Revival of the Music Industry

Last month we discussed the subscription-based model and explained why so many companies from various industries are flocking towards this model. We couldn’t leave this topic without a further exploration around the impact these services are having on the music & recording industry.

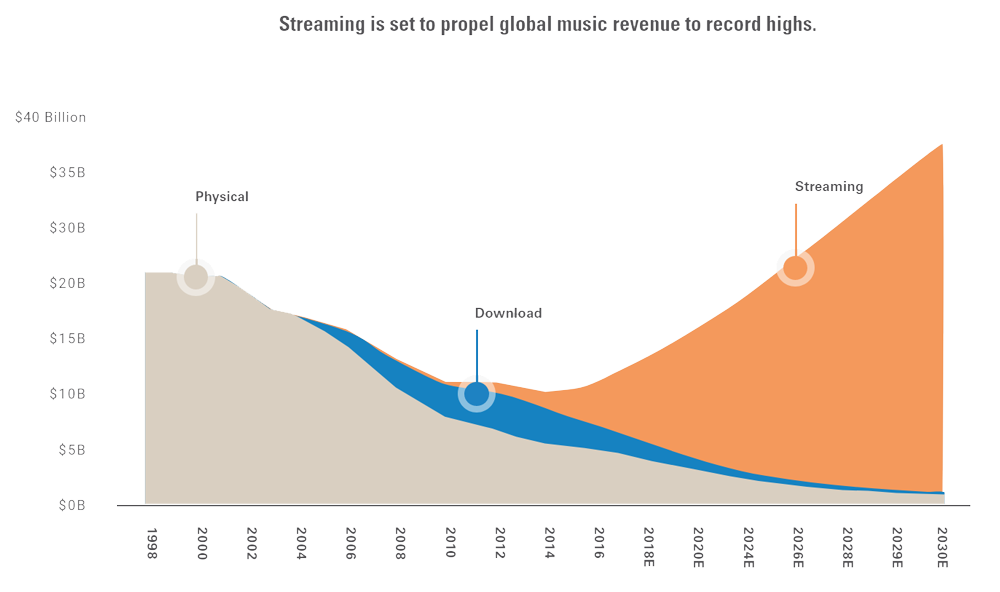

Whilst it may come as no surprise that there hasn’t been any growth in the number of records being sold, the U.S. record music market has quietly recorded double-digit revenue growth for the last few years. This comes following a big climb in the use of both subscription and streaming services as the preferred way for entertainment to be delivered to end-users. The adoption of the technology continues to climb year on year, raking in USD 4.3 billion in the first half of 2019.

Streaming solutions offer the user access to an endless library of entertainment at the edge of their fingertips. Examples of such services, in order of streaming subscribers market share, include Spotify, Apple Music, Amazon Music, Tencent Music, Deezer, Pandora and Google Play Music.

These services now make up as much as 80% of the industry’s revenues: Subscription services (Spotify & Apple Music), digital and customised radio services (Pandora and other Internet radio), and ad-supported on-demand streaming services (YouTube or Vevo). Paid subscriptions make up 62% of the industry’s revenue with the number of paid subscribers coming in at a little over 60 million.

These solutions have helped to change the direction of the industry’s declining revenues, which had been primarily eroded by peer-to-peer internet sharing applications.

Whilst the way these new revenues trickle back to the artists remains hazy, the three biggest recording companies globally, Sony Music Entertainment, Universal Music & Warner Music Group, who make up more than 50% of the market, have found a bit more wind behind their sails. This has been music to the ears of investors.

Sources:

[1] GoldmanSachs

[2] RIAA

[3] Statista