Market Summary | December 2017

MARKET OVERVIEW

2017 was a favourable year for investors with the global economic backdrop being highly supportive of further gains on share markets. Economic growth firmed across Europe, Japan and the United States, creating a rare synchronisation of improvement in the world’s major economies

After a number of false starts, the Brexit negotiations between the EU and the UK have entered the second and decisive phase. By October 2018, both sides aim to have a divorce agreement.

As we have already seen, December was a volatile month for Bitcoin, but this didn’t stop Venezuelan President Nicolas Maduro announce the creation of a new currency in a bid to ease the country’s economic crisis. A new virtual currency – the Petro – will apparently be backed by Venezuela’s oil, gas and diamond reserves.

UNITED STATES

There were two major pieces of news in the United States, with the Federal Reserve once again raising interest rates and a programme of major tax cuts being passed by Congress.

The Fed raised rates by a further 0.25% (the third rise in 2017) as it projected growth of 2.5% for 2017 and 2018, expecting the US economy to be stimulated by Donald Trump’s tax cuts. At the moment the Fed is targeting a range of 1.25% to 1.5% for US interest rates, but further rises are expected next year, with most forecasters expecting a base rate of around 2% by the end of 2018.

The tax cuts (agreed by both houses of Congress) have been described as the biggest overhaul of the US tax system for 30 years, with corporation tax falling from 35% to 21% and the highest rate of individual income tax coming down from 39.6% to 37%.

ASIA

In China, there was a small rise in the bank base rates, following the interest rate rise in the US, however for once it was Japan that was really making the news in the region. Japan is enjoying its longest period of sustained economic growth since 1994 (thanks to four years of economic stimulus from Prime Minister Shinzo Abe), as growth for the three months to September was revised upwards to 2.5%, well ahead of initial estimates of 1.4%.

In another sign of what Japan can look forward to in the near future, Nissan announced that it would start trialing driver-less taxis from March next year. The plan is that passengers will be able to summon the cars using an app, with free trials due to take place in Yokohama.

There was more turbulence for crypto-currency Bitcoin as the South Korean authorities (worried about Bitcoin being used for money laundering) announced a crackdown on anonymous trading accounts and said they would close exchanges if necessary.

EUROPE

December was the month when some progress finally appeared to have been made on the Brexit negotiations as the UK’s ‘divorce bill’ seemed to have been agreed. By the end of this year the UK will, in theory, be just 88 days away from leaving the EU.

There was better news for other EU relationships as a trade deal was tied up between the EU and Japan which will (subject to ratification by EU members) create the world’s largest open economic area. The agreement is seen as a challenge to the protectionism of Donald Trump, with a joint statement saying that the EU and Japan are “committed to keeping the world economy working on the basis of free, open and fair markets … fighting the temptation of protectionism”.

AUSTRALIA

In Australia, annual GDP growth accelerated to 2.8% year-on-year in Q3 from 1.9% in Q2 and shows signs of stronger domestic spending driven by another quarter of very strong engineering construction spending. Employment growth is also very strong with Australia having its strongest annual growth in employment in more than two decades, whilst the unemployment rate has fallen to a four-year low of 5.4%.

The RBA has maintained the cash rate at 1.50% for well over a year, and appears content to wait and see how high other central banks go and how quickly.

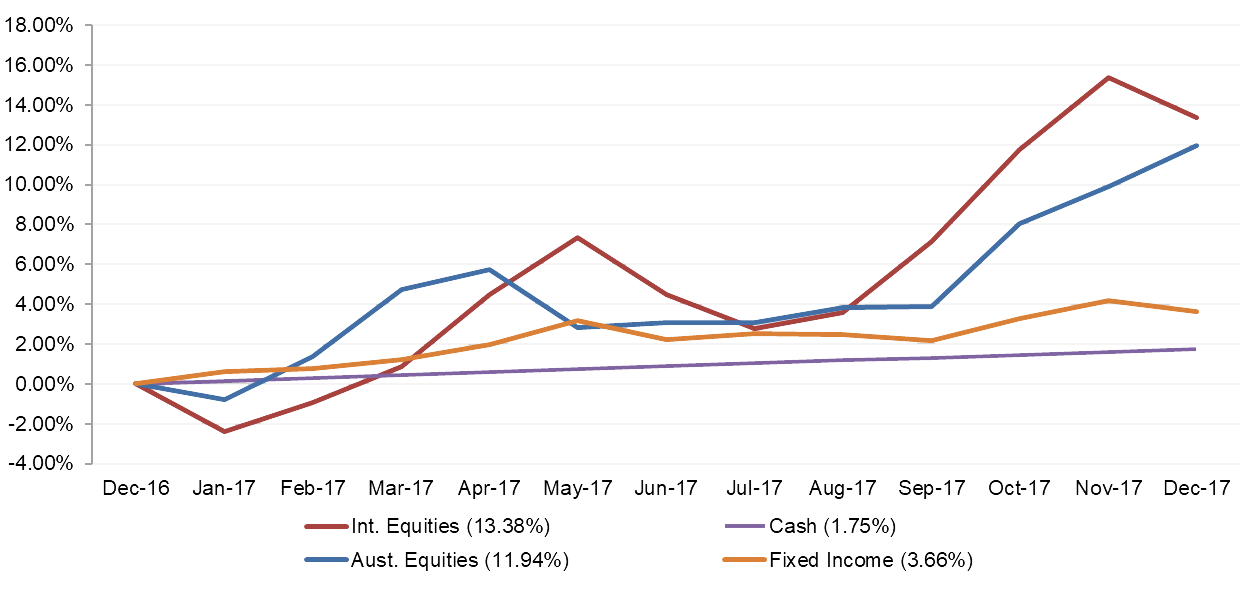

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of December provided mixed returns across the asset classes with strong performance particularly from Australian Equities.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.