Market Summary | June 2023

Market Overview

Global equity markets experienced a mixed performance in June, with Australian equities rising only 1.8 per cent, lagging behind the global rally of 6.1 per cent. The Reserve Bank of Australia's cautious approach to raising interest rates provided temporary relief to the equity market, while Chinese equities struggled due to weaker consumer spending and geopolitical tensions in the emerging markets.

United States & Developed Markets

Global equity markets rallied strongly in June, up 6.1 per cent in USD terms to take the June quarter return to 7 per cent. While growth stocks and the IT sector generally led the way over the quarter largely on the back of a focus on AI exposures, the rally in equities broadened out in June to include banks, retailers, small caps, REITs, and materials while Value stocks also joined in. For the year, the MSCI World ex-Australia index was up 18.7 per cent while in AUD terms the index was 22.6 per cent higher.

The rise in equity markets continues to confound many observers, particularly in light of a ratcheting up of Fed tightening expectations and tighter policy in response to “sticky” inflation data. Market expectations for the peak Fed funds rate moved up to 5.6 per cent from the current 5.25-5.5 per cent range with no real prospect of an easing by end-2023. Contrast this with end-March when the market expected a 4.5 per cent Fed funds rate by year end and close to a 3.25 per cent Fed funds rate by end-2024. Bond yields reflected the changing Fed funds outlook, rising to 3.8 per cent from 3.4 per cent. However, equity markets managed to absorb the impact of higher rates, instead focusing on the better than expected economic and earnings picture. Solid nominal GDP growth, bolstered by higher inflation, a resilient consumer and signs of life in housing have combined to sustain GDP growth close to 2 per cent, keeping the much-anticipated recession at bay. Earnings have declined by around 5-7 per cent but expectations are for an improvement in late 2023 and into 2024.

Inflation continued to decline across most regions although in core terms, inflation is proving more difficult to tame. US headline inflation dropped to 4.1 per cent from 5 per cent while in Europe the CPI eased to 5.5 per cent. UK inflation remains a major concern, sitting at 8.7 per cent. However, US core CPI is 5.3 per cent, 2-3 times target and in Europe it is 5.6 per cent compared with the 2 per cent target. Central banks seem willing to risk recession in order to achieve their inflation objectives over a reasonable time frame and indeed US Fed staff are projecting a recession while Europe is already “technically” in one. The reality, however, is that economies and labour markets are holding up much better than expected, partly due to the existence of large savings buffers coming out of Covid-lockdowns as well as solid jobs and wages growth.

As noted above, Japan continues to perform well, up a further 4.1 per cent in June to take the return for the quarter to 6.4 per cent and for the year to 18.1 per cent. Relatively cheap valuations, easy policy settings and improved corporate governance are cited as key drivers of the solid performance. Europe ex-UK enjoyed another strong month, driven by outsized returns in Spain and Italy. For the quarter Europe ex-UK is up only 2.9 per cent but the for the 12 months has risen 24.6 per cent, outperforming other major regions. Italy and Ireland were up more than 40 per cent. The US market, after lagging European and Japanese markets for much of the rally since October 2022, came to the fore over the June quarter, rising 8.6 per cent, assisted by the large rally in the “magnificent seven” stocks. As mentioned above, the rally broadened out in June with small caps rising 4.2 per cent in AUD terms, taking the June quarter gain to 4.6 per cent.

EMERGING MARKETS

The MSCI Emerging markets index rose 3.7 per cent in USD terms in June, and 0.9 per cent for the quarter, taking the annual gain to just 1.8 per cent. In AUD terms emerging markets were up 5.1 per cent for the year.

Emerging markets continue to lag global developed and Australian equity markets. While Hungary, Poland, Mexico and Brazil have provided returns in excess of 30 per cent over the year and India and Korea have added 14.2 per cent and 13 per cent, respectively, Chinese equities have seriously weighed on overall emerging market performance. The MSCI China index managed to rise 4 per cent in June but fell almost 10 per cent for the quarter and 16.8 per cent for the year. Weaker than expected consumer spending, slowing home sales and a disappointing recovery in manufacturing following the re-opening have all contributed to the poor performance this year. Geopolitical tensions and a weaker currency have not helped. The official June China manufacturing PMI remained under the critical 50 level for the third consecutive month. Exports declined 7.5 per cent over the 12 months. Meanwhile inflation, unlike the rest of the world, is non-existent.

During June, the Chinese authorities responded with some stimulus measures including a 10 basis point reduction in the benchmark rate to 3.55 per cent. However, the prospect of a major stimulus seems distant while the economy continues to deal with a deflating property sector and weaker global growth.

In terms of the economic data, the PMI readings for India remain very strong while the Taiwan and South Korean economies continue to struggle with weaker global growth and exports. The central banks of most emerging markets appear to be on hold as inflation shows signs of peaking.

Australia

The Australian equity market underperformed global equities, rising 1.8 per cent in the month, taking the quarterly gain to 1 per cent and the 12-month return to 14.8 per cent. In contrast to 2022, a lack of IT exposure has been a key factor behind the underperformance of global equities and although the materials and bank sectors produced solid returns in June (4.7 per cent and 3 per cent, respectively), their performance over the quarter was subdued, while the pharma and food sectors also performed poorly in the quarter.

The RBA lifted the cash rate in early June to 4.1 per cent, the highest level since 2012. RBA governor Philip Lowe again warned on the rising cost of services, such as hospitality, which are labour intensive and therefore sensitive to rising wages. "Recent data indicate that the upside risks to the inflation outlook have increased and the board has responded to this," he noted following the meeting. "While goods price inflation is slowing, services price inflation is still very high and is proving to be very persistent overseas. Unit labour costs are also rising briskly, with productivity growth remaining subdued." "Growth in public sector wages is expected to pick up further and the annual increase in award wages was higher than it was last year”. It is clear that the RBA remains very concerned about the lack of productivity to offset rising wages growth, although the only tool it has at its disposal, the cash rate, has little, if any influence on productivity.

To the surprise of many, the RBA chose not to lift cash rates in early July, providing relief to the equity market. The RBA views this as a pause, as do markets, with the expectation that there will be another hike in August.

During June the materials sector rose 4.7 per cent on stronger iron ore and Chinese easing, banks rose 3 per cent while insurance benefited from higher bond yields. For the quarter, insurance and IT have been the best performing sectors.

On the data front, consumer and business confidence continue to be impacted by rising rates while overall business conditions appear to be deteriorating. Retail sales rose a stronger than expected 0.7 per cent in May, an outsized 76,000 jobs were added while hours worked continued to expand. The inflation data was lower than expected with the CPI dropping to 5.6 per cent from 6.8 per cent although core inflation remains above 6 per cent. The data suggests that overall earnings growth should begin to feel the pressure of weaker discretionary spending and a softer housing market.

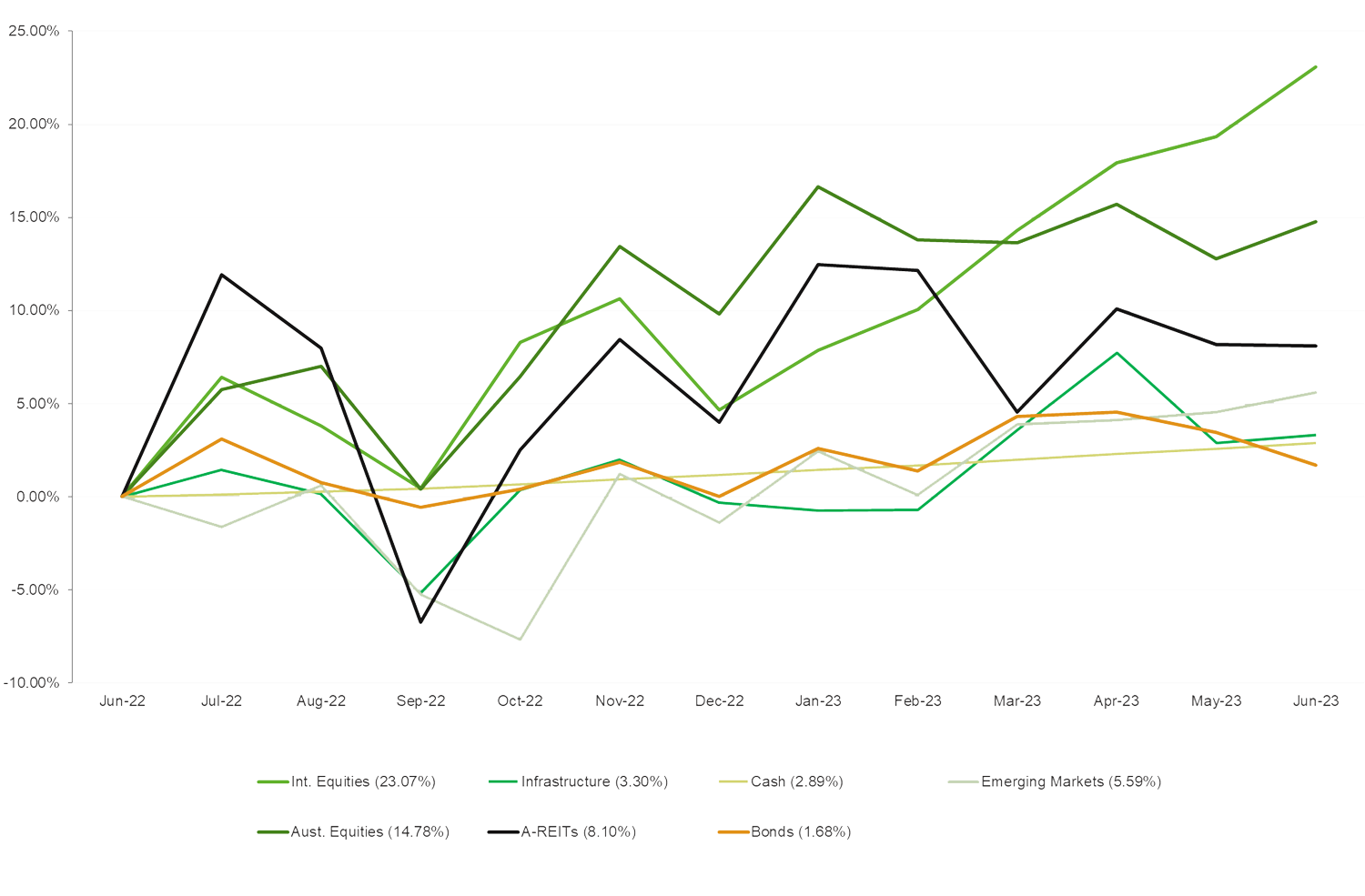

Asset Class Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners