Market Summary | November 2021

MARKET OVERVIEW

After a strong recovery in global markets over the prior month and stable performance for most of November, the month ended with volatility and the worst one-day decline of the year, as news of the spread of the new Omicron Covid-19 variant drove a sharp sell-off in global equities.

Developed markets decreased by -1.5% over the month, faring better than Asian and emerging markets, which fell -3.4% and -3.9%, respectively in local currency terms. Global small caps faired worse than their broad cap counterparts

during November, receding by -4.8%.

Whilst global markets have stabilised since the end of month sell off, further volatility may occur until scientists can confirm if the new variant has greater resistance to the available vaccines. If this were the case, a return to social restrictions and lockdowns would see further de-risking in global equities.

The Australian dollar withered over the month of November closing -5.5% against the USD

United States

The Federal Reserve kept its policy rate unchanged at 0.00-0.25%, as expected. Personal consumption increased 1.7% annually, ahead of the expected 1.6%. Prices soared as inflation hit a 30 year high of 6.2% in November, fuelled by strong consumer demand and shortages of goods amid a tight supply chain.

Over the month, all sectors in the developed market index excluding IT delivered negative returns in USD terms, with IT returning 2.6%, whilst finance and energy detracted by -6.2% and -7.3%.

Non-farm payrolls rose 210,000 in November, well below expectations of 550,000 as employers continue to report difficulties in hiring and retaining workers. The unemployment rate fell 40bps to 4.2% in November, coming in below expectations of 4.5.

The S&P 500 Index (USD) returned -0.83%

The Dow Jones (USD) returned -3.73%

Asia

Within emerging markets, IT was again the only sector with positive returns over the month, returning 1.3%, with energy and consumer discretionary detracting by -7.5% and -10.1% for the period in USD terms.

China’s inflation rate increased 0.7% month-on-month in October, in line with market expectations, with the annual rate increasing sharply to 1.5%, above the expected 1.4%. Yearly industrial production came in at 3.5% in October, above expectations of 3%. The unemployment rate was unchanged at 4.9% in October, the lowest level since December 2018

The Hong Kong Hang Seng PR Index (HKD) returned -7.49%

The Nikkei 225 PR Index (JPY) returned -3.71%

The Shanghai Shenzhen 300 PR Index (RMB) returned -1.56%

Europe

The European Central Bank (ECB) kept interest rates on hold at 0.0%, as expected, and indicated the very generous monetary policy support to the economy would need to be reassessed at some point in the future in view of the improved inflation outlook. The yearly inflation rate rose 80bps to 4.9% in November, coming in above expectations of 4.5% and is the highest rate of inflation since July 1991, well above the ECB’s target of 2.0%.

The UK’s FTSE 100 PR Index (GBP) returned -2.46%

The German Dax (EUR) returned -3.75%

Australia

The RBA left the cash rate unchanged at 0.1%, as widely expected, with indications that inflation had picked up but remains low in underlying terms. GDP surprised in 3Q, falling 1.9% against expectations of a 2.7% decline, while the yearly rate came in at 3.9%, above the expected 3.0%. This marked the first contraction in the economy since 2Q20, amid prolonged lockdowns across NSW.

The Australian share market declined for a third consecutive month with the S&P/ASX 200 falling 0.5% despite seven out of the eleven sectors in the Index finishing higher. Materials was the standout sector producing a return of 6.3%, whilst Communication Services (5.2%) and Consumer Staples (4.5%) also contributed positively. Heavy declines in the Financials (-7%) and Energy (-8.3%) sectors weighed on the Index.

Local miners were bolstered by a slight recovery in the price of iron ore which was driven by China’s move to ease the recent liquidity crunch on the debt-laden property sector. The Financials sector was impacted by fears of contracting margins for the major banks as cash rates remain at record lows and competition in the home loan market continues to intensify. Weaker oil prices weighed on the Energy sector as concerns grow that the Omicron variant will further disrupt travel and lead to additional lockdowns globally.

The Australian dollar withered over the month of November closing -5.5% lower against the greenback and -4.6% in trade-weighted terms. Indicative forecasting by the RBA implied that rate increases would still not occur until 2024, triggering a sell-off early in the month and setting the stage for sustained downward pressure on the AUD.

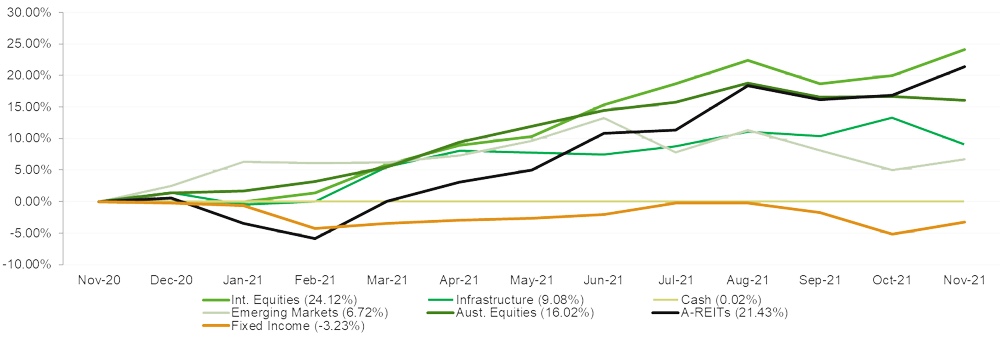

Market Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd