Global Update | March 2018

THE MARCO VIEW

The announcement by the U.S. Government of its intention to introduce tariffs on the import of steel and aluminium is a concerning development for both equities and bond markets. Consistent with President Trump’s America First approach, the U.S. had previously dipped their toe into the protectionist water with the announcement in January of tariffs on washing machines and solar products. In absence of any immediate retaliatory response, the far more significant decision has now been made to impose tariffs of 25% on steel and 10% on aluminium. The President indicated the measures would be formally signed off during the week beginning 5th March and be in place “for a long period of time.”

At current elevated valuations, equity markets are vulnerable to scenarios that involve an unexpected jump in inflation or unexpected slowdown in economic growth. The new U.S. tariff measures increase the probability of both scenarios. Although the direct impact of the tariffs could be contained to the industries targeted, it is the likelihood of retaliatory measures being put in place by other nations, including China, that provides the biggest threat. A rise in inflation and a slowing in trade flows and economic growth would be the expected net result from a general lift in protection. The initial negative response on equity markets to the news of the tariff announcements appears insufficient given the materiality of the potential medium to longer term impact.

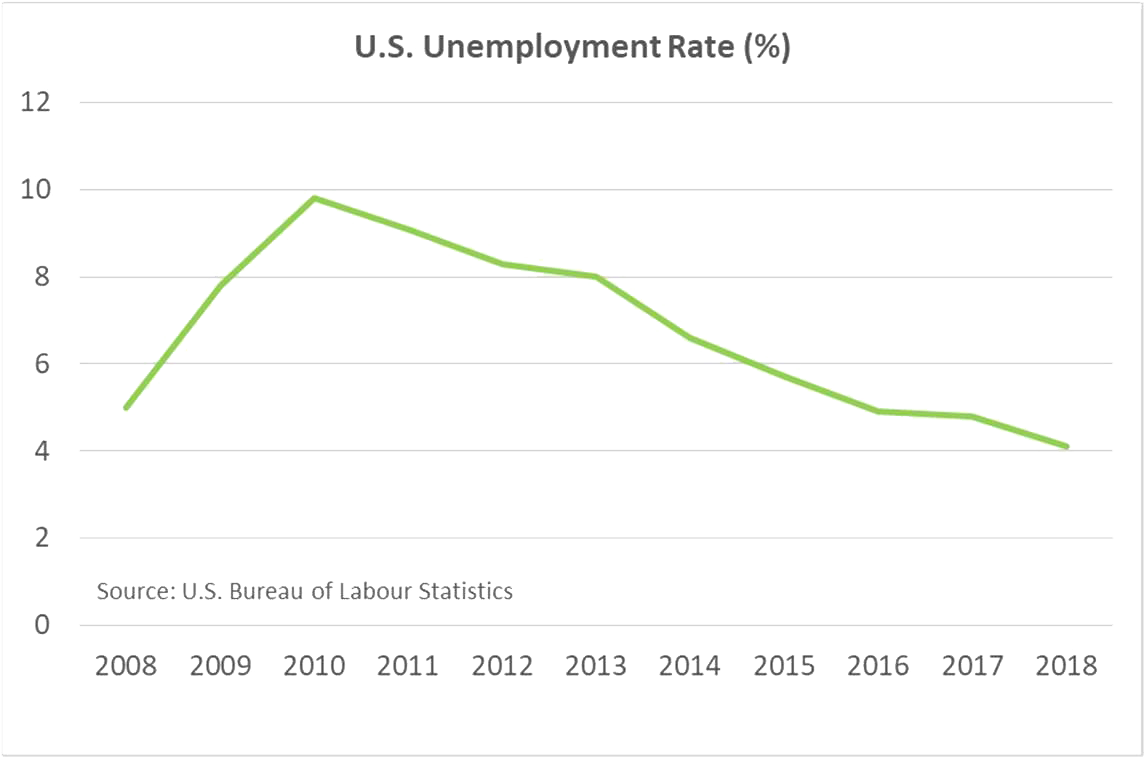

Somewhat perversely, bond markets rallied (pushing yields lower) in response to the news of the new protectionist measures. This classical “risk-off” response to negative news ignored the obvious inflationary consequences of increased protection. There has been no larger contributor to the structural decline in inflation over the past 3 decades than globalisation and the largely unencumbered shift in production to locations offering lower costs. The reemergence of protection threatens to reverse this process. Additionally, the implementation of tariffs in the U.S. comes at a time when the U.S. economy is operating at full employment, thereby magnifying the inflationary consequences of the shift in production to the U.S. in key industries.

For Australia, the net impact of the new tariff measures is likely to be negative. China is clearly the target of the U.S. initiative and Australia’s economic prosperity is inextricably linked to China. Most directly, Australian exports of iron ore and coking coal (two essential inputs into the production of steel) are likely to suffer, thereby worsening the prospects for the local mining sector. There may, however, be some compensating effect from a lower $A, should demand for our key commodities trend lower. With the mining sector likely to be adversely impacted by the recent trade developments and the banking sector facing a period of flat asset growth, the larger cap end of the local share market may be an under performer in the months ahead. Midsized and smaller companies would appear to offer superior growth prospects and a better mix of industry exposure.

From a valuation perspective, Australian listed property may stand out as being attractive following recent price falls and a potential beneficiary of the higher inflation implied by an escalation in protectionist measures. However, the structural challenges of the shopping centre business model (which accounts for 45% of the AREIT index) have been brought to the fore over recent months. Indicative of these challenges, Myer, which occupies significant floor space across Australia’s major shopping centres, has experienced a share price decline of 65% over the past 12 months. These structural challenges for retail property, combined with rising interest rates, may further test the listed property sector in the weeks ahead.