Market Summary | January 2018

MARKET OVERVIEW

Widespread positive macroeconomic data continued to drive global equities firmly higher in January. Government bond yields rose, reflecting higher growth and inflation expectations.

US equities enjoyed a strong advance as economic momentum remained robust.

Eurozone equities posted gains; the region’s economic expansion led to some suggestions that the European Central Bank (ECB) could soon end its ultra-loose monetary policy.

Emerging market equities posted a robust return with continued strength in global growth and trade, as well as US dollar weakness, supporting performance.

Government bond yields rose significantly, reflecting higher growth and inflation expectations after the US tax reform bill passed in December. Corporate bonds performed well.

UNITED STATES

At its January meeting, the Fed voted to maintain the fund's rate at its target range of 1.25–1.50%, following its 25 bp hike in December. Members voted unanimously to maintain the current range, which remains accommodative and supportive of strong labour market conditions and gradual return to the 2% inflation target.

Fed Chairman Janet Yellen has taken a measured approach of gradually raising rates to a more normal level. This strategy is likely to continue under Jerome Powell, who was recently appointed to be the new Fed Chairman by President Trump and will be sworn in on February 5th. Under Powell’s direction, the Fed is expected to raise rates two or three more times this year.

The U.S. economy picked up its pace in the most recent period and has entered its 102nd month of expansion. This ranks as the third longest expansion in U.S. history. Recent economic readings have continued to confirm the positive trend. Real GDP growth was measured at 3.2% in the third quarter, and unemployment has fallen to 4.1%.

ASIA

One of the best-performing equity markets in January was emerging markets heavily driven by emerging Asia. A number of factors contributed to positive performance including a weaker US dollar, stronger commodity demand and prices, and an expansion in global business investment. All of which are supportive of emerging market technology producers.

Figures released in January confirmed that the Chinese economy had grown by 6.9% – the first time in seven years that the pace of growth had picked up and ahead of the official target of 6.5%.

January’s big story was Canada’s decision to join the Trans-Pacific Partnership (TPP) which Donald Trump so spectacularly pulled out of last year. Canada had initially been reluctant to sign up because of concerns about the environment and labour protection, but will now join 10 other countries in Chile in March to sign the agreement. The TPP has been championed by Japan, which sees it as a way to counter China’s economic dominance in the region: Economy Minister Toshimitsu Motegi said the agreement would be an “engine to overcome protectionism”.

EUROPE

Europe came back from its Christmas holidays to find Germany still without a government – although it appears that Angela Merkel is gradually drawing closer to a deal with the Social Democrats, which will allow her to remain as German Chancellor and de facto leader of Europe.

However, it appears that Europe could be set for more problems, with the re-election of the anti-mass immigration, Eurosceptic Milos Zeman, to the Czech presidency, raising the prospect of a referendum on the country’s continued membership of the EU.

Markets are mindful of the Italian election on 4 March, but the most populist parties have recently toned down their rhetoric towards a referendum on the country’s membership of the single currency. The most likely scenario appears to be a fragmented result and a minority government.

AUSTRALIA

The RBA’s January monetary policy statement was undeniably more bullish compared to its December release, but nevertheless, the board opted to keep the cash rate on hold at 1.50%, with inflation still low but expected to move higher. The Bank’s central forecast for GDP growth is just above 3% over the next two years, supported by monetary policy conditions that remain expansionary, while the benefits of broad-based global growth and increased international trade are flowing through to the local economy.

The strongest support for household spending continues to come from near-booming growth in jobs, up another 34,700 in December after lifting 63,600 in November and bringing total jobs growth in 2017 to more than 400,000, up 3.3% y-o-y, the strongest growth in more than 20 years. More importantly, there is ample evidence in various job vacancy surveys that Australian businesses need to employ many more workers over coming months helping to improve a sense of better job security in the household sector.

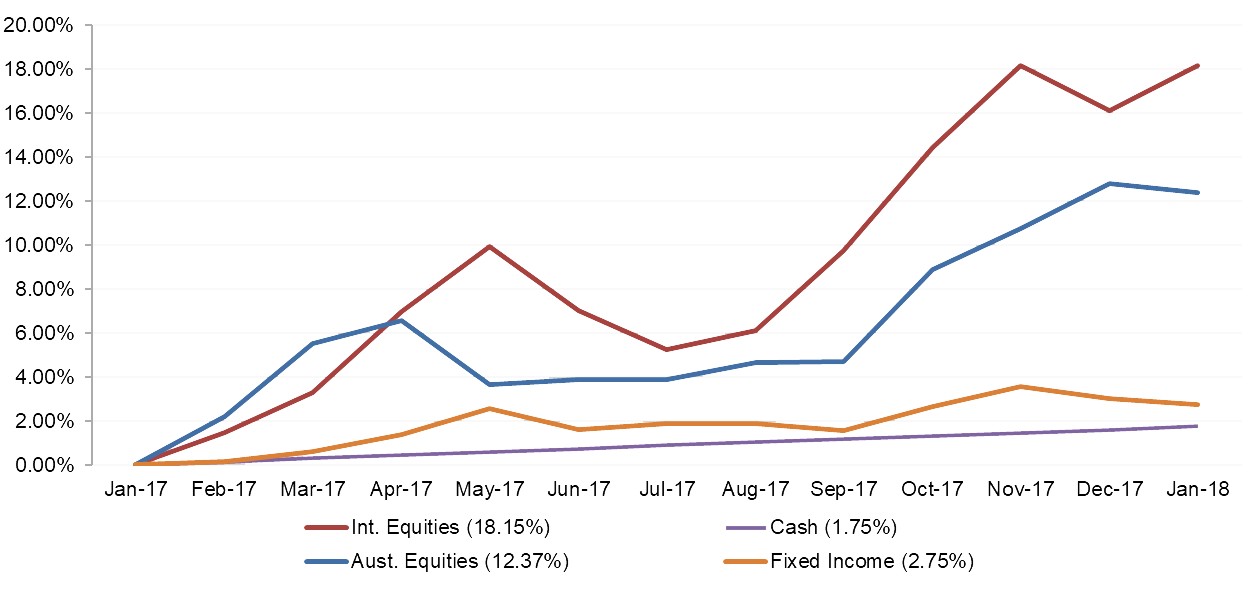

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a positive 12 months. Returns have been positive in all growth asset classes.

Equity markets generally have performed well while fixed income and cash returns remain at historically low levels.

The month of January provided mixed returns across the asset classes with strong performance particularly from International Equities

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.