Q2 2023 Investment Market Update

The second quarter of 2023 brought continued performance for investment portfolios as international equities continued to build on their momentum from the first three months of 2023. The market continued to gain confidence as the headline inflation rate continued to decline month on month. International equities were a significant driver of returns throughout the quarter, outperforming Australian equities substantially. Currency markets remained relatively flat as the U.S. dollar was relatively flat against the Australian Dollar.

Central banks continued to combat inflation, raising rates throughout the quarter against the consensus, almost entirely ruling out the possibility of any interest rate cuts for 2023. The Reserve Bank of Australia (RBA) increased rates from 3.6% to 4.1%, whilst the U.S. Federal Reserve raised rates from 5% to 5.25%.

From a portfolio perspective, our investment portfolios climbed throughout April, declined in May, and rose again in June, ending the quarter with positive returns between 1.55% & 4.70%, depending on the strategy. The investment committee made some changes throughout the quarter. Portfolios were positioned underweight equities, overweight infrastructure and overweight cash come quarter’s end.

International Equities

International equities rose during the June quarter returning 7.00%, outperforming Australian equities substantially. Performance was dominated by mega-cap companies such as Nvidia, Apple and Microsoft that have benefited from an artificial intelligence fuelled rally. Our international equity allocation underperformed during the quarter as allocations to emerging markets and smaller businesses underperformed relative to the index.

Despite the positive performance, corporate earnings across the S&P500 at the headline level have drawn down the last two quarters, totalling a touch over 5% from their peak, with further declines expected as corporates report second quarter (Q2,23) earnings this month. The market rally and combined fall in profits have caused valuation multiples to expand throughout the quarter, leaving them on the expensive side of the average.

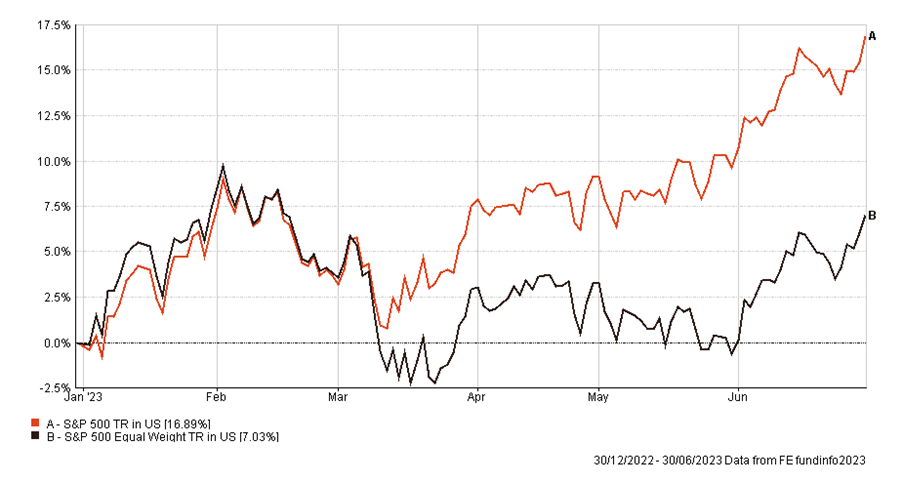

There has been much talk regarding the dispersion of returns year to date. The S&P 500 index represents most but not all of the largest companies in the United States, and its constituents are weighted by market capitalisation or size. The top 10 companies within the index contribute over 30% of the total benchmark, becoming increasingly concentrated at the pointy end. While the S&P 500 is up 16.89% this year, until June, most of that performance was driven by just a handful of companies. This is best compared by contrasting the S&P 500 to the equal-weighted equivalent of the S&P 500 (which invests in an equal weighting of the 500 companies – a 0.2% weight for each stock), which generated negative returns to the end of June whilst the market-cap-weighted S&P 500 had performed substantially better. This is highlighted in the chart below:

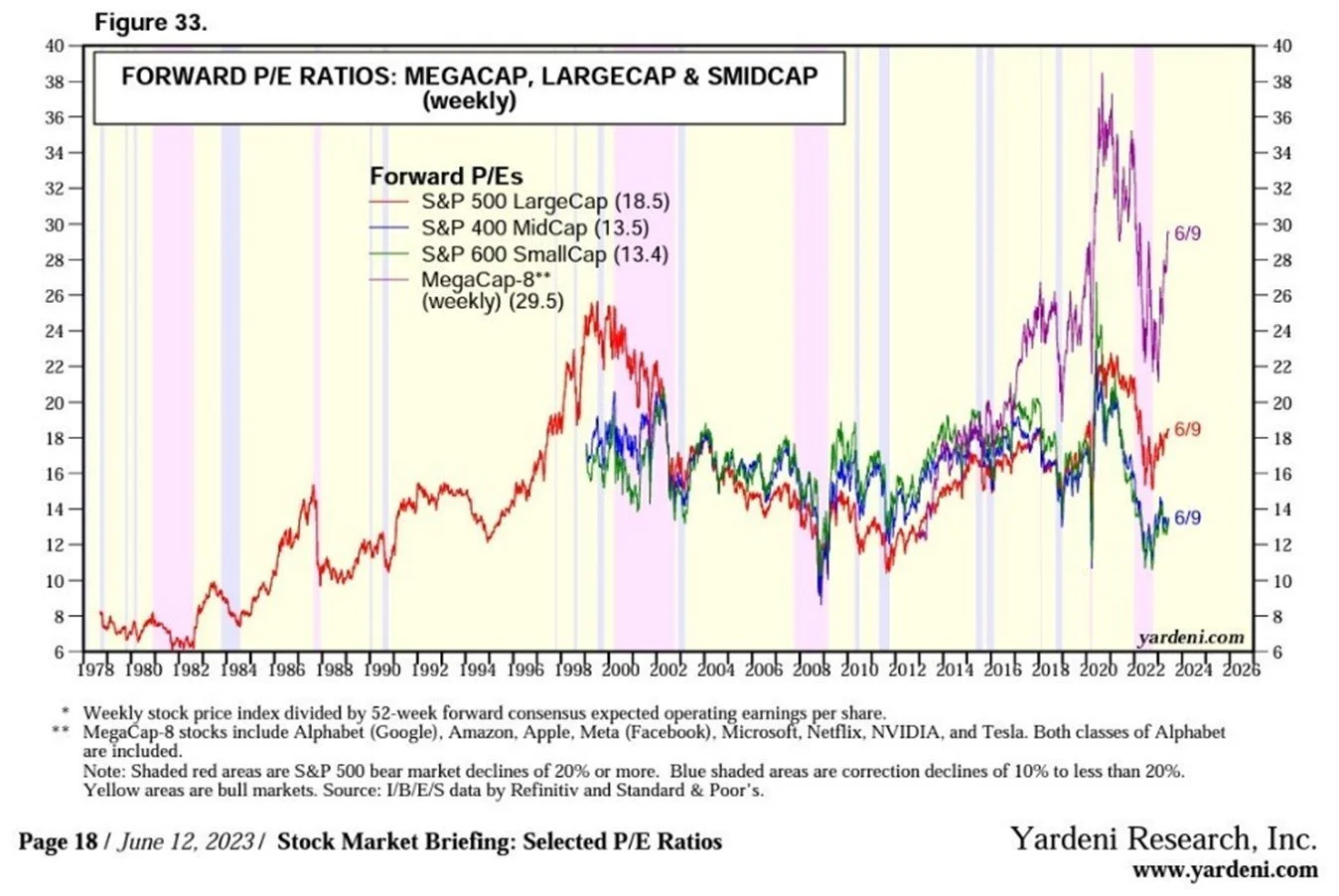

This concentration in performance has also led to a significant differential in valuation multiples between large & small businesses, with larger companies trading at a substantial premium to smaller businesses, with the differential widening the most in recent years. Some extremes of this are companies such as Nvidia, a semiconductor producer right at the centre of Artificial intelligence mania currently trading on 39x sales and 211x earnings at the time of writing.

Unfortunately, these dynamics have not favoured our positioning year to date, given our allocations to both emerging markets and global small caps result in our positioning being more diversified & less concentrated than the index. However, from a forward-looking perspective, we are confident this underperformance will revert. Historically investing at lower valuations and more attractively priced assets has resulted in superior return outcomes for investors.

There were no changes to the international equity allocation of the portfolio during the second quarter.

Australian Equities

Australian equities returned 1.01% during the quarter, marginally contributing to performance. Our Australian equity allocation outperformed by roughly 1.5% as a mix of strategies generated outperformance relative to the index.

Australia's economy faces challenges on many fronts. New Zealand has now entered a recession, mirroring similar inflationary pressures about six months ahead of Australia. An influx of migrants has improved labour shortages. It is leading to record-low vacancy rates in major cities, causing rental prices to skyrocket, with over 20% year-on-year increases in some cities. The Fair Work Commission approved a 5.75% minimum wage hike and energy price hikes are expected in the second half of 2023. These will complicate the RBA's mission in driving the inflation rate back towards the target band of 2-3% p.a. Aggregate demand is expected to deteriorate further in the coming months as fixed-rate mortgages expire over the coming months and potential further interest rate hikes.

Across the Australian equity market, we've seen a reversal of 2022's return dynamic when Australian shares outperformed international shares. Year to date, Australian shares have returned 4.51% vs international equities at 16.41%, almost giving back all of the outperformance since the start of 2022.

Sector performance across the Australian equity market has been disperse and has been the major contributor to relative performance against international equities. More considerable exposure to financials (0.37% YTD), healthcare (0.39% YTD), resources (4.34% YTD) and materials (5.07% YTD) has hindered performance due to rising recession risk, which in turn has impacted commodity prices whilst issues seen across the banking sector during the first quarter has affected the financial industry. While the ASX's technology sectors have performed well (30.88% YTD), the industry only makes up 2.33% of the index relative to the 28.1% allocation within the S&P 500.

A positive for both the Australian market and the economy could be China. The region's covid reopening has surprisingly underwhelmed on an economic front and hasn't seen the same boost that reopening inspired across the Western world. This could result in China pursuing stimulus measures, and historically, this implemented through infrastructure spending, which would be very supportive for Australian exports and Australian resource companies & equities.

There were no changes to the Australian equity allocation of the portfolio during the second quarter. The allocation ended the quarter underweight, with a preference toward more yield-focused asset classes.

Property & Infrastructure

Property added to portfolio performance during the quarter as Australian listed property returned 3.4% whilst infrastructure detracted slightly, returning -0.27%.

The outlook for commercial real estate continues to be cloudy. Charter Hall, one of Australia's largest real estate managers, published their movements in valuations for the first six months of 2023. The report showed a 2.8% decline in valuations across the platform associated with a 32 basis point rise in capitalisation rates. Sectors that have been able to grow rental income, such as industrial, continue to perform better than those, such as office, which are facing pressure.

During the quarter, we took profits on our listed real estate position. In October 2022, the committee elected to change the composition of the portfolio's property allocation from a majority unlisted to listed exposure, seeking to take advantage of the discounts available across listed property. Since this trade has worked well, listed property has participated in the recovery seen across markets over the past few quarters, adding value to the portfolios. We elected to reduce exposure to listed property to reduce overall portfolio risk given the asset class is a higher beta position, meaning that the position will both rise & fall more than the broader market. Re-allocating elsewhere may allow us to de-risk the portfolio without trading off future returns.

Infrastructure assets continue to recover operationally from covid related ramifications as traffic on developed toll roads, commuter rail, and airports continue to be utilised higher over time. Chinese tourism should continue to boost airport outlook as their population moves back into international travel. Long-term fundamentals for the asset class continue to be attractive. The global population is forecasted to grow by one billion over the next decade, significantly impacting new and existing investments.

Private Equity & Venture Capital

Our private market exposures generated positive returns for portfolios during the quarter. Noting we are still awaiting the end of March valuation for some assets.

Private equity has played an integral role in portfolios over the past 18 months, delivering stable and consistent returns throughout a volatile period for publicly traded equities. Investors have been able to benefit from exposure to industries and companies without the volatility that is traditionally inherent in listed investments. Primarily due to the valuation of private equity strategies being tied to the underlying performance of the companies it's invested in rather than investor sentiment that influences public markets. For investors, this has resulted in a smoother investment experience.

There were no changes to the private equity allocation of the portfolios during the second quarter.

Enhanced income

Bonds generated negative returns for portfolios returning -2.51% in the second quarter after a solid start to the year. The market saw a rapid rise in yields around mid-May as the market moved on from expectations of central bank cuts in the second half of 2023. Yields have rallied to their highest levels of this cycle at the time of writing.

Australian cash rate expectations continued to climb during the quarter, with the market-implied terminal rate now at 4.51%, peaking in November up from 3.61% only a few months ago. This would indicate two further rate hikes by the RBA over the coming months.

The U.S. Debt Ceiling was also a significant focal point during the quarter as the U.S. Government avoided default by several hours. The debt ceiling is the maximum amount the U.S. government can borrow by issuing bonds, essentially how far they can go into debt without defaulting on said debt. Congress has elected to revise and extend the ceiling providing extra headroom that should extend into 2025.

Whilst traditional bond allocations have been a pain point in many investor portfolios, our positioning has been focused on shorter duration and floating rate investments such as term deposits which haven't been subject to the same degree of negative returns as the benchmark. The outlook for many subsets of enhanced income investments continues to benefit as all-in returns rise in line with cash rates. For short-term investors, the highest rate we can access on a 12-month term deposit has reached 5.67%.

We continue to believe it's an excellent time to be a lender of credit, with the asset class having the potential to generate substantial risk-adjusted returns. Throughout the first half of 2023, we've seen a consistent increase in loan yields, and the improved bargaining power of direct lenders presents a favourable entry point for long-term capital lenders. All in returns for some strategies have now crossed into equity-like double digits levels and are substantially higher than the yields available on other asset classes such as real estate.

We have been gradually ratcheting up the exposure to interest rate risk over the last few quarters, which has the potential to provide defensive qualities should yields begin to decline, which would be likely in a recessionary scenario.

Pleasingly 2023 has gotten off to a positive start for investors as the portfolios have delivered positive returns throughout the first half of the year, with broad-based performance across asset classes.

Looking forward, it's our view that the full impact of tighter and continuing tightening of policy settings is yet to be felt by participants and the risk of a recession remains high. This would likely coincide with rising unemployment and a drawdown in corporate earnings as the consumer faces headwinds, likely leading to lower equity markets. Stocks in recent cycles have peaked on average two months before the beginning of a recession but the period before that often saw strong returns.

For now, our portfolios reflect our views and are positioned in a defensive position. Pleasingly, the alternatives to risk assets now offer significantly enhanced returns to what was available throughout 2021 & 2022 with cash-like solutions offering running yields over 4%, with any form of credit risk only enhancing returns from there.

As always, should you have any queries about any of the material outlined in this letter, please do not hesitate to contact me.

Kind regards,

Ryan Synnot

Associate Director, Investment Research & Solutions