Market Summary | August 2021

MARKET OVERVIEW

Global markets continued their climb into August, with emerging markets slightly outperforming developed markets as the region recovers from a sharp sell-off driven by Chinese equities in late July. Developed markets continue to be supported by economic stimulus and vaccination efforts, despite unabated trends in daily case rates across developed economies.

In Australian dollar terms, small cap global equities continue to be the best performer over the last twelve months, whilst their larger cap counterparts continue to outperform both small cap and emerging markets over the longer term.

China banned for-profit tutoring triggering a big sell-off in Chinese education stocks.

United States

At the recent Jackson Hole Symposium, Federal Reserve Chair Jerome Powell signalled the central bank will likely begin tapering before the end of the year, but this may not translate to a direct increase in interest rates. Inflation data for July was in line with expectations, with inflation lifting 0.5% month-on-month and taking the yearly rate of inflation to 5.4%.

Inflation will be a key discussion point for the Federal Reserve meeting scheduled for the second last week of September. The timing and degree of stimulus tapering remains a central issue for policy makers to contend with as they must balance managing inflation without compromising economic growth. This poses a significant short-term risk for global equity markets which have been enjoying an unprecedented bull run since the March 2020 COVID induced sell-off.

The S&P 500 Index (USD) returned 2.90%

The Dow Jones (USD) returned 1.22%

Asia

Losses in emerging markets were driven by a deep selloff in Chinese technology and education stocks towards the end of the month as Chinese regulatory officials confirmed a leaked policy document banning for-profit tutoring, an industry with an estimated value of US$120 billion. This began a sell-off in Chinese education stocks which spread to the Chinese technology sector, shaving off a combined US$1.0 trillion in company value, with the MSCI China index posting its largest decline since March 2020.

From a sporting perspective, the Tokyo Olympics and Paralympics were a massive success for Japan but losses from spectator free games will total 2.4tn Yen and the surge of COVID cases in Tokyo has continued.

Toyota, the world’s largest car maker, announced a 40% cut in vehicle production due to a shortage in semiconductors, amid the outbreak of the Delta variant of the coronavirus in south-east Asia.

The Hong Kong Hang Seng PR Index (HKD) returned -0.32%

The Nikkei 225 PR Index (JPY) returned 2.95%

The Shanghai Shenzhen 300 PR Index (RMB) returned -0.12%

Europe

Eurozone economic sentiment dropped to 117.5 in August, from an all-time high of 119.0 in the previous month and below market expectations of 117.9. Sentiment deteriorated for the first time since January's slight decline, amid concerns over the Delta coronavirus variant.

And in what could signal supply change issues becoming a regular occurrence, a national shortage of truck drivers caused milkshakes to be taken off the menu at McDonald’s restaurants across the UK.

The UK’s FTSE 100 PR Index (GBP) returned 1.24%

The German Dax (EUR) returned 1.87%

Australia

As widely expected, the RBA left the cash rate unchanged at 0.1% during its August meeting and reconfirmed the gradual reduction of its quantitative easing program.

GDP increased 0.7% in the second quarter, ahead of the 0.5% growth expected, and following the upwardly revised 1.9% growth in the previous quarter. The Westpac consumer confidence index fell 4.4% to 104.1. This is the lowest point in a year, but it remains comfortably above lows seen in the national lockdown last year (75.6) and is above the reading seen over the twelve months prior to the pandemic (average read of 97.5).

The Australian share market continued its advance for the year following a strong reporting season, with the S&P/ASX 200 gaining 2.5% for the month; year to date the index is up an impressive 17%. Information Technology contributed strongly with a 17% gain for the month, with Consumer Staples (+6.9%) and Health Care (+6.8%) also leading the index higher. Materials and Energy were the only detractors for the month with the sectors retracing 7.3% and 3.9% respectively; continued weakness in iron ore prices and a softer month for oil contributed to the losses.

It was a busy month for investors as attention turned to the FY21 reporting season. Healthy profits and record dividends were a feature of the reporting season as materials and COVID beneficiaries continue to recover strongly from the March 2020 lows. Banks also continue to build momentum as bad debt provisions are scaled back amidst an improving economic backdrop.

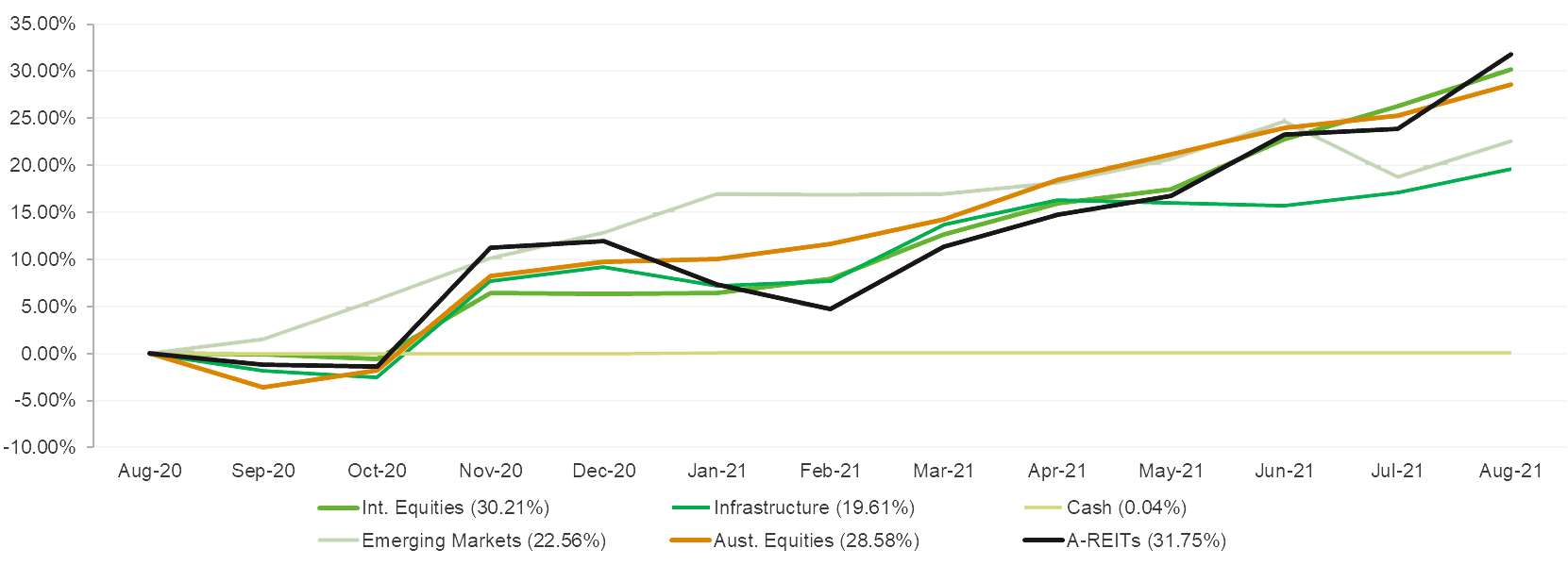

Market Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd