Q4 2023 Investment Market Update

In the final quarter of 2023, investors witnessed strong returns concluding the year on an optimistic note. The year marked a recovery across asset classes in which equities and bonds gradually recuperated throughout 2023 from the substantial drawdowns seen in 2022. The major driving force behind this rebound was a period of immaculate disinflation and economic resilience, particularly from the US economy that increased global mega-cap stocks. Despite Australian equities clocking negative returns to the end of October, they remarkably reversed their fortunes in Q4, ending the year on a positive note. Lastly, bonds showcased a positive performance in the last quarter of 2023, thereby preventing a three-year streak of losses for this asset class.

Inflation continues to be the primary focus for market participants. Economically, the rate of inflation has significantly decreased from its highest point. However, consumers are still experiencing financial strain as living costs persistently increase. Central banks subtly altered their language throughout the quarter, suggesting potential rate cuts in 2024. The Federal Reserve (FED) maintained its interest rates unchanged throughout the quarter. In contrast, the Reserve Bank of Australia (RBA) implemented a rate hike of 0.25% during the same period.

Regarding our portfolio performance, our portfolios experienced a decline in October, followed by a rally in November and December. This late-year surge pushed positive returns, ranging between 4.79% and 6.31%, depending strategy employed. Throughout this period, the investment committee implemented several strategic adjustments. By the end of the quarter, the portfolios were positioned with an underweight allocation in equities and an overweight allocation in cash.

International Equities

International equities advanced during the September quarter, returning 5.13% in Australian dollar terms. Currency was a large deterrent to investment performance as the U.S. dollar fell over 7% against the Australian dollar from late October onwards. Our international equity allocation outperformed the benchmark, with excess returns largely attributable to currency hedging.

The financial markets are buoyed by expectations that the Federal Reserve will significantly lower interest rates in 2024, despite no imminent signs of a recession. Should we manage to achieve a "soft landing," this optimism may already be factored into market prices, as evidenced by the overwhelmingly positive sentiment and full valuations.

US equities outperformed the MSCI All Country World Index by 4% in 2023 and the "Magnificent Seven" was without a doubt the dominant investment narrative for 2023. This refers to the seven major tech companies that have significantly influenced the US equity market's performance. These companies, including NVIDIA, have driven a substantial concentration of market performance. NVIDIA's first-quarter earnings were particularly impressive, signalling strong performance in the tech sector. This success was largely attributed to the growing enthusiasm surrounding the potential of artificial intelligence (AI) to enhance the earnings and innovative capabilities companies around the global. NVIDIA, known for its significant contributions to AI and computing, played a key role in driving this positive sentiment.

The European economy is currently facing more challenges than the U.S., with signs pointing towards a potential slowdown in economic growth. Conversely to this some analysts are forecasting an uptick in European corporate earnings throughout 2024.

Turning to China, the market there had a tough run in 2023 and presents attractive investment proposition on a valuation basis but China's cautious stance on economic stimulus and a combination of high real interest rates and deflation make it a less compelling choice for investments at this moment. The picture is a bit more positive in other emerging markets, but we're keeping a balanced view. India, for instance, shows strong fundamentals but is on the pricier side.

In early November, there were some changes in the global equity allocation of the portfolio. The investment committee elected to increase the level of currency hedging across the portfolio from the 50% to 60%. This move was designed to fortify the portfolios against currency fluctuations and enhance the overall portfolio in the scenario that the Australian dollar strengthens or the US dollar weakens.

Australian Equities

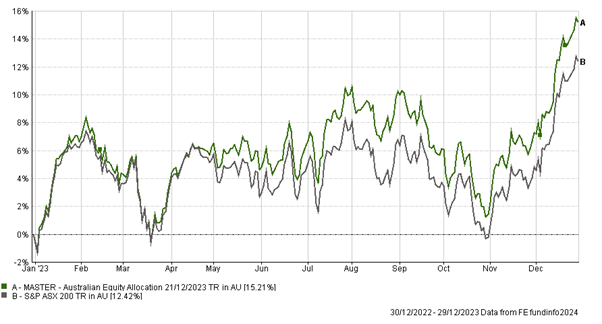

During the quarter, Australian equities posted an impressive return of 8.40%. The performance of this asset class in 2023 was particularly noteworthy, as a strong rally in the final two months dramatically reversed the trend of negative returns experienced earlier in the year. The portfolio’s allocation to Australian equities performed well in both the quarter and year, with many of our strategies exceeding the ASX200, as highlighted in the chart below.

*Source: FE Analytics

Despite a peak in inflation in 2023, the Australian economy grew below trend due to cost-of-living pressures and increased interest rates, impacting household consumption and real incomes. Employment growth stabilised, but labour market tightness remained, contributing to wage growth and ongoing labour cost pressures. The Reserve Bank responded with a further interest rate hike to manage inflation, acknowledging the need for a balanced approach to support economic growth and employment while addressing inflationary challenges. This situation reflected global trends of sustained high inflation and tight labour markets, underscoring the complexity of returning to targeted inflation levels.

We made two key adjustments to our Australian equity allocation during the quarter. We decided to merge our micro-cap and small-cap holdings into a singular investment. This decision was driven by recognising overlapping strategies between the two positions. By consolidating them, we aimed to streamline our investments, enhancing concentration within the portfolio and significantly cutting costs in the process.

Additionally, we divested from our position in the Australian Bank Exchange-Traded Fund (ETF). The proceeds from this redemption were strategically reallocated to a resources-focused alternative investment.

Property & Infrastructure

In the fourth quarter, our portfolio saw notable gains from both listed property and infrastructure sectors. Specifically, listed infrastructure grew by 4.56%, while listed property saw a more significant rise of 16.56%.

On the other hand, their unlisted counterparts encountered challenges, which negatively impacted overall performance. This was primarily due to the ongoing effect of rising interest rates on asset valuations, as reflected in the widening of capitalisation rates. Within our range of solutions, strategies in this area ranged from break-even to underperforming, with the least successful strategy showing a decline of 5.56%. Additionally, liquidity has emerged as a concern in recent months, leading to the implementation of gates in numerous unlisted strategies to manage investor redemptions effectively.

During the fourth quarter, the performance of listed property was significantly bolstered by a marked decrease in bond yields. This decline in bond yields is often favourable for listed property investments. Think of it as a balancing act: as bond yields drop, the allure of property investments usually increases. This is because property can offer more attractive returns than bonds, which yield less. As a result, more investors turn their attention to property, driving up its value – a positive outcome if you invest in listed property. Additionally, lower bond yields often mean lower interest rates, reducing borrowing costs for property investors and potentially leading to higher profits.

Unlisted property typically experiences similar trends, albeit with a delay. This is due to the less frequent revaluation of these assets. As such, we anticipate that the benefits observed in listed property may gradually manifest in unlisted property in 2024, reflecting these market dynamics should yield levels hold or decline further.

In the past quarter, the committee consolidated our listed infrastructure investments under a single manager. This decision was influenced by the manager's impressive performance history and our confidence in their ability to continue delivering strong returns. By concentrating our infrastructure allocation with one manager, we aim to enhance conviction in our investment strategy and increase cost efficiency across certain portfolios.

Private Equity & Venture Capital

In the fourth quarter, private equity's performance was more varied, significantly influenced by the 7% devaluation of the US dollar. Despite this obstacle, private equity maintained robust performance throughout 2023, providing consistent returns for investors. Over the past three years, private equity has been a crucial component of our portfolios, contributing to strong returns while helping to reduce overall portfolio volatility.

The accompanying chart illustrates the performance of a private equity composite, which includes the two products with the most exposure in across our client base: the Hamilton Lanes Global Private Assets Fund and the Partners Group Global Value Fund (equally weighted). This comparison against both Australian and international equities highlights the effectiveness of our private equity allocation. Notably, the chart shows that our private equity investments have met return expectations and successfully mitigated the significant market downturns experienced in 2022. This demonstrates the strategic value of including private equity in a diversified investment portfolio.

*Source: FE Analytics

In 2023, private equity 'dry powder' – the industry term for undeployed capital – reached a record high of US $2.59 trillion. This surge is largely due to a slower pace in deal-making over the year, which limited opportunities for firms to invest the capital accumulated in previous years. With this capital often subject to deployment deadlines, we may witness a flurry of mergers and acquisitions (M&A) activities, including take-private deals and trade sales among private equity firms.

Looking at the venture capital sector, 2024 is shaping up to be a particularly dynamic year. A significant number of companies are gearing up for public listings, buoyed by improved investor confidence observed in the fourth quarter. Notably, the Nasdaq is preparing for over 80 companies to go public, starkly contrasting the subdued initial public offering (IPO) activity in 2023. This upcoming trend represents a significant rebound from the lull that followed the peak IPO activity in 2021.

There were no changes to the private equity allocation of the portfolios during the fourth quarter.

Enhanced Income

Australian bonds contributed solidly to portfolios, yielding a 3.59% return in the fourth quarter. After several challenging years, traditional defensive assets such as bonds and cash have performed well in 2023, proving more effective than alternative diversifiers such as hedge funds.

Over the year, Australian bonds achieved a 5.20% return, bolstered by the higher base rates and yields that characterised 2023. Despite considerable volatility throughout the year, bond yields concluded approximately where they began, allowing investors to benefit from the interest accrued without any reduction in capital.

Floating rate investment also performed well, benefiting rising cash rates, with any credit risk undertaken providing a beneficial premium above the Reserve Bank of Australia's cash rate. Private debt stood out as a valuable portfolio component, with the most prominent strategy among our clients delivering a 9.87% return. We maintain that private debt remains an appealing option for investors in 2024, given its consistent income generation, robust investor protections, and low volatility. It presents a compelling alternative to many risk asset that may be trading at full valuations.

Continuing the strategy from the previous quarter, we increased our exposure to interest rate risk, which paid off in December as bond yields fell from 5% to 4%. Although this tactic entailed some short-term discomfort, we believe locking in yields at these levels is a prudent defensive investment strategy. Looking ahead 2-3 years, we are confident these yields will represent an exceptional opportunity to secure attractive long-term returns.

The outlook for 2024 is complex and influenced by a tapestry of factors. Chief among these is the anticipated shift from the historic low-interest rate environment of 2009-2021 to a period of higher average interest rates, which promises to ripple through the economy more broadly than simply affecting mortgage rates. Such changes underscore the need for careful economic and financial planning in the coming year.

We maintain that, irrespective of whether the economy faces a hard or soft correction, bond yields are expected to remain within a certain range or potentially decline. This view has shaped our strategy towards long-duration assets like bonds and infrastructure, which we believe offer better defensive return potential than holding cash.

This would result in global equities being better positioned given their inherent growth bias, although we must be mindful of the elevated starting valuations, especially when compared to other markets. In contrast, the pronounced cyclicality of the Australian equity market may increase its vulnerability to any economic setbacks seen across 2024.

Continued global instability is a factor for 2024, with the direction of the next US administration set to be a decisive factor for global politics. The forthcoming US election will significantly influence whether the US takes a unilateral or a multilateral stance from 2025 to 2029, with far-reaching implications for global stability.

An encouraging sign for risk assets is the record capital levels ready for investment, notably within private equity and money market funds. Should yields continue to fall, we expect this capital to flow towards higher-risk assets, spurring market flows and potentially triggering a surge in mergers and acquisitions.

As always, should you have any queries about any of the material outlined in this letter, please do not hesitate to contact us.