Market Summary | May 2024

In May, Australian equities saw a modest rise, trailing behind global markets. The country's lower exposure to AI stocks, a subdued earnings environment, weak domestic growth, and limited growth sector presence contributed to this underperformance. Persistent high inflation and sluggish economic growth are weighing down the market. The recent Budget highlighted deteriorating growth projections, although some inflation relief is expected due to new policies. Globally, equity markets performed well with a positive economic outlook and easing inflation. The US led in earnings growth, particularly in tech sectors, while emerging markets had mixed results, with China and Taiwan showing gains despite challenges in Korea and Brazil.

Australia

Australian equities rose just 0.9 percent in the month, taking the year-to-date rise to 3.2 percent, clearly underperforming global equities. Banks had a solid month, as did real estate, utilities, and pharma, while communications and retailing were down sharply.

Australia’s more sluggish performance can largely be explained by its lower exposure to AI/productivity-related stocks and its very subdued earnings backdrop, weak domestic growth, and a lack of exposure to growth sectors. While global EPS growth for the next 12 months is expected to be 10 per cent, Australian earnings are expected to grow by just 2.5 per cent.

At present, the Australian market is being weighed down by the combination of slowing growth but stubbornly high inflation, preventing the RBA from signalling easier policy ahead. The 3.6 per cent April inflation result was above expectations and together with the upcoming tax cuts (equivalent to more than $23 billion, or 1 per cent of GDP) and the energy bill support package announced in the 2024-25 Budget ($3.5 billion), has prompted market expectations of a possible further hike in interest rates. However, as the recent March quarter GDP data showed, the economy has slowed to a 1.1 per cent annual growth rate, with evidence of very weak discretionary retail spending, declining business forward orders and declining hours pointing to cash rates eventually coming down.

The May 2024-25 Budget showed a deterioration in growth projections and in the forward estimates with deficits expected following this year’s lower fiscal surplus. The Treasury expects inflation to fall into the 2-3 per cent target band sooner than the RBA, partly as a result of policies announced in the Budget.

United States & Developed Markets

Global equity markets performed well in May, bolstered by a positive economic outlook and improved inflation data. The MSCI World ex-Australia index more than reversed April’s decline, rising 4.5 per cent, for a year to date performance of just under 10 per cent. In AUD terms the index was up a more modest 2 per cent in the month.

US core inflation rose 0.3 per cent for the month, after successive 0.4 per cent outcomes, allowing the annual rate to drop to 3.6 per cent. This return to the disinflation trend was greeted well by markets and together with signs of softening in several labour market indicators, prompted a decline in bond yields from close to 4.7 per cent to 4.51 per cent. After the “no-landing” narrative took hold in April, the month of May was more about “soft-landing”. Lower oil prices also helped drag down near term inflation expectations.

Earnings continue to surprise to the upside and according to FactSet data, the US recorded earnings growth of 5.9 per cent over the year to March, the best result since Q1 2022. Of course, the large mega-cap stocks continue to lead the way, helping drive earnings growth of 34 per cent in the communications sector, 25 per cent in IT and 25 per cent in consumer discretionary. Earnings growth in consumer staples, industrials, financials, materials, healthcare and energy has been below 5 per cent.

The continued strength in earnings, against a backdrop of lower bond yields and slightly softer growth favoured the Growth and Quality parts of the market, up 5.7 per cent and 6.1 per cent, respectively, outperforming Value stocks by 2.5 per cent. Momentum stocks also performed well as did small caps, matching the returns of the broader market.

The ongoing strong performance of AI-related stocks saw the US rise 4.7 per cent while Europe ex-UK was up a solid 5.2 per cent in USD terms. The UK rallied while Japan lagged after a very strong 12-18 months. On a year to date and annual basis, the US market still leads the way.

On the economic data front the news on activity was slightly softer. The US ISM manufacturing index for May fell back below 50, new orders declined while labour market indicators such as job openings and unemployment claims pointed to a softening. As mentioned above, the inflation news was the best this year, underpinning market expectations of a “soft-landing” scenario.

The data improved in Europe with the region escaping recession and PMI’s showing improvement in both manufacturing and services. With inflation tracking towards target, the ECB is expected to cut rates in June while in the UK the BoE seems more inclined to reduce rates over coming months. This supported European and UK equities.

Emerging Markets

Emerging markets lagged global developed markets with the key markets of Korea and Brazil weighing on returns. In AUD terms the MSCI Emerging markets index was down 1.8 per cent in the month, with EM Asia up 1.4 per cent, including a continued recovery in China, up 2.4 per cent, a 5.3 per cent gain in Taiwan while Korea was down 3.6 per cent. Brazil was the major detractor from EM returns, down 5 per cent, partly reflecting concerns over central bank independence.

Chinese economic data has generally pointed to a modest recovery, supporting Chinese equities, although it seems to be based on trade and exports while the property sector continues to deleverage, and the consumer remains hamstrung by low levels of confidence. The May official PMI data showed activity easing back below the critical 50 level while retail sales growth has slumped back to 2.3 per cent. The authorities did announce further policy moves in May including lowering down payment requirements to 15 per cent for first-home purchases and 25 per cent for second-home purchases. In addition, the PBoC announced it would provide 300 billion Chinese renminbi (USD41 billion) in a relending programme for local governments to acquire properties and convert them into social housing. The central bank expects the programme to boost bank lending. The national floor for mortgage interest rates was also removed. These policy changes are designed to support the housing market and bolster household confidence although there is debate as to whether they will add noticeably to growth.

Several Emerging economy central banks have now eased policy in response to declining inflation, leading the way for developed markets central banks over coming quarters. Over the past year, USD strength has been a headwind, as has the policy/regulatory risk in China. These risks remain although easier policy and signs of a lift in the global manufacturing cycle are typically positive for Emerging markets.

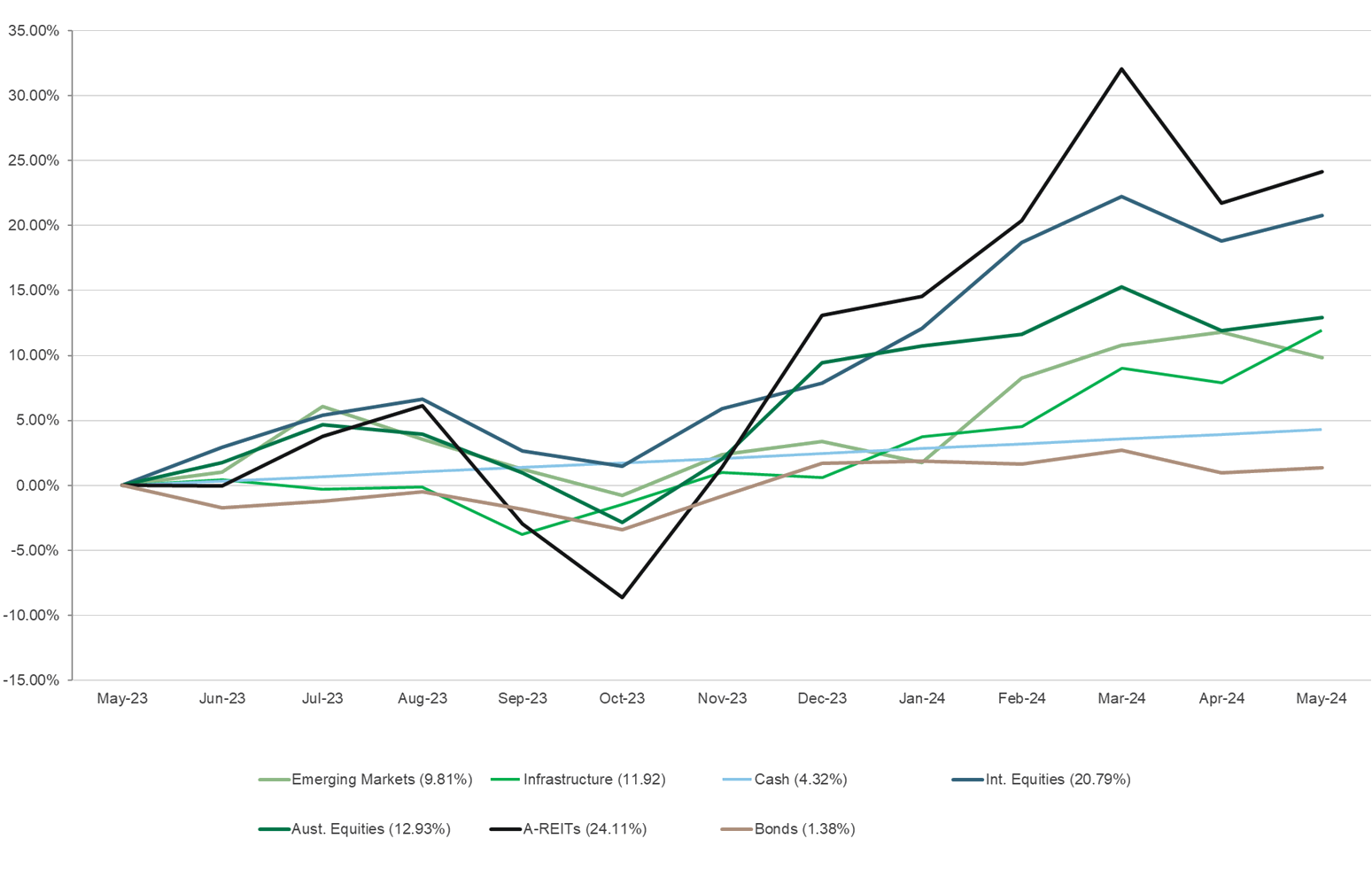

Asset Class Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners