Market Summary | October 2024

Global markets faced challenges in October due to rising bond yields, a stronger USD, and mixed economic signals. The Australian market fell, weighed down by declines in materials and energy, while financials and healthcare gained. Inflation eased, but diminished expectations for RBA rate cuts and stretched valuations added pressure. Developed markets saw mixed performance, with the S&P 500 reaching highs on strong earnings, while Europe lagged. Emerging markets declined, led by weakness in China, India, and Korea, as limited Chinese stimulus and US tariff risks dampened sentiment. A potential Chinese fiscal stimulus package offers optimism for future growth.

Australia

The Australian equity market fell by 1.3% in October as investors reassessed the potential impact of Chinese stimulus measures and rising bond yields. The materials sector dropped 4.9%, and energy declined by 4.8%. Consumer staples, REITs, and utilities also weakened. However, financials and healthcare sectors posted gains, with financials reaching a record PE multiple of 18.3 times.

Economic indicators provided some support to the market. Core inflation eased to 3.5%, while headline inflation dropped to the 2–3% target range for the first time since March 2021. Consumer sentiment showed signs of improvement, likely due to lower inflation and recent tax cuts, even as business conditions stabilised. Employment data showed a gain of 64,000 jobs in September, with the unemployment rate steady at 4.1%. RBA Governor Michele Bullock noted that the economy remains "too hot," highlighting high capacity utilisation.

In September, markets anticipated up to 100 basis points of RBA rate cuts over the next 12 months. However, by early November, this expectation had fallen to just 50 basis points, with the first cut projected for May 2025. These shifting expectations, along with rising bond yields, created headwinds for equities.

From an earnings and valuation perspective, challenges persist. Consensus points to low single-digit EPS growth, with valuations appearing stretched in the banking sector. Market performance will likely hinge on interest rate movements and the potential for significant Chinese fiscal stimulus.

United States & Developed Markets

Global equity markets faced challenges in October due to rising bond yields and a stronger USD. Resilience in the US economy and speculation about a Trump presidency led markets to reverse some of the anticipated Fed rate cuts. Market expectations for the Fed's interest rates in 12 months rose from 2.9% in late September to 3.7%, impacting the entire yield curve. A 2.8% GDP growth rate in Q3 suggested no immediate need for the Fed to ease its monetary policy.

The MSCI World ex-Australia Index in USD terms declined by 1.9% in September, trimming the year-to-date gain to 16.7%. However, with the AUD weakening against the USD, the return in AUD terms rose to 3.5% for the month and 21.1% year-to-date.

The S&P 500 achieved record highs in early October, supported by a strong earnings season. According to FactSet, Q3 earnings are up 5.1% year-over-year, with consensus projections of 14% growth over the next 12 months. Japan's TOPIX index increased by 1.9% in local currency, but the yen's depreciation (from 140 to 153 against the USD) offset these gains. European markets (ex-UK) struggled, with losses over 10% in Portugal and the Netherlands. The US, Singapore, Italy, and Spain were top performers year-to-date.

Defensive stocks, which rebounded in the September quarter, saw losses in October, declining 3.8%. Consumer staples and utilities weakened, while materials fell due to lackluster Chinese fiscal measures. MSCI Quality and Growth segments, however, continued to deliver robust returns exceeding 21% year-to-date.

Emerging Markets

After a strong performance in September, emerging markets declined by 4.4% in October, weighed down by disappointment over the scale of Chinese stimulus, rising bond yields, and a strengthening USD. MSCI China dropped 5.9%, India fell 8.3%, and Korea declined 7.6%, while Brazil also faced challenges. In AUD terms, emerging markets gained 1.4% for the month, bringing the year-to-date return to 16.6%.

The US election outcome has added further risks for China, with President Trump proposing a 60% tariff, potentially reducing Chinese GDP growth by 1%. However, details of a significant fiscal stimulus package, expected to total 10 trillion yuan over three years (equivalent to 2–3% of GDP annually), are anticipated soon. If implemented, this would be a positive development for Chinese growth.

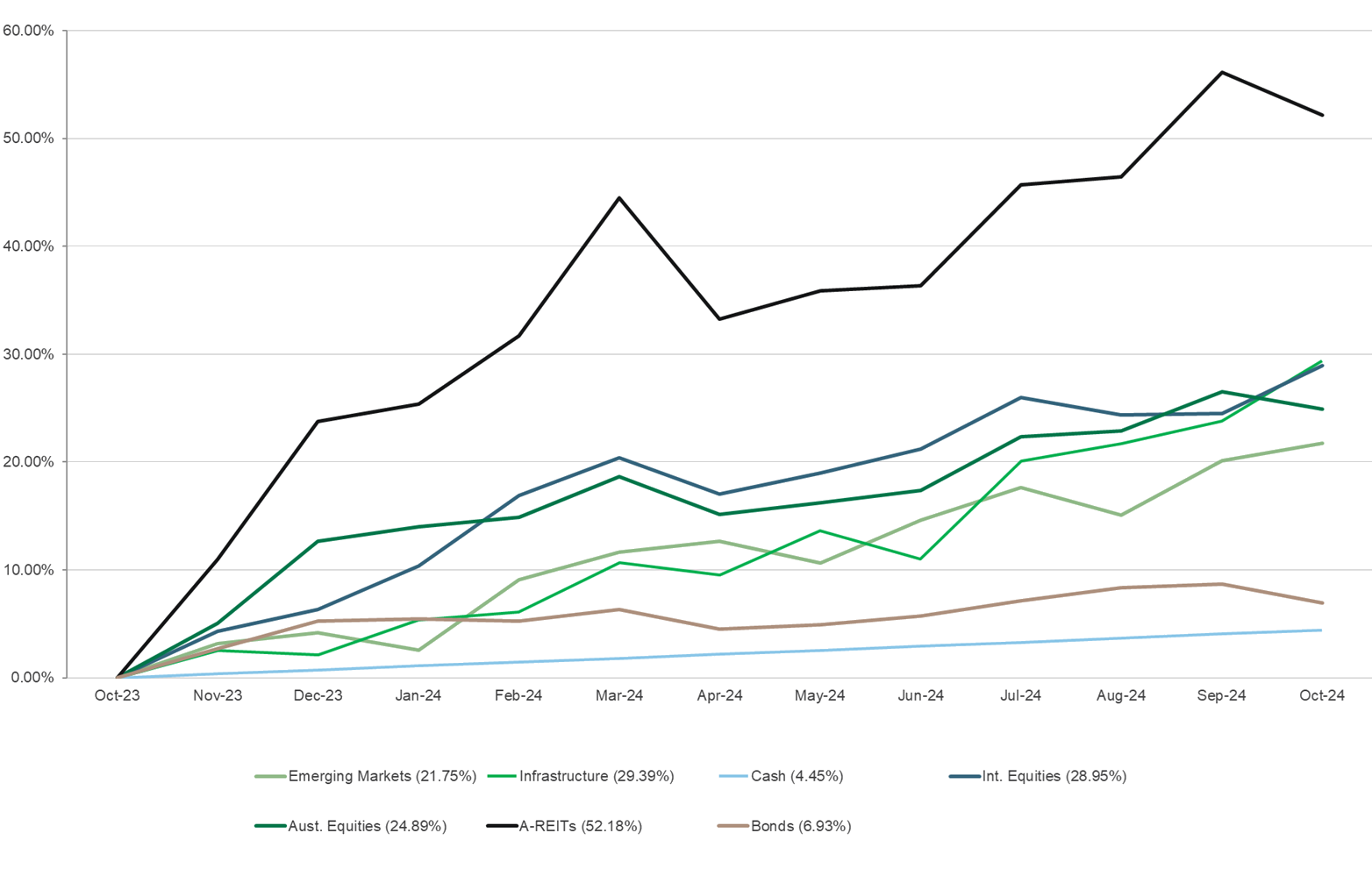

Asset Class Returns (last 12 months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners