Market Summary | March 2021

MARKET OVERVIEW

The vaccine narrative is still propelling the economic recovery. The rollout has been slower than many had hoped, but the US and UK are now making strong progress. The International Monetary Fund is forecasting the world economy to expand 6.0% in 2021, up from the 5.5% it had forecast in January.

Markets performed well in March, however some ration is beginning to be seen among sectors. Following the March 2020 low, the subsequent rebound in global markets was initially fuelled by growth companies in technology and healthcare that performed well as the pandemic swept across the globe and strict lockdown measures were implemented in most countries. As vaccines continue to roll out globally, the rebound has shifted to more cyclical areas of the market that are expected to perform strongly as the world returns to ‘normal’.

New Zealand announced plans to open a two-way, quarantine-free trans-Tasman travel bubble.

UNITED STATES

In the US, the style rotation has been most strongly depicted in the performance disparity between the ‘old economy’ Dow Jones Industrial Index, which rose 8.3% in the March quarter, and the ‘new economy’ NASDAQ Composite Index, which rose 1.8%. The rotation is being aided by rising bond yields, which challenge the lofty valuations that have been assigned to growth assets, especially in the technology sector.

The US economy continues its upward trajectory with recent data pointing to an upswing in activity and an improvement in confidence as the vaccine rollout increases pace. More than 100 million people have received at least one coronavirus vaccine dose, and over 1 million doses were administered on a single day. The IMF expects US GDP to grow by 6.4% in 2021, an upgrade of 1.3 percentage points, driven in large part by the Biden administration’s $1.9 trillion stimulus.

The S&P 500 Index (USD) returned 4.24%

The Dow Jones (USD) returned 6.62%

ASIA

Chinese shares remain under pressure as markets express concerns around potential policy normalisation as the economy recovers from the pandemic. In addition, uncertainty surrounding potential regulation for some industries and ongoing geopolitical tensions continue to dampen investor sentiment in the region. Emerging markets were weak in March, rising only 0.1% in Australian dollar terms, but have outperformed developed market shares over the past 12 months.

India reported more than 100,000 daily Covid-19 cases in early April, a grim measure achieved only by the United States and Brazil. However, despite the economic pain wrought by the pandemic, which caused a record 8.0% drop in GDP over 2020, the IMF forecasts a 12.5% rebound in 2021, and further growth of 6.9% in 2022. India—along with the US, China, Indonesia and South Korea—will be among the only major economies to exceed pre-pandemic GDP levels by the end of 2021.

The Hong Kong Hang Seng PR Index (HKD) returned -2.08%

The Nikkei 225 PR Index (JPY) returned 0.73%

The Shanghai Shenzhen 300 PR Index (RMB) returned -5.40%

EUROPE

Europe’s battle against the coronavirus took a backward step as France and Italy were forced to impose nationwide lockdowns ahead of the Easter weekend following a surge in cases. France’s President Macron announced that the lockdown rules currently in operation in 19 French departments, including the Paris region, will be extended to the rest of the country and will remain in place for at least four weeks. German Chancellor Angela Merkel said she is in favour of a “short national lockdown” as the country struggles to bring case numbers under control with a surge in the British variant.

The UK’s FTSE 100 PR Index (GBP) returned 3.55%

The German Dax (EUR) returned 8.86%

AUSTRALIA

With no community transmitted Covid-19 cases, the Queensland government ended the snap three-day Brisbane lockdown, but maintained some mask wearing and social distancing measures. Whether tight elimination lockdowns or more moderate versions will be needed as Australians get vaccinated is still up for debate. The Australian government announced a preference for the Pfizer vaccine for Australians under 50 amid concerns of rare blood clots potentially linked to the AstraZeneca vaccine.

New Zealand announced plans to open a two-way, quarantine-free trans-Tasman travel bubble, with the option to continue, pause or suspend if a case is detected in Australia.

In economic news, February employment numbers surged by 88,700, accentuated by the fact that the entire increase came from full-time jobs. As widely expected, the RBA maintained its current accommodative monetary policy settings at its April meeting.

Australian shares extended their rally through March, gaining 2.4%, but could not keep pace with global markets, which have been buoyed by the vaccine story. In Australia, very low levels of community transmission and the rollout of the vaccine program have delivered a boost to optimism, particularly for sectors directly linked to the re-opening of the economy such as consumer discretionary and industrials. Meanwhile, companies that benefited from Covid-19 (e.g. Coles and JB Hi-Fi) will have higher comparable sales to meet in upcoming result periods.

Sydney Airport released traffic performance numbers for February showing total passenger traffic down 79.8% on the prior corresponding period. China confirmed it will place a tariff of 175.6% on Australian wine exports in bottles and containers holding less than two litres. Treasury Wine Estates made plans last year to divert most of its high-end wine from China to other Asian markets.

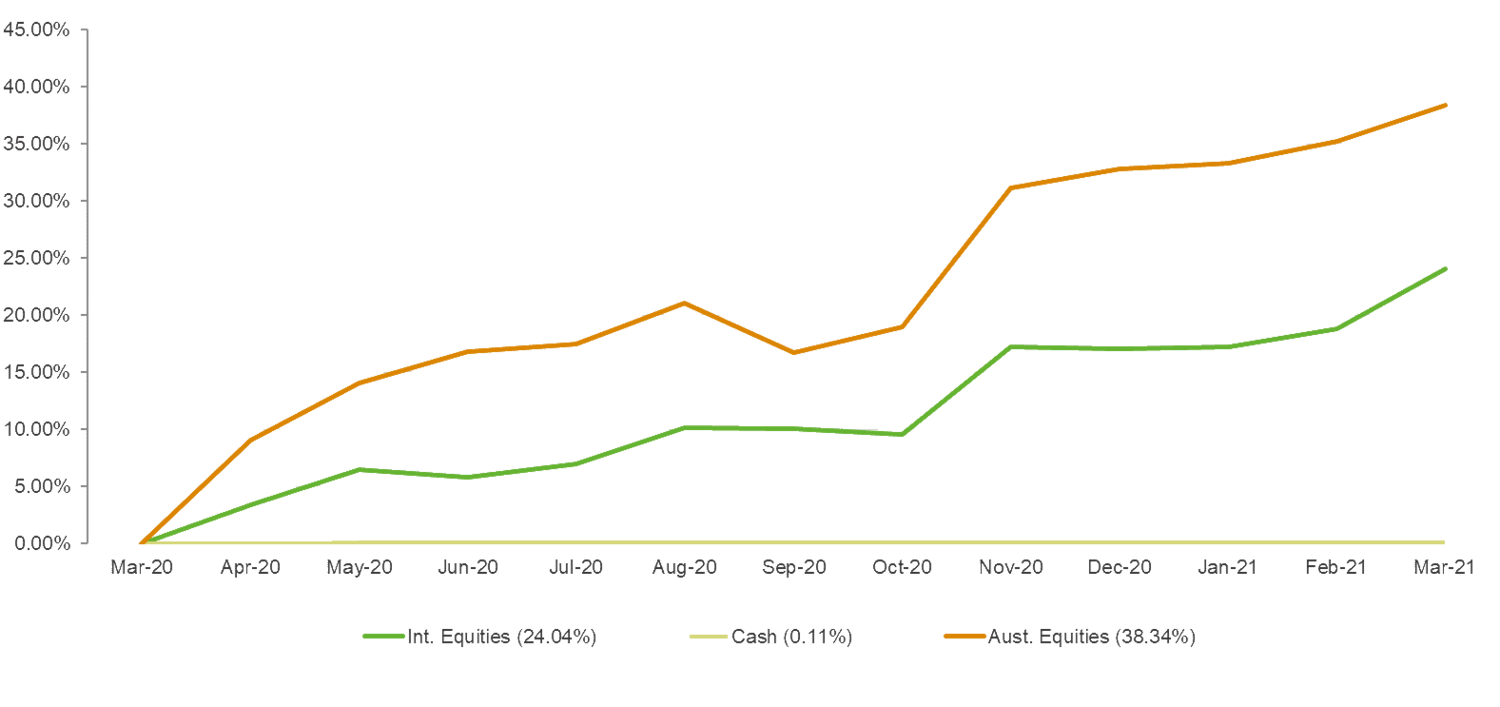

MARKET RETURNS (LAST 12 MONTHS)

Over the last 12 months Australian Equities have outperformed international equities largely due to an appreciating Australian Dollar which has hindered global returns.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd