Market Summary | June 2024

In June, Australian equities rose slightly but were down for the quarter, with bank sector gains offsetting losses in materials and energy. For the year, Australian equities increased, led by banks, consumer discretionary, and IT, while staples, materials, and energy declined. Australia's sluggish performance is due to low exposure to AI stocks and weak domestic growth. Higher inflation limits monetary policy support, with a rate hike expected by September. Global markets rose in June, driven by mega-cap AI stocks. The S&P500 rose, while the equal-weighted index dropped. US earnings grew in the June quarter, led by IT, communications, and healthcare. Despite easing inflation, service sector inflation remains high. Emerging markets outperformed in June, with notable contributions from China, Taiwan, and India.

Australia

Australian equities managed to rise 1 per cent in the month although they were down 1.1 per cent for the quarter, lagging global market once again. A 5 per cent gain in the bank sector during June helped offset losses in materials and energy stocks. For the year Australian equities rose 12.1 per cent with the bank sector rising 29 per cent, consumer discretionary 22.3 per cent and IT 28.2 per cent while consumer staples, materials and energy were in the red.

Australia’s relatively sluggish performance can largely be explained by its lower exposure to AI/productivity-related stocks and to the very subdued earnings backdrop, a function of weak domestic growth and a lack of exposure to growth sectors. While global EPS growth for the next 12 months is expected to be 11 per cent, Australian earnings are expected to grow by just 3 per cent.

An additional factor for the Australian equity market is higher than expected inflation which is limiting the scope for any monetary policy support for the economy going forward. Earlier in the year the market was factoring in three rate cuts over a 12-month period. In the aftermath of the 4.4 per cent trimmed mean CPI result in May, markets were pricing in a 60 per cent likelihood of a rate hike by September, followed by an easing in mid-2025.

The situation for the RBA is complicated by the fiscal stimulus flowing through in the form of $23 billion in tax cuts, equivalent to more than 1.2 per cent of income, as well as the energy bill support package. However, as the recent March quarter GDP data showed, the economy has slowed to a 1.1 per cent annual growth rate, with evidence of weak discretionary retail spending, declining business forward orders and declining hours pointing to cash rates eventually coming down.

United States & Developed Markets

Global equity markets managed to rise 2 per cent in June, caping off a very strong year with returns of 20.3 per cent in USD terms. While markets stumbled in April on higher inflation and the associated “higher for longer” narrative, improved US inflation readings in April and May allowed bond yields to decline from the high of 4.7 per cent in April, underpinning market confidence in a “soft-landing”.

However, the major theme over the quarter was the continued dominance of the mega cap, AI-related stocks. In the US these stocks led the market-cap weighted S&P500 index 4.2 per cent higher while the equal-weighted S&P500 index dropped 2.6 per cent. At the global level the IT sector, of which Microsoft, Apple and Nvidia account for more than half of the index weight, rose 11.4 per cent for the quarter and 38 per cent for the year. The Communications sector, of which Meta and Alphabet comprise almost 60 per cent, rose 8.1 per cent in the quarter and 37.2 per cent for the year. Sectors that registered negative returns in the quarter included financials, construction materials, insurance, industrials, consumer discretionary, materials and real estate suggesting that the economic and earnings backdrop is not as positive as the major market indices are suggesting.

According to FactSet data, US EPS grew by 8.8 per cent in the June quarter on a year ago and consensus is for a 13 per cent lift over the next 12 months. The Communications, Healthcare and IT sectors all grew earnings by more than 16 per cent while Consumer staples, Industrials and Materials experienced declines. At the global level consensus is for 10.8 per cent earnings growth.

As mentioned above, US core inflation rose 0.2 per cent in May following the 0.3 per cent rise in April, a welcome relief following successive 0.4 per cent outcomes in the March quarter. Despite the drop in the annual rate to 3.4 per cent, service sector inflation remains sticky, leaving inflation well above the Fed’s target. At its June meeting the US FOMC lifted its inflation projection this year and with growth expected to remain at or above trend, the dot-plot revealed a projection of only one rate cut in 2024 compared with the three expected at the time of the March meeting. Nevertheless, the better recent inflation news allowed bond yields to ease from the 4.7 per cent high in April to 4.34 per cent by the end of the quarter.

As noted above, companies exposed to AI continue to generate strong earnings growth contributing to the strong showing from the Growth and Quality factor in global markets, rising 6.4 per cent and 5.7 per cent, respectively in the quarter. Value lost ground during the quarter while defensive stocks were close to flat.

The US market was the main beneficiary of the AI theme, rising 3.9 per cent for the quarter while Europe and Japan were negative in the quarter. For the year the US was up 24.1 per cent, outpacing Japan (13.2 per cent) and Europe ex-UK (11.5 per cent).

In Europe, the first ECB rate cut in five years was widely expected and supported equities. However, more notable was the outcome of the European parliamentary election in which the Far Right and Leftist parties in France dominated the vote and prompted President Macron to announce a snap election, causing a sell-off in French markets. The results of the first round of voting largely confirmed the swing away from the more Centrist Macron party, adding to concerns over the outlook for France. The MSCI France index dropped 7.5 per cent in June while its 10 year bond yield rose to 3.3 per cent, widening the spread to other European bond yields.

On the economic data front the news on activity was slightly softer. The US labour market seems to be coming back into balance with fewer job openings but there are no signs of a significant drop off in demand. US ISM data for June was somewhat disappointing as was the flash PMI activity data for Europe. In summary, the global economy appears to have two speeds at present with manufacturing and trade lifting from low levels while consumers are beginning to feel the impact of higher rates and reduced savings.

Emerging Markets

Emerging markets outperformed global markets in the month and for only the third quarter since 2020. In AUD terms the MSCI Emerging markets index was up 2.6 per cent in the June quarter compared with 0.7 per cent for the developed markets index. For the year, however, emerging markets rose 12.2 per cent against more than 20 per cent for developed markets.

Despite a setback in June, the Chinese equity market contributed positively in the quarter, up 7.1 per cent, assisted by moves by the authorities to support the real estate sector. However, Taiwan and India were the main drivers, up 15.1 per cent and 10.2 per cent, respectively. In the case of Taiwan, TSMC, the leader in the manufacture of semiconductor chips and a major source of AI chips, was a main driver of returns. In India, the consensus is for earnings growth of more than 12 per cent although the market is expensive with valuations in line with previous peaks in 1994, 2000, 2007 and 2022.

Chinese economic data has been mixed with the property sector still undergoing a de-leveraging cycle while manufacturing and trade appear to be improving. In May the value of new home sales was down 34 per cent on a year earlier although early estimates suggest some recovery in June. Household consumption was better than expected in May, but it remains constrained by poor confidence and declining property prices.

India has been one of the standout performers globally with strong equity market returns and solid economic growth. However, the recent election provided a surprise with Prime Minister Narendra Modi’s party, the BJP, losing its parliamentary majority. While it is set to form a coalition government with the minor parties that make up the National Democratic Alliance, getting legislation passed will be more difficult. For some observers, who feared the country was leaning toward authoritarianism, the election result is welcomed.

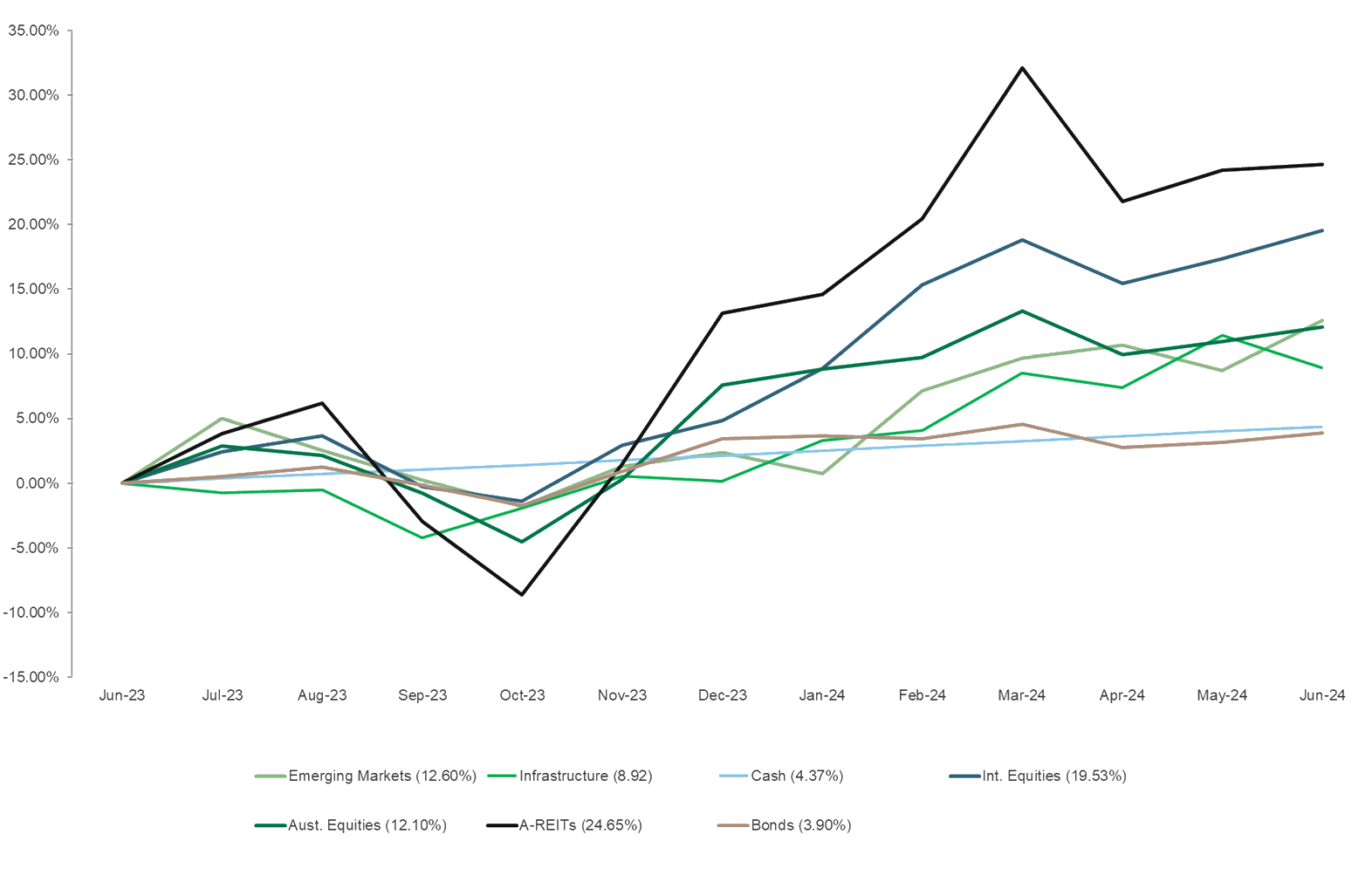

Asset Class Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners