Market Summary | February 2018

MARKET OVERVIEW

The markets fell sharply in the first week of the month due to signs of inflationary pressures in the United States. President Trump has drastically cut corporation tax and many firms have passed the savings on to their employees in higher wages. Fears of inflation prompted worries that the Federal Reserve would tighten monetary policy in the US.

Share markets recovered mid-month on signs of still strong global economic activity only to fall again towards month-end on a potential threat to global economic growth. This stemmed from President Trump’s sudden announcement to impose big tariffs on steel and aluminium imports into the US threatening to spark a global trade war.

In politics, German Chancellor Angela Merkel finally found a way to stay in power for another four years and Donald Trump saw his popularity rating climb past 50% and announced he would be running for President again in 2020.

UNITED STATES

The Federal Reserve Bank certainly seems to have an optimistic view of the US economy. Minutes from the latest Federal Reserve Bank meeting show that the Fed is preparing for “stronger-than-expected” economic growth this year as corporate America continues to benefit from the President’s decision to slash corporation tax.

The decision was taken by the Trump administration to impose 25% tariffs on imported steel and 10% tariffs on aluminium are the most aggressive anti-trade move by the US government in 30 years according to several reports. The reality is that the impact on China will likely be much less than feared or hoped by US policymakers. The US imports over 4.5 times as much steel from Korea as it does China and the largest exporters of steel to the US are actually close allies like Canada and the Euro area. US companies will bear the brunt of this policy change as higher production prices may force tighter margins for import firms.

ASIA

Following the death of Mao Zedong in 1976, the Chinese Communist Party introduced term limits (two consecutive five-year terms) to ensure that future leaders could not ‘rule for life’ and enjoy the same cult of personality that had been bestowed upon Chairman Mao. Now all that seems set to change, with the Party last week proposing to remove the term limits, essentially giving Xi the authority to rule indefinitely, having originally been due to step down in 2022. With his ‘thought’ now enshrined in the constitution, Xi is moving towards absolute power in China.

In February, we also saw Japan respond to the problem of its ever-ageing population by raising the state pension age to 70. As part of the reform Japan will also consider raising the mandatory retirement age to 65 from the current 60 for some 3.4 million civil servants; that change, however, would happen in gradual stages.

EUROPE

Angela Merkel finally stitched-up a coalition with Germany’s Social Democrats, allowing her to remain as Chancellor for another four years. This does, though, mean that the anti-immigration party, Alternative fur Deutschland, becomes the official opposition to the coalition. With anti-immigration sentiment already strong in EU member states like Poland, Slovakia, Hungary and the Czech Republic, there may well be increased tensions in the EU in the months ahead.

At the beginning of March, Italian voters delivered a hung parliament, flocking to anti-establishment and far-right parties in record numbers and casting the euro zone’s third-largest economy into a political gridlock that could take months to clear.

AUSTRALIA

Australian economic growth is slowly improving but economic prospects are still challenging with uncertainty surrounding spending by the heavily-indebted household sector compounded by a softer outlook for housing activity and still soft wages growth.

Business investment spending is starting to rise and government infrastructure spending is lifting. Jobs growth has been very strong with more than 400,000 jobs added in 2017, providing a boost to household disposable income even while wages growth has languished. Most likely the tight labour market will see wages lift a little more through 2018, whilst the Federal Government is also hinting at income tax cuts in the May Budget.

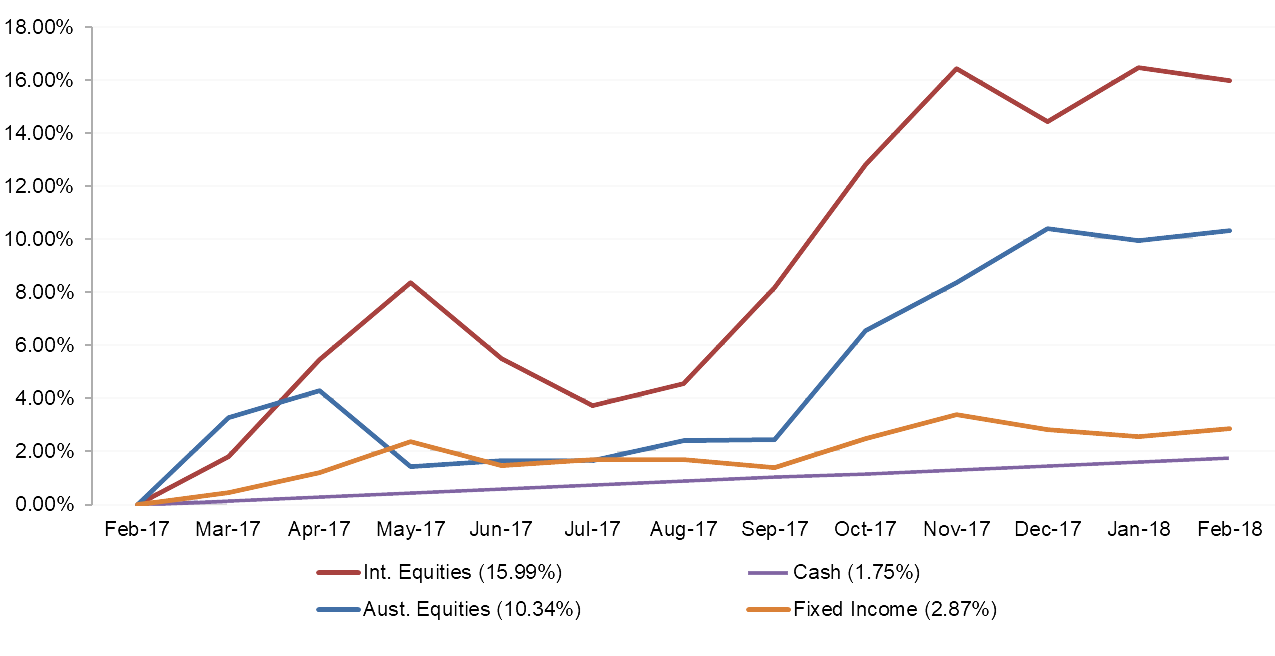

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a positive 12 months. Returns have been positive in all growth asset classes.

Equity markets generally have performed well while fixed income and cash returns remain at historically low levels.

The month of February provided mixed returns across the asset classes with stronger performance coming from Australian equities.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.