Market Summary | April 2023

MARKET OVERVIEW

The volatility that had characterised the last few months in equity and bond markets subsided in April, underpinning a slight bid tone to most assets. A combination of declining inflation, expectations of a peak in central bank hawkishness and better than expected earnings results helped push equity markets higher despite lingering risks of recession.

UNITED STATES & DEVELOPED MARKETS

Global equity markets rose a further 1.8 per cent in April, following the 3.2 per cent advance in March, taking the annual gain to 3.3 per cent. The turmoil in the bank sector in March was put aside for the most part although as we exited April, First Republic was quietly closed, the 2nd largest bank failure in US history, and taken over by JPMorgan.

The data remains mixed. As noted above, the inflation news has been broadly better. US inflation dropped to 5 per cent from 6 per cent although the core CPI rose modestly to 5.6 per cent. In Europe inflation continued to ease although in the UK inflation remained over 10 per cent.

However, there is also growing evidence of recession. In the US, particularly in the aftermath of the failure of several US banks, credit conditions and accessibility appear to be tightening while business capex intentions are pointing to weakness in investment spending. US GDP growth slowed to a 1.1 per cent rate in the March quarter and the latest Atlanta Fed GDPNow estimate is 1.8 per cent for the current quarter. The labour market, although softening a touch, remains tight with unemployment at 3.5 per cent and the broadest measure of wages growth, the employment costs index, just under 5 per cent.

For equities, the combination of hefty prices rises and a relatively resilient household sector has meant corporate earnings have exceeded expectations and is a reminder that equities carry an inflation hedge component. The latest data from Factset suggests earnings have so far notched up their best performance relative to analyst expectations since Q4 2021. Combining actual results to date with estimates, the earnings decline for the first quarter is -3.7 per cent, compared to an earnings decline of -6.7 per cent at the end of the first quarter.

At the sector level, insurance, consumer staples and healthcare outperformed, perhaps reflecting the ability of those sectors to offer inflation protection. The IT sector was off marginally while banks lost 2.2 per cent as tightening credit conditions undermined the outlook. Defensive sectors gained 3.7 per cent while momentum and quality exceeded the index. For the past 12 months defensives and quality have returned over 5 per cent with momentum stocks down slightly.

EMERGING MARKETS

The MSCI Emerging markets index declined 1.1 per cent in USD terms in April, taking the 3-month loss to 4.7 per cent and the annual decline to 6.5 per cent. In AUD terms emerging markets managed to lift slightly although for the 12 months are up just 0.5 per cent.

The major reason for the recent weaker performance relative to developed markets was the weakness in China where an uneven recovery in the economy emerging from Covid lockdowns undermined confidence. Although the Chinese economy grew a stronger than expected 4.5 per cent in the March quarter, led by the consumer sector, the bounce is not as large as experienced by most western economies in the aftermath of lockdowns due to the fact that the Chinese government and central bank did not provide the same degree of stimulus. While real estate prices and sales have recovered, investment in the sector remains weak. This fits with the government’s emphasis on consumption rather than real estate as the driver of growth going forward.

The outlook for emerging markets is heavily dependent on the outlook for China. While the performance of Chinese equities has been volatile, a combination of solid growth, low inflation and accommodative policy settings stands in contrast to most developed markets. Policy uncertainty and risks associated with the heavily indebted property sector remain.

AUSTRALIA

The Australian equity market rose 1.9 per cent in April, producing an annual gain of 2.8 per cent. The Australian market’s outperformance of global markets seemingly ended in the first few months of 2023 as investors turned to growth stocks and became more cautious on domestic banks in light of concerns over the household sector and on materials as China’s post-Covid recovery proved underwhelming.

Although banks gained 3 per cent in April, over the three months they have declined almost 7 per cent with investors acknowledging that the bank sector may be negatively impacted by any further movements in short term rates. For most of 2022 banks benefited from the rising interest rate environment however signs of a peak in net interest margins and the impact of cumulative mortgage rate increases on household disposable incomes and the housing market has been undermining the sector in 2023. Meanwhile, the materials sector declined 2.6 per cent in the month, taking the three-month decline to 3.7 per cent, partly reflecting the 17 per cent drop in iron ore prices in April. Weaker than expected growth in construction in China, after an initial burst post-lockdowns, was cited a factor behind the weakness.

After a period of poor performance, REITs gained 5.3 per cent in April while insurance, benefiting from higher bond yields, extended its run, up a further 4.9 per cent to take the annual increase to 18.5 per cent.

The RBA kept the cash rate unchanged in April after hiking at each of the previous ten meetings with RBA governor Philip Lowe noting "The decision to hold interest rates steady this month provides the board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty,". The RBA had commented that at 3.6 per cent the cash rate was already in "restrictive territory". Furthermore, the board had been discussing the lags in monetary policy, the effects of the large cumulative increase in interest rates since May 2022 and the difficulties that higher interest rates were causing for many households. Hence, the 25 basis point increase in early May was seen as a surprise.

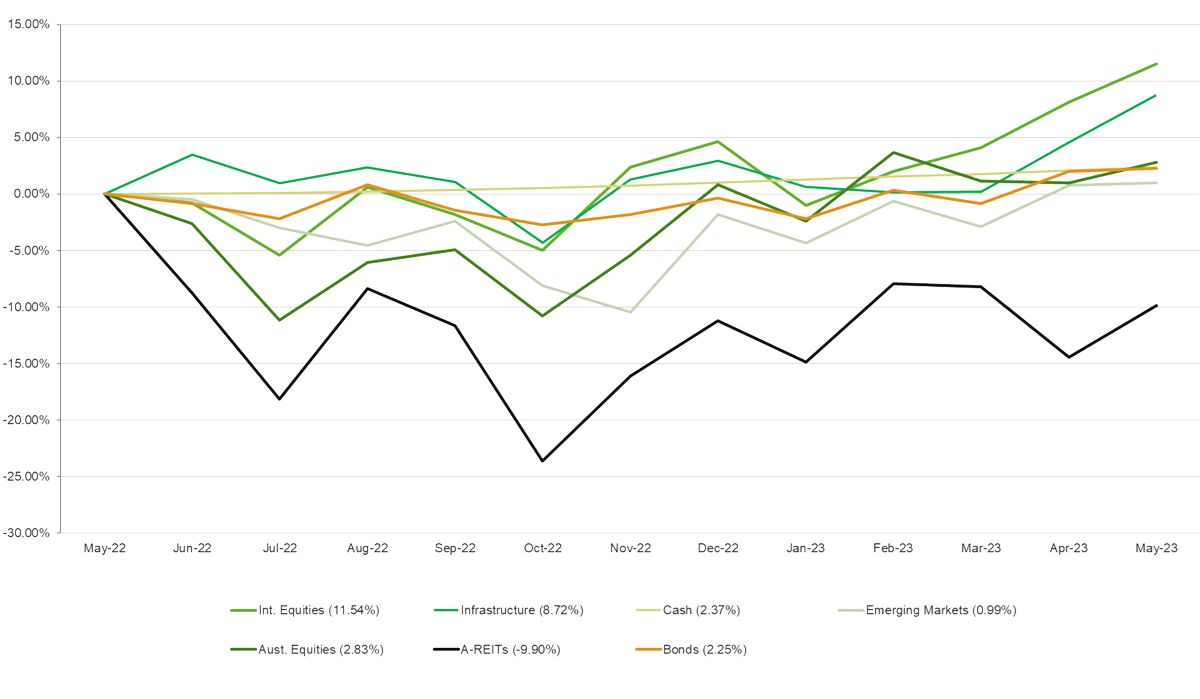

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners