Market Summary | October 2020

MARKET OVERVIEW

A mixed month for markets globally as each market faced its own challenges. Both the Australian market as well as emerging market economies performed well in October as easing restrictions brought life to markets.

In contrast to the Australian experience, global markets were down in October due to resurgent COVID-19 cases in Europe and the US, while an uncertain presidential election added to volatility in US shares.

UNITED STATES

The economic data points to ongoing strength in the US recovery, however record daily cases of COVID-19 are dragging on sentiment. After a tense presidential election race, Joe Biden was projected to win the presidency and Republicans looked to hold their majority in the Senate. Markets responded favourably to news in November of the Pfizer/BioNtech vaccine, which saw a rotation back into cyclicals and value.

US GDP growth was 33.1% in the September quarter, the biggest expansion ever recorded, beating expectations of 30.9% and rebounding strongly from the 31.4% contraction in the previous quarter.

While earnings were largely overshadowed by politics, reporting is on track to soundly beat expectations. As of 6 November, 89% of S&P 500 companies had reported for 3Q20, of which 86% reported actual earnings above estimates. Apple reported its 4Q20 results, with revenue of US$64.7 billion and earnings per share of US$0.73, beating expectations.

The S&P 500 Index (USD) returned -2.77%

The Dow Jones (USD) returned -4.61%

ASIA

China unveiled its 14th five-year plan, outlining its economic and social priorities for 2021-25. The plan is centred around maintaining economic growth, with technology and innovation again a key focus, especially strategic emerging sectors like biotechnology, semiconductors and new energy vehicles. China aims to be a “moderately developed” country by 2035, which would mean a GDP per capita of around US$30,000 (nearly three times its current level).

The Chinese economy continues to bounce back from the pandemic-induced slump. Compared to the same quarter last year, GDP rose 4.9% in Q3 2020, lagging the 5.2% growth expected, but still leading the world in terms of the strength of the recovery.

The Hong Kong Hang Seng PR Index (HKD) returned 2.76%

The Nikkei 225 PR Index (JPY) returned -0.90%

The Shanghai Shenzhen 300 PR Index (RMB) returned 2.35%

EUROPE

New coronavirus cases continued to rise across Europe, prompting countries to implement new restrictions. The UK broadened the number of cities under the highest tier restrictions, while Germany and France announced heightened restrictions to prevent an uncontrolled outbreak.

Eurozone GDP for the September quarter came in stronger than expected at 12.7% (9.4% expected), the steepest pace of expansion on record, as activity rebounded following the easing of lockdown restrictions.

The Bank of England increased its quantitative easing program by £150 billion, as it grapples with an economy expected to fall by 11% in 2020.

The UK’s FTSE 100 PR Index (GBP) returned -4.92%

The German Dax (EUR) returned -9.44%

AUSTRALIA

With a string of zero daily cases, the Victorian Premier Daniel Andrews announced an easing of restrictions, including the removal of the 25km ‘ring of steel’ around Melbourne and a further relaxing of rules around social gatherings and businesses.

The Australian economy is expected to contract by 4.0% in 2020, before increasing by around 5.0% in 2021 and 4.0% in 2022. Retail sales fell 1.1% in September, following a 4.0% fall in August, while headline inflation jumped 1.6% in the September quarter, largely in line with expectations of a 1.5% rise.

Australian shares bucked the global trend to post a 1.9% return in October as easing restrictions, low case numbers, and a highly supportive federal budget bolstered confidence. Information Technology (+9.0%) was the top performing sector, followed by Financials (+6.3%). Even the beaten-down banks enjoyed a reprieve having been impacted by provisions, a rise in customer deposits, and contracting net interest margin.

In earnings news, Resmed (+16.9%) announced 1Q21 results with revenue up 9% on the prior corresponding period and operating profit was up 27%. Revenue in the US, Canada, and Latin America, excluding Software as a Service, increased by 9%, driven by strong mask sales and increased demand for ventilators due to COVID-19, which was partially offset by lower demand for sleep devices.

Global biotech leader CSL will begin producing 30 million doses of the Oxford University-developed AstraZeneca vaccine to be ready for distribution should trials prove successful. The vaccine is still subject to approval by the Therapeutic Goods Administration for use in Australia.

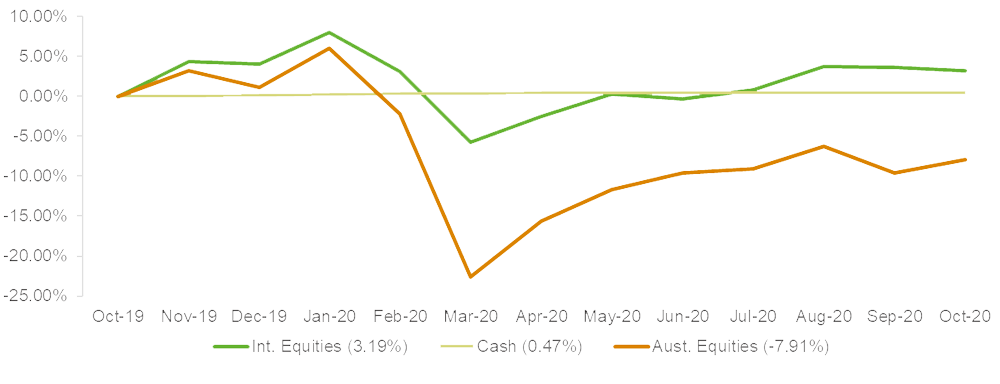

MARKET RETURNS (LAST 12 MONTHS)

International Equities have significantly outperformed domestic equities over the last 12 months largely driven by advancing technology companies which have been a big beneficiary of the COVID-19 environment.

Returns on cash and fixed income remain subdued.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd