Market Summary | March 2022

MARKET OVERVIEW

Global markets continued their downward trend over the month of March as the Ukrainian conflict continued with no certain end in sight.

Geopolitical uncertainty continues to be the core focus for investors as upward price pressure on energy and commodities hastens the pace of inflation across the globe.

A new Omicron sub variant emerged, causing a spike in infections across Europe and China, with China imposing targeted lockdowns in key provinces.

The Ukrainian conflict continued with no certain end in sight

United States

The Russian war on Ukraine continued to put pressure on energy prices, with Oil remaining volatile. Upwards of 4 million people have been displaced by the war with many fleeing to Poland and Germany. Inflation remains a concern, especially in the US and Europe, as it outpaces wage growth and puts pressure on household budgets.

The Federal Reserve lifted interest rates from 0.25% to 0.50% in March - the first rise in three years - as they look to tackle the highest level of inflation in years and leveraging off a strong US economy. Further near-term rises are expected, with the Fed anticipating rates to be in the range of 1.75-2.00% by years end.

Inflation climbed 0.8% in February, 10bps higher than anticipated, pushing the annual rate to a 40 year high of 7.9%.

Developed markets fared better than in February closing -0.9% lower. Global small caps performed worse than their large cap counterparts closing with a -2.7% loss. Momentum and quality factors were the best performers over the month returning 4.3% and 3.1% respectively, whilst equal-weighted and value factors were the laggards returning -0.7% and 0.4% respectively.

The S&P 500 Index (USD) returned 3.58%

The Dow Jones (USD) returned 2.32%

Asia

Emerging and Asian markets loosely mirrored the return profile of the previous period, continuing to fall by -5.6% and -5.7% respectively.

A resurgence in COVID-19 cases resulted in targeted lockdowns in key cities and regions, including Shanghai and Shenzen, threatening more global supply chain

disruption.

Tokyo’s population fell in 2021 for the first time in more than a quarter of a century, with a net loss of 48,592. This follows concerted efforts from other cities and prefectures to attract new residents with business loans and lower cost of living.

The Hong Kong Hang Seng PR Index (HKD) returned -3.15%

The Nikkei 225 PR Index (JPY) returned 4.88%

The Shanghai Shenzhen 300 PR Index (RMB) returned -7.84%

Europe

As widely expected, the European Central Bank kept interest rates at 0%, however it surprisingly sped up its asset purchase schedule for the upcoming months, noting that it could end in the third quarter if the medium-term inflation outlook holds firm.

The inflation rate increased 0.9% in February, while the annual rate rose to a record high of 5.9%. Inflation is largely being driven by increasing energy prices.

The UK’s FTSE 100 PR Index (GBP) returned 0.77%

The German Dax (EUR) returned -0.32%

Australia

The RBA left the cash rate unchanged at 0.1% as widely expected. While mentioning that the war in Ukraine was a major new source of uncertainty, policymakers reiterated unpredictability over how persistent the pickup in Australia's inflation will be, on the back of recent developments in global energy markets and ongoing supply-side problems.

The Australian market closed out the quarter with the S&P/ASX 200 up 6.9% in March and all 11 sectors finishing positively. The Technology sector (+13.2%) led the index and rebounded from a February selloff, with Energy (+9.8%), Materials (+8.9%), Financials (+8.5%) and Utilities (+7.6%) all performing strongly.

The Energy and Materials sector continued their stellar year-to-date performances as commodity prices continued to soar. Meanwhile, Information Technology rebounded strongly from a perceived ‘bottom’ in February amidst rising interest rate pressures in overseas markets. However, volatility in this sector persisted given the uncertain macroeconomic backdrop. The Financials sector continued its sturdy performance as the major Australian Banks contributed to the strong Australian broad market performance.

The S&P/ASX 200 finished the month within 2% of its August 2021 historical high. Overall, whilst the geopolitical issues in Ukraine remain a point of concern, Australian equity performance has been more robust than other markets with greater geopolitical risk.

The Australian dollar continued to climb in the month of March closing 3.4% higher relative to the greenback. Rising commodity prices continued to be the primary driver of AUD support over the month of March, albeit some domestic support was provided through better than-expected February employment figures.

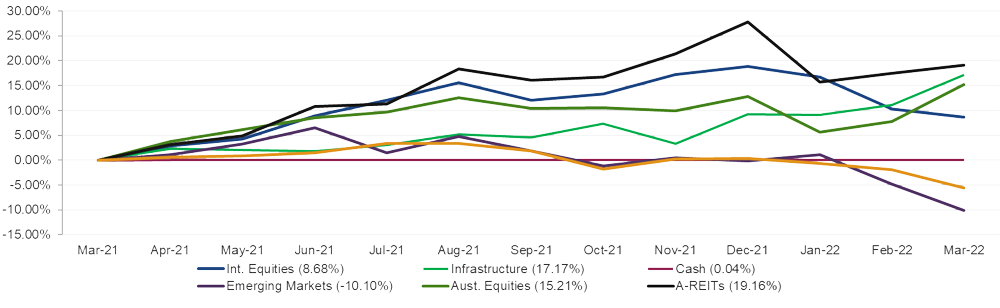

Market Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd