Strategy Talk | October 2018

Coinciding with the launch of the Arrow Socially Responsible Portfolio, we thought we’d unpack what ‘socially responsible’ investing actually is. The equity markets have been volatile of late, so we’re revisiting the investment strategies that have withstood the test of time. Thinking of downsizing your family home, plenty on that below in this month’s edition of Strategy Talk.

What is ‘Socially Responsible Investing’

Many investors want to know that their investments are making a positive impact on our world and its inhabitants.

Socially responsible investment or ethical investing fits this bill with investors asking the hard questions about how profits are being made. Companies that make their millions through environmentally destructive behaviour or are socially irresponsible may find it harder to raise money when going public.

What is “ethical”?

Of course, “ethical” is a subjective term. For example, an ethical fund manager could define tobacco and gambling as unethical yet consider alcohol to be okay. Another ethical fund could be reluctant to invest in banks because they lend to companies that damage the environment. We are seeing this affect lenders that fund coal mining for example.

Obviously the important issue is what you, the investor, considers ethical. If you are contemplating an ethical investment then not only will you need to understand the financials of the potential investment but also ensure that the underlying businesses and their activities meet your standards.

Whilst it is difficult to lay down an exact formula for ethical investments, there are some basic values which many people share:

Avoid causing illness, disease, or death;

Avoid destroying or damaging the environment;

Avoid treating people with disrespect.

In Australia, many well-recognised investment names are on the list of ethical fund providers. Although some ethical funds have achieved good results, as with any share-based investment, the focus is on long-term investing and sound management capabilities of the fund manager.

What about the risk?

Be aware that when the range of stocks available to fund managers is reduced because of ethical considerations, extra risk and volatility could occur.

Contact us if you are interested in learning more about ethical investing.

Timeless Investing:

Successful Strategies That Have Passed The Test of Time

The past few years have seen heightened share market volatility and uncertainty. While markets and

investments change constantly, there are a set of fundamental investment principles that are

timeless: buy good quality investments; don’t pay too much; diversify widely (including outside the

mainstream asset classes) and allow your investments sufficient time to perform. These principles

are tested by markets periodically, but they have stood the test of time.

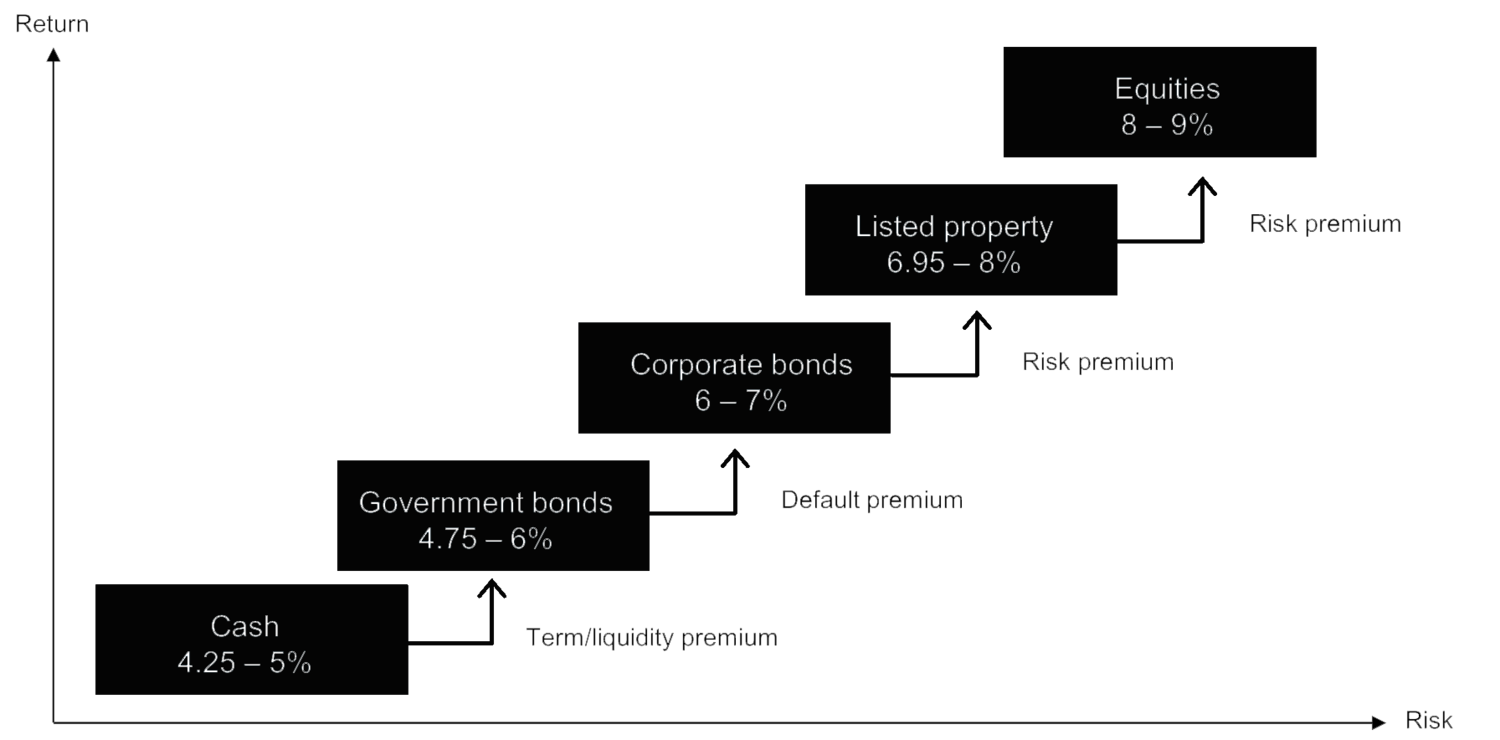

Climbing the risk/return ladder:

The higher you climb on the risk/return ladder, the greater the risk taken to achieve a higher potential

return. Term deposits are generally very safe but returns are usually low. Shares involve more risk

but the potential returns are higher. For more long-term investors, it’s not a case of choosing one or

the other. To spread risk without sacrificing return, it’s usually smart to have a combination of

investments.

Expected long term returns and risks

Shares pass the test of time in Australia

The shape of this chart tells a story. On the left of the vertical line are the years that the Australian

share market has fallen since 1981, the first full year after the Australian share market index started.

On the right are the years the market rose. Since 1981, markets have risen by approximately 20% or

more in a year on 11 occasions and fallen by more than 20% just once. Over long periods, the good

has definitely outweighed the bad. This shows that it pays to stay committed to investment objectives

over the long term.

Returns of the Australian share market since 1981

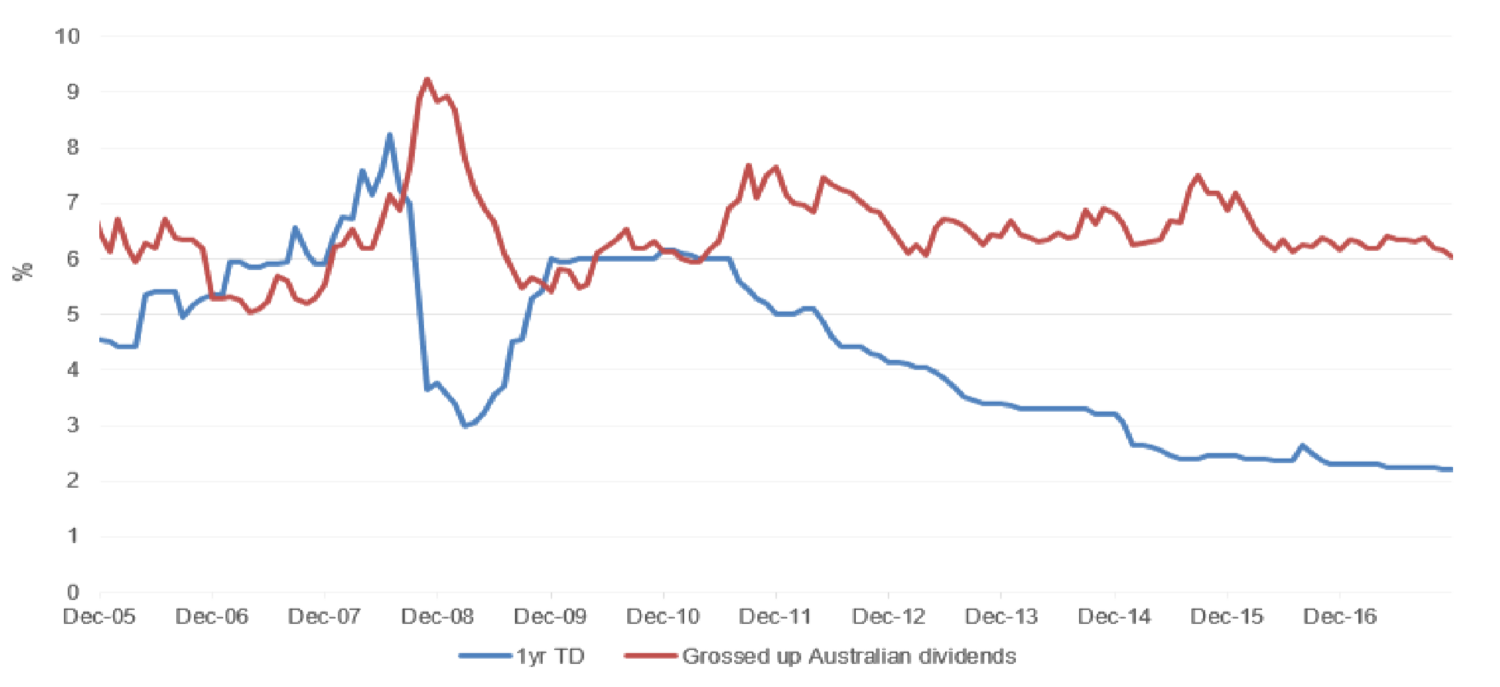

Dividends deliver stable income

While term deposits historically have offered attractive interest rates, that is no longer the case. Currently,

dividends delivered by Australian companies are attractive, and when we include the benefit of franking credits, this income stream is even more attractive. In addition to this, investing in shares provides an opportunity for capital growth.

The yield offered by term deposits is less than that of Australian shares

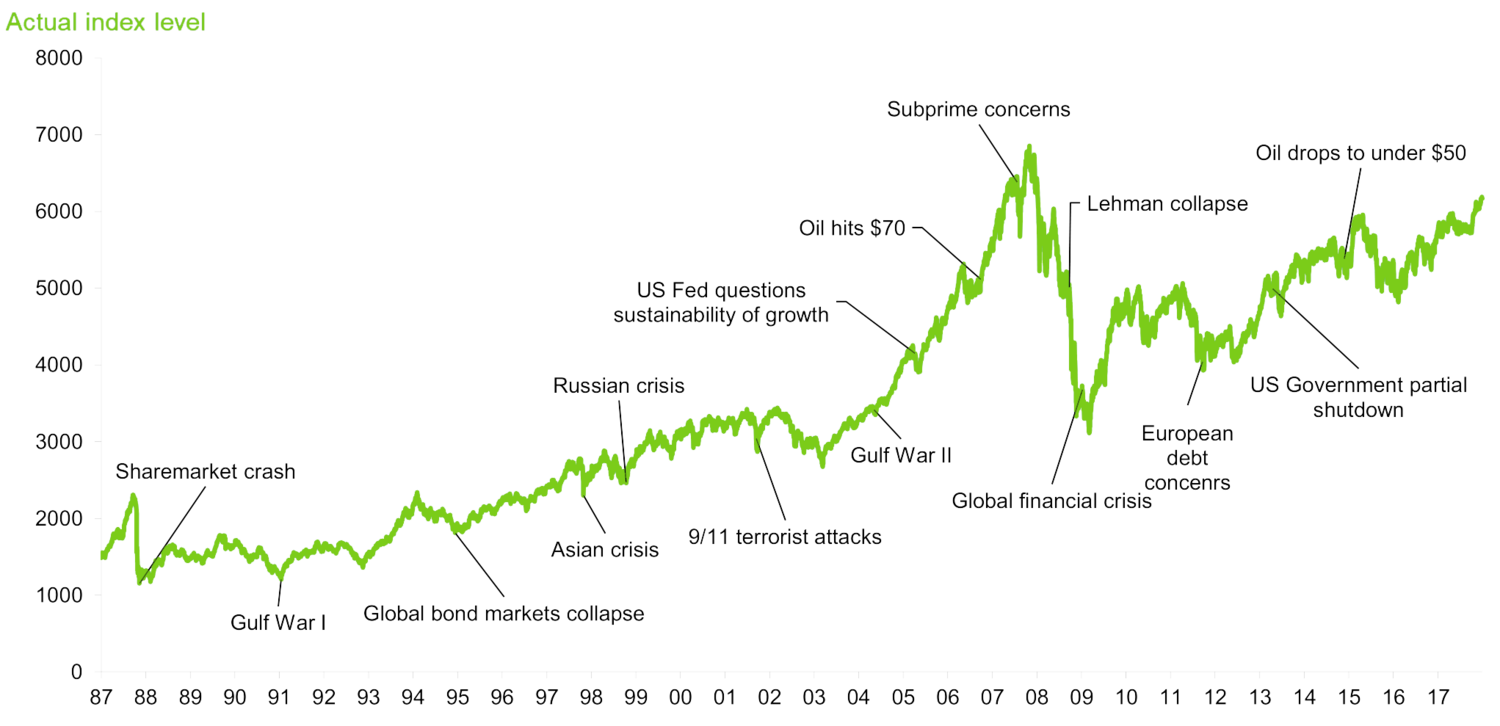

Ride the ups and downs

Share markets have their ups and downs as the major events of our time have an impact on investor

sentiment and the performance of listed companies – this is demonstrated in the chart below. However, it’s

important to keep in mind that the market has always recovered from major events and moved on to new

highs. While markets have not yet recovered to the levels they were at before the Global Financial Crisis,

we can look at other share market falls, and take a lesson from these.

ASX All Ordinaries index

Courtesy of AMP Capital. For the full presentation, please click this link.

THE ART OF DOWNSIZING

The kids have finally left home and now you’re rattling around in a house way bigger than you need. If it’s time to think about downsizing, there’s more to it than simply selling one house and buying another. Here are a few things to consider.

Tax-free gain

Selling a large house and buying a townhouse or unit, perhaps in a more affordable suburb, can free up a significant sum of money which you could use to help fund your retirement or take that dream international holiday. But before you get too excited by your potential windfall, remember to take into account expenses such as agent’s fees, removalist costs and stamp duty on the new property. This will give you a better idea of how much additional cash you are likely to be left with.

Generally, any capital gains on the sale of the family home are exempt from capital gains tax (CGT). However, if the home has been used for income-producing activity, such as running a business or letting out a room, then a portion of the gain may be subject to CGT.

On the upside, downsizing may reduce your living costs. New homes are usually more energy efficient, and cost less to heat and cool than older housing stock.

Centrelink considerations

The family home is exempt from Centrelink’s age pension asset test. If qualifying for a full or part age pension is important to you, you may not want to free up too much cash when downsizing.

Indeed, some retirees actually dip into their savings to buy a higher value home. Their aim is to reduce their assessable assets and maximise their pension entitlement. This isn’t always a good idea as it increases the risk of being caught in the ‘asset rich, cash poor’ trap.

Super boost

As an incentive to downsize, from 1 July 2018 Australians over the age of 65 are permitted to make a contribution to super of up to $300,000 each ($600,000 for a couple) from the proceeds of selling their home. The amount will be treated as a non-concessional (after-tax) contribution, and exempt from the usual restrictions. The contribution must be made within 90 days of the change of ownership.

For most people under 65, super may also be a desirable destination for most of the money freed up by downsizing. Make sure that any contributions fall within the relevant limits.

Emotional cost

While the financial benefits of downsizing can be considerable, moving house is amongst life’s most stressful events. This is particularly the case when you are giving up a home full of family memories, and parting with many prized possessions to fit into a smaller space. Just being aware that you may face an emotional reaction is a start, but be open to seeking professional support if moving does bring on a bout of the blues.

Seek financial advice

Downsizing has both financial and lifestyle dimensions, and you’ll want to make the most of any profits you realise. Talk to us before you get the real estate agent in. We will work with you to craft a short-term strategy to help ensure your downsizing experience supports you in achieving your long-term goals.