Market Summary | October 2021

Global markets saw a recovery in performance during October from a volatile prior month, with developed markets returning 1.65%. More broadly, Asian and emerging markets continue to face pressure, with equities detracting there by 4.3% and 2.9% over the month.

Ongoing Covid cases, production bottlenecks, soaring commodity prices and power supply issues continue to pose a risk to already strained global supply chains.

The ASX was flat for the month of October

UNITED STATES

The Federal Reserve kept its policy rate unchanged at 0.00-0.25%, whilst deciding to begin reducing the monthly pace of asset purchases by the end of the month. The Fed Chairman, Jerome Powell, noted that they are able to be patient on increasing rates but will not hesitate to act if inflation levels continue to remain elevated.

October was the best month of the year for the S&P500, driven by strong third quarter earnings results reported by the country’s largest companies. Support for risk appetite going forward is expected to improve as Washington comes close to approval of its US$1.85 trillion stimulus plan, which comes off the back of US$1 trillion infrastructure support package that gained Senate approval in late October.

GDP expanded an annualised 2% in Q3, well below market forecasts of 2.7% and slowing sharply from 6.7% in Q2. It is the weakest growth of pandemic recovery as an infusion of government stimulus continued to fade and a surge in COVID-19 cases and global supply constraints weighted on consumption and production.

The S&P 500 Index (USD) returned 6.91%

The Dow Jones (USD) returned 5.84%

ASIA

Continued regulatory tightening in China remains a persistent issue with a newly proposed real estate tax weighing on the property sector. Although Chinese GDP has returned to its pre-pandemic level, the broad reaching policy shift is expected to dampen growth in the near term.

Elsewhere, retention of Japan’s sitting prime minister is expected to support Japanese investor sentiment going forward, as political uncertainty caused foreign investors to become net sellers of Japanese equities leading up to the election in the final week of October.

The Hong Kong Hang Seng PR Index (HKD) returned 3.26%

The Nikkei 225 PR Index (JPY) returned -1.90%

The Shanghai Shenzhen 300 PR Index (RMB) returned 0.87%

EUROPE

Equities in the UK and Europe continue to rise in line with US markets, with inflation and a shift in FED policy remaining the most significant near-term risks for developed market equities.

The ECB kept interest rates on hold at 0.0%, as expected. GDP expanded 2.2% in Q3, slightly ahead of expectations of 2.1%, while the yearly rate now sits at 3.7%. Economic sentiment surprised in October, rising from 117.8 to 118.6, against an expected fall to 117.1. Consumer confidence fell in October from -4.0 to -4.8, in line with forecasts.

The unemployment rate fell 10bps to 7.4% in September, the lowest level since April 2020.

The UK’s FTSE 100 PR Index (GBP) returned 2.13%

The German Dax (EUR) returned 2.81%

AUSTRALIA

The RBA left the cash rate unchanged at 0.1%, as widely expected, while continuing with plans to trim the purchase of government bonds to $4 billion a week until at least mid-February 2022. Retail sales increased 1.3% in September after slumping 1.7% in August. September’s unemployment rate rose 0.1 points to 4.6%, below the expected 4.8%, with the participation rate decreasing 0.7 points to 64.5%.

NSW and Victoria reopened in late October as full vaccination rates reached 80% of the population over 16 in each state. The Federal government announced the opening of the international border to vaccinated travellers without the need to quarantine from 1 November.

A late selloff for the Australian share market led to modest overall losses for the month, with the S&P/ASX 200 retracing 0.1%. Information Technology was the standout sector, gaining 2.1% for the month, with Health Care (+1%) and Financials (+0.8%) also contributing positively. Industrials were the biggest lag on the Index, falling 3.2% as inflation fears weighed on investor sentiment in the sector. Energy also pulled back with a decline of 2.7%, unwinding some of the impressive gains from the previous month.

During the month, third quarter inflation data was released with underlying inflation coming in at 2.1% year-on-year, which was ahead of the 1.8% expected by the market. Inflation now sits within the bottom of the RBA’s target range of 2% to 3% for the first time in six years.

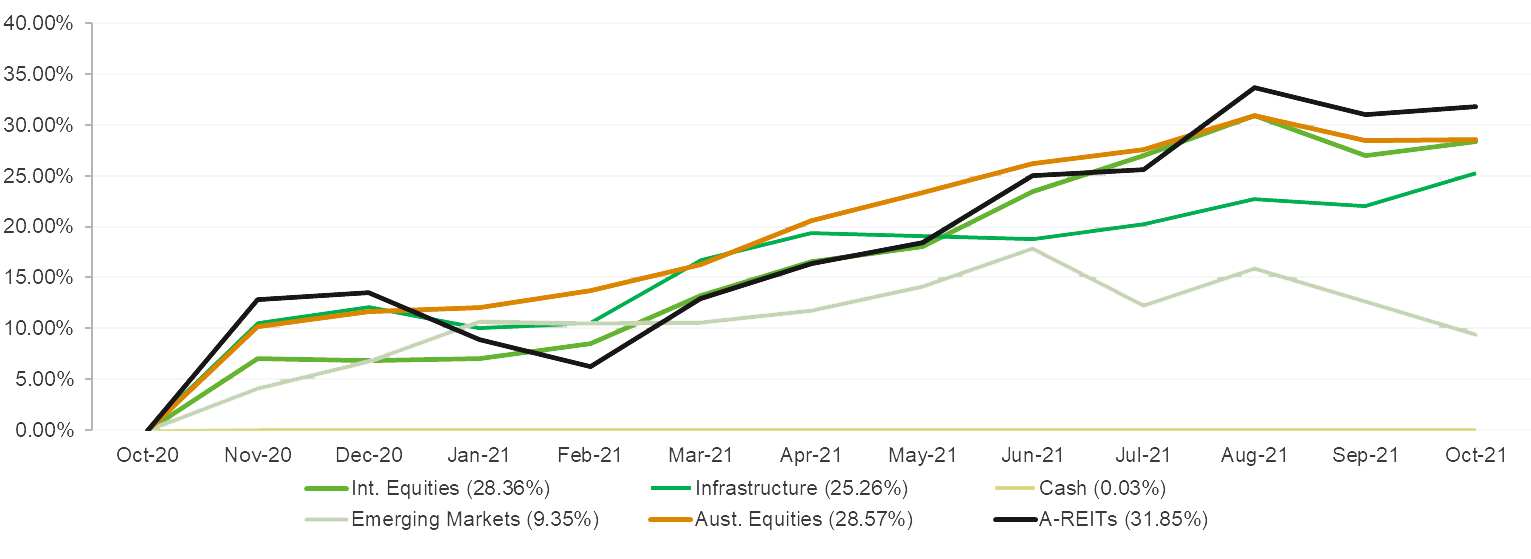

MARKET RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd