Market Summary | April 2018

MARKET OVERVIEW

Global equities made a modest gain in April, as political tensions appeared to soften and the oil price rallied strongly in light of the continuing troubles in Syria and the instability in the region.

In April, North Korean leader Kim Jong-un made a historic visit to South Korean President, Moon Jae-in. There followed a commitment to rid the Korean peninsula of nuclear weapons. The meeting would have been unthinkable at the beginning of the year when North Korea was boasting of being able to reach the US mainland with its rockets: now Pyongyang says it will invite US observers to witness the shutdown of its nuclear site in May.

In Syria, conflict continued to escalate: The U.S, U.K and France fired a barrage of missiles at military targets inside the country following an alleged chemical weapons attack by the Assad regime. The U.S also followed with stiff sanctions against Russia for malign activity, including its support of President Bashar al-Assad and involvement in the civil war.

UNITED STATES

The US President had some troubling numbers to contend with in April. The US trade deficit widened in February to USD 57.6bn and there are suggestions that the US could have a trade deficit of a trillion dollars a year by 2020.

In a tit-for-tat sequence, the U.S and China announced a series of retaliations that many feared could descend into a trade war. China’s Ministry of Commerce responded to previously announced levies on imports of steel and aluminium as well as Section 301 tariffs from the U.S, with additional duties on American products. President Donald Trump then rattled markets by calling for additional tariffs on Chinese goods worth $100 billion, and China later imposed an antidumping tariff on U.S.-grown sorghum. However, trade tensions subsided, following reports that U.S Treasury Secretary Steven Mnuchin would travel to Beijing to discuss the dispute.

ASIA

In a sign of moderating tensions on the Korean peninsula, Kim Jong-un became the first North Korean leader to cross into the South Korea-controlled side of the border to attend a summit hosted by President Moon Jae-in. The one-day summit concluded in a joint statement calling for a peace treaty and continued dialogue on denuclearization, setting the stage for upcoming U.S.-North Korea discussion.

Speeches from President Xi and central bank governor Yi Gang at the Boao Forum were perceived as conciliatory as opposed to confrontational. Their remarks included the announcement of measures to accelerate the opening up of Chinese markets to foreign companies, notably the car industry.

Chinese growth also remained robust. Annual growth was 6.8% in the first quarter of the year. There is also increasing evidence that China is managing to successfully transition from export and investment-led growth to an economy that is driven by consumption.

EUROPE

April was a busy month for French President Emmanuel Macron, who made a speech in Strasbourg calling for ever-closer union between the EU’s member states. Throughout April, the debate raged about whether the UK should stay in some sort of customs union with the EU after March next year. Doing so would avoid a hard border between Northern Ireland and Ireland– but would severely limit the UK’s ability to do trade deals with countries outside of the EU.

The European Central Bank announced it would leave interest rates unchanged, despite the pace of growth in the Eurozone starting to slow. There was bad news from Deutsche Bank, who announced significant job cuts as it scaled back its corporate and investment banking operations. Christian Sewing, the new CEO of Germany’s biggest lender, said that the cuts were painful but unavoidable as the bank reported a sharp drop in first-quarter corporate and investment banking revenues.

AUSTRALIA

In a decision that undoubtedly surprised very few, the RBA left the cash rate on hold at 1.50% at its May meeting, making this the 21st successive month and the longest spell of inactivity since 1990. Growth is expected to be around 3.25% through 2018 and 2019, supported by public infrastructure spending, which should help reduce spare capacity.

However, the Australian economy is still marked by ongoing consumer caution, and policymakers remain concerned about the impact of any interest rate rise on the household sector, especially given current low wages growth and high levels of household debt.

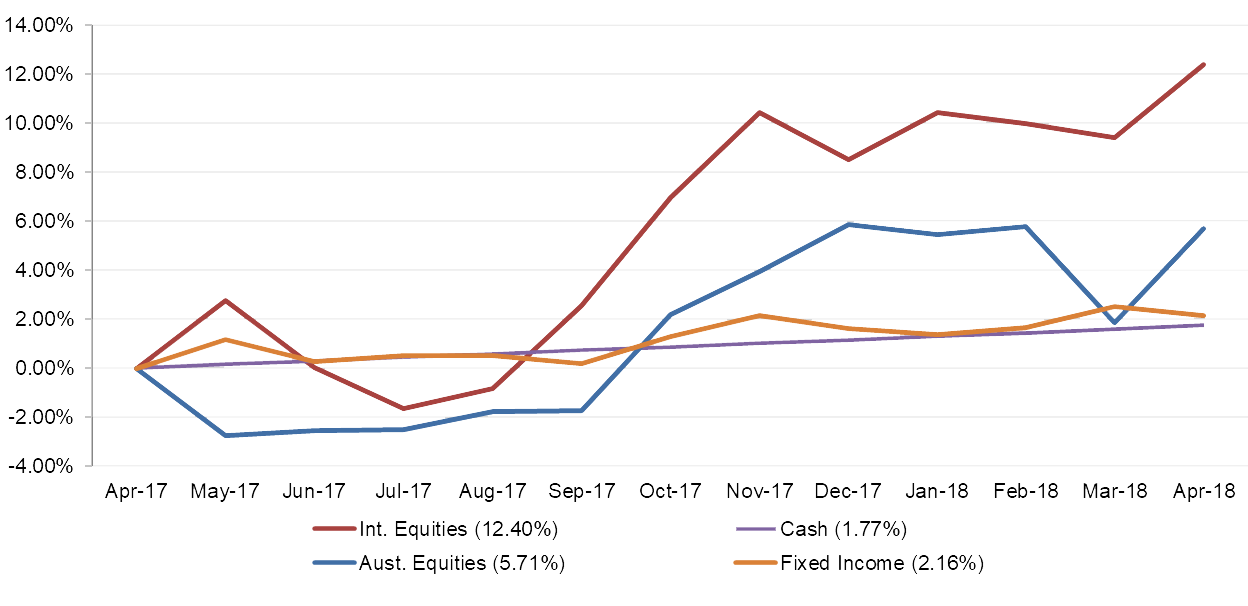

MARKET RETURNS (LAST 12 MONTHS)

Markets have had a positive 12 months. Returns have been positive in all growth asset classes. Equity markets generally have performed well while fixed income and cash returns remain at historically low levels. The month of April provided mixed returns across the asset classes with stronger performance coming from International & Australian Equities.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.