valuations. Diversified financials were down 7.7 per cent. For the quarter, the best performing sectors were utilities (up 15.9 per cent), food retailers (11 per cent), healthcare (10.4 per cent) and retailing (10 per cent). As noted above, banks, REITs and diversified financials detracted.

The RBA lifted the cash rate for the 10th consecutive meeting, to 3.6 per cent, but softened the language in response to weaker GDP and wages data while expressing confidence that the risk of a wage-price spiral had diminished. "At the aggregate level, wages growth is still consistent with the inflation target and recent data suggest a lower risk of a cycle in which prices and wages chase one another," Dr Lowe said. In a speech to the AFR Business Summit, Lowe revealed the RBA board had talked about the possibility of leaving the cash rate target on hold at a future meeting, acknowledging that at 3.6 per cent it was already in "restrictive territory". "At our board meeting yesterday, we discussed the lags in monetary policy, the effects of the large cumulative increase in interest rates since May and the difficulties that higher interest rates are causing for many households," Mr Lowe told the audience in his prepared remarks.

On the economic front, the employment data rebounded from the soft January figure with 65,000 jobs added and the unemployment rate back down to 3.5 per cent. The wages data for the December quarter was not as strong as expected with wages up 0.8 per cent in the quarter and 3.3 per cent for the year. Perhaps more importantly, the national accounts for the December quarter showed a household sector labouring under the weight of the rapid lift in mortgage rates. Household disposable incomes contracted by 0.7 per cent, despite solid wages growth with mortgage costs as a percentage of incomes reaching 4 per cent, the highest since 2015.

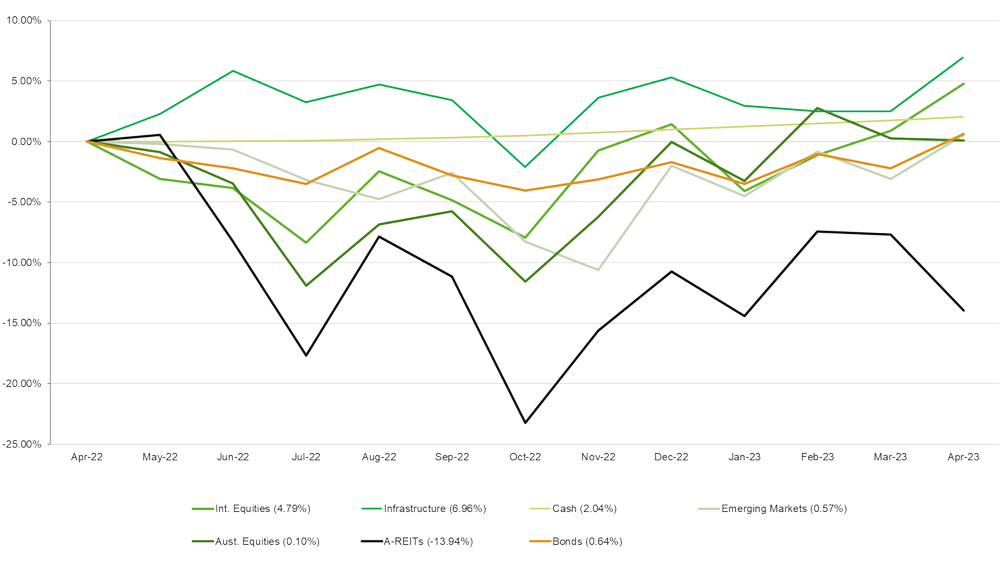

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners