Market Summary | January 2019

MARKET OVERVIEW

January was a positive month for investors as equity markets climbed across the board recovering from some of 2018’s turmoil.

Growth prospects brightened following a positive earnings season in the US and some backtracking in the federal reserve’s plans to increase rates. Donald Trump’s Whitehouse was also closed for most of the month but we cannot confirm how much of an effect this had on markets.

UNITED STATES

With US growth slowing, the Federal Reserve were forced to address concerns around their current tightening path, backtracking on the intended rate hikes. Markets responded well to this news.

A strong earnings season encouraged further growth, the biggest gains came from Industrials (+11.4%), led by General Electric (+34.2%) and also supported by a recovery in major airline shares, which have benefited from concerns of an oversupply of crude oil.

Information Technology (+6.9%) shares managed to claw back December’s losses. Apple (+5.5%) saw modest gains as investors looked beyond declining iPhone sales to strong growth in Apple services and other devices. Facebook (+26.4%) was able to beat revenue and earnings expectations for the quarter.

The S&P 500 Index (USD) rose 7.87% for the month of January.

ASIA

Given the ongoing threat looming from Trump’s trade war and an increasingly cautious household sector, China has yet again reached the point where additional stimulus is required in an attempt to sustain high growth rates. Not surprisingly, the Chinese authorities announced their 5th rate cut this cycle feeing up US $200 billion, with many economists believing they still have plenty of fire power left in the stimulus tank.

The Chinese markets rallied in January after a disastrous 2018. Positive progress in trade negotiations could be a catalyst for further market growth in the coming months.

The Hong Kong Hang Seng PR Index (HKD) returned 8.11%

The Nikkei 225 PR Index (JPY) returned 3.79%

The Shanghai Shenzhen CSI 300 PR Index (RMB) returned 6.34%

EUROPE

Across broader Europe, the growth picture continues to be clouded by developments in the German auto industry, with major car manufacturers continuing to have issue with the new exhaust and consumption standards. Meanwhile, disruption within the French political system as a result of the yellow vest protests, continues to take a toll on the French economy.

British Prime minister, Teresa May was forced to renegotiate with the EU to have a revised deal as soon as possible after failing to have her initial deal approved in Britain. With the Brexit deadline only weeks away our guess is that there will be an extension to the Brexit deadline.

The UK’s FTSE 100 PR Index (GBP) retuned 3.58%

The German Dax (EUR) rose 5.82%

AUSTRALIA

Confidence in the Australian economy took a hit in 2018 following the correction in housing prices and a poor year across equity markets. This forced the RBA to reassess their downside risk hinting their next move may be down. Interestingly GDP Growth has remained above the trend rate of 2.75% driven by a fall in savings rates.

The S&P/ASX 200 Index returned 3.90% through January as Australian shares recovered from the global sell off in December.

The Royal Commission report into financial services misconduct was released, which provided a response to the system’s failings. The major financials were green following the news, but the overall the sector remains beaten up having fallen 14.8% over the course of 2018.

The large miners also had a strong month following a steep climb in iron ore prices after the failure of the Brumadinho tailings dam in Brazil. Miner, Fortescue Metals was the best performer on the ASX 200 in January up 34.84%. In due course, the increase in mining profitability would be expected to have a positive influence on the federal budget.

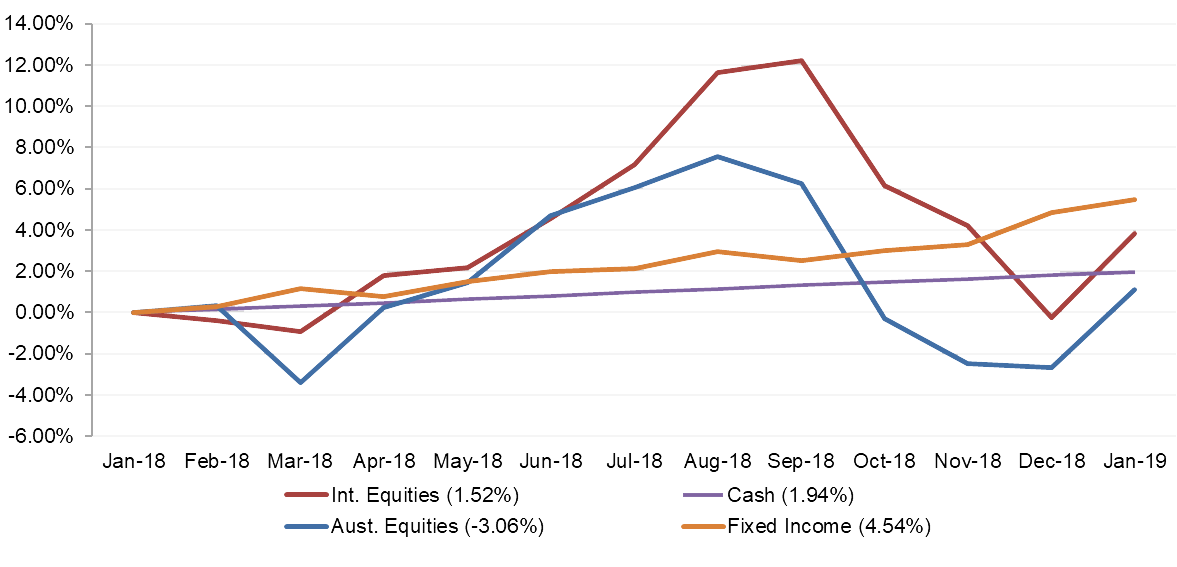

MARKET RETURNS (LAST 12 MONTHS)

Recent performance has pushed equities back into positive territory whilst returns from International Equities (AUS dollar Terms), Fixed Income & Cash remain positive.

January’s performance provided positive returns across equity markets. With the divergence between International & Australian Equities tightening.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.