Market Summary | December 2023

In Australia, stocks rebounded in December but lagged globally for the year, with cautious rate cut expectations and subdued earnings. The Reserve Bank kept rates steady amidst high inflation. Growth was stagnant, impacted by higher rates and taxes.

In the US and developed markets, equities ended the year strongly, driven by a shift in Federal Reserve policy and declining bond yields, overcoming various economic challenges.

Emerging markets saw modest gains in December but underperformed compared to developed markets for the quarter.

AUSTRALIA

After lagging markets for much of the year, Australian stocks rebounded sharply in December, rising 7.3 per cent to close to record levels. The Australian equity market gained 12.4 per cent for the year, more than 10 per cent behind global markets. As was the case globally, the theme was increased confidence in the end of the hiking cycle, lower bond yields and an expansion in PE multiples. However, unlike the US, the market is more conservative with respect to prospective rate cuts given the lag in inflation and wages while the earnings outlook for Australia remains subdued with consensus EPS growth for the next 12 months around 2 per cent.

In its final meeting of 2023, the RBA board left the cash rate unchanged at 4.35 per cent despite concerns that inflation could remain above the 2 to 3 per cent target "for a prolonged period". According to the minutes, "members agreed there was sufficient value in waiting for further data to assess how the balance of risks was evolving", however "there had been encouraging signs of progress towards the Board's objectives and that this needed to continue". Inflation fell back to 4.9 per cent in October from 5.6 per cent.

On the data front the September quarter National Accounts showed economic growth flatlining as consumer spending remained very weak under the weight of higher interest rates and tax payments. Taking into account solid population growth the result was very poor with GDP per capita negative for the third consecutive quarter. The NAB business survey also painted a less positive picture with forward orders down and confidence subdued. But the key remains household spending which in turn is dependent on the interplay between what has been up to now solid income growth (jobs and wages) and rising debt servicing costs.

In terms of sectors, REITs led the charge, rising 11.4 per cent in the month, 16.5 per cent in the quarter as lower bond yields supported valuations. Healthcare was up 9.1 per cent in December and 13.3 per cent for the quarter. The financials sector, after enduring a sluggish year, jumped 6.2 per cent in December and 8.2 per cent in the quarter.

UNITED STATES & DEVELOPED MARKETS

Equity markets ended the year on a very strong note, driven by an apparent Fed pivot and an ongoing decline in bond yields. The MSCI World ex Australia index jumped a further 4.8 per cent in USD terms, taking the quarterly gain to 11.3 per cent, the best quarterly performance since 2020. For the year the global market was up 24 per cent, extraordinary considering the recession fears associated with a 500 basis point Fed tightening in response to high inflation, concerns over parts of the banking system early in the year, the ongoing Ukraine-Russia war and the Israel-Hamas conflict in early October. At the heart of the strong market performance was the resilience in the global economy and in corporate earnings as well as the larger than expected decline in inflation, which allowed markets to effectively rule out the worst case scenario of a central bank induced deep recession.

At the end of December markets were implying the Fed funds rate would be cut as early as March, with the prospect of six 25 basis point reductions in 2024 to 3.8 per cent and a further 100 basis points to 2.85 per cent by early 2026. Bond yields dropped from their high around 5 per cent in late October to below 3.9 per cent by year-end. Over the same period, 10-year real yields dropped from 2.5 per cent to 1.7 per cent putting a rocket under PE multiples which expanded to 20 times forward earnings of close to US$240, implying earnings growth of around 11 per cent.

As mentioned earlier, the inflation news was positive. US inflation dropped to 3.2 per cent in November while the critical core PCE prices index rose at an annualised pace of just 1.9 per cent in the last six months. In Europe the CPI dropped sharply to 2.4 per cent, with Germany at 3.2 per cent. Meanwhile, UK inflation dropped below 4 per cent and in Japan the CPI eased back to 2.8 per cent. Although core inflation measures suggest services inflation is higher and stickier, the broad trend is positive.

In terms of growth, the US economy posted a larger than previously thought 5.2 per cent expansion in the September quarter while the ISM indices tentatively point to a trough in the manufacturing sector. Payrolls growth has eased but is still strong enough to keep the unemployment rate extremely low. Meanwhile in Europe, growth was close to flat in the September quarter, on the verge of technical recession.

For the quarter the standout markets were Sweden, up 21.2 per cent and the Netherlands 19.9 per cent. Europe ex-UK was up 12.3 per cent while the US was up 11.8 per cent and Japan 8.2 per cent in USD terms. On a sector basis REITs benefited from the decline in real yields, up 18.1 per cent for the December quarter, construction materials 22.8 per cent (60 per cent for the year) while the IT sector gained a further 17.5 per cent to take the annual gain to an eye-watering 53.7 per cent. The communications sector was up almost 46 per cent for the year while consumer discretionary was 35 per cent higher. Only utilities, consumer staples, healthcare and energy were close to flat for the year.

EMERGING MARKETS

Emerging markets rose 3.9 per cent in USD terms in December or 1.8 per cent in AUD terms. For the quarter, emerging markets are up 7.9 per cent, or 2 per cent in AUD terms, lagging global developed and domestic equities by a considerable margin.

As has been the case for much of 2023, given the large weighting to China, Chinese equity market performance has undermined emerging market returns. Beset with concerns over the ailing property sector, a lack of serious policy stimulus and investor requirement for a higher risk premium to invest in China, Chinese equities dropped a further 4.2 per cent in the quarter to take the annual loss to 11.2 per cent. On the positive side, the economic data on retail sales and production appeared to be lifting going into year-end.

Outside of China, many emerging markets performed well. EM Latin America, led by Brazil and Peru, was up 8.3 per cent in the month, 17.6 per cent for the quarter, taking the annual gain to 32.7 per cent. EM Europe jumped 12.9 per cent in the quarter and almost 30 per cent for the year as Hungary and Poland rose by around 50 per cent on the back of an improved interest rate backdrop. Korea, Taiwan and India all enjoyed strong quarterly and annual returns.

Emerging markets remain relatively cheap to developed markets but have long required a catalyst for outperformance. Some EM central banks are already easing policy (Brazil, Hungary, Poland) which is positive while recent USD weakness is also a positive. Perhaps what is required is more evidence that the global cycle is turning.

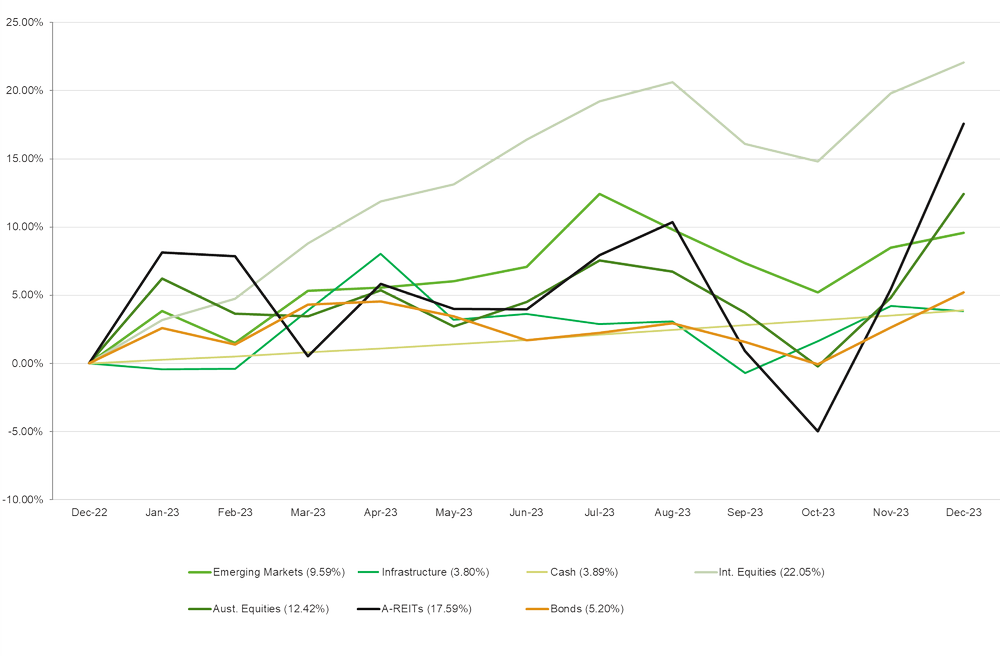

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners