Market Summary | January 2024

In Australia, stocks rebounded in December but lagged globally for the year, with cautious rate cut expectations and subdued earnings. The Reserve Bank kept rates steady amidst high inflation. Growth was stagnant, impacted by higher rates and taxes.

In the US and developed markets, equities ended the year strongly, driven by a shift in Federal Reserve policy and declining bond yields, overcoming various economic challenges.

Emerging markets saw modest gains in December but underperformed compared to developed markets for the quarter.

AUSTRALIA

Australian equities finished 2023 on a strong note and that momentum continued into January with a 1.2 per cent lift, taking the three month advance to 14 per cent. Banks continued to lead the charge, responding to a more favourable growth and interest rate backdrop, rising 5.3 per cent with insurance up 5.9 per cent and energy 5.2 per cent. However, weaker iron ore and concerns over China undermined the resources sector, down 4.8 per cent.

The RBA kept rates on hold at 4.35 per cent as expected. RBA Governor Michele Bullock noted that there was still a “job to be done” and that consideration of policy easing was possible once the RBA was confident in the progress to the 2-3 per cent inflation target. The December quarter core CPI, while showing a welcome decline from 5.2 per cent to 4.2 per cent, is still well above the RBA target.

The key to the outlook for the domestic economy is the tradeoff between strong jobs and wages growth and higher debt servicing costs. RBA data shows that scheduled repayments (principal and interest) amounted to 9.5 per cent of total household income in June 2023 and this has most likely risen to more than 10 per cent. This suggests that for those with mortgages (a third of households) debt servicing costs are around 30 per cent of income, close to “stress levels”. As such, cashflows will remain tight and we should expect soft spending over coming quarters before the prospect of lower rates begins to support confidence.

The Government announced that Stage 3 tax cutting measures to offset bracket creep would be adjusted in favour of lower income groups. Although these income groups tend to have a higher marginal propensity to spend, it is difficult to conclude that there will be a meaningful impact on spending and inflation.

Earnings revisions turned higher over the month although 12 month growth is expected at just 2 per cent. As noted earlier, the bank sector led the rally during the month and the sector has risen more than 17 per cent in three months. This has propelled the forward PE to 15.5 times, record highs and roughly in line with the broader market compared with a typical 15 per cent discount.

UNITED STATES & DEVELOPED MARKETS

Global markets managed a positive return in January after a strong end to 2023. Corporate earnings trumped a rise in bond yields to help push the US equity market to a record high around mid-month. Although the inflation news continued to improve, the US Fed pushed back on expectations of an imminent rate cut, while strong growth data also prompted a market re-assessment of the timing of an easing cycle, causing a modest rise in bond yields. Against the uncertain backdrop of Middle East tensions, the ongoing Ukraine-Russia war and a strong showing from President Trump in early presidential primaries, markets managed to remain positive.

The MSCI World ex Australia index rose a further 1.3 per cent in USD terms, taking the quarterly gain to 16.1 per cent. For the financial year to date the global index was up 8.8 per cent. In AUD terms, the index was 4.5 per cent higher for the month and 11.2 per cent for the three months.

Core inflation edged lower from 4.0% to 3.9% in the month. The more critical core PCE price index registered 2.9 per cent in December, with the last 6 months annualising at around 2 per cent, broadly in line with the Fed’s target. Nevertheless, the disruption to Red Sea navigation as a result of Middle East tensions and retaliatory Western air strikes has raised concerns that it could impact oil prices and cause delays in the supply of goods. The Red Sea accounts for 15 per cent of global sea trade, including vital supplies of grains, seaborn liquid natural gas and oil.

At the end of January, markets were confidently projecting the Fed funds rate would be cut by May-June with a total of four or five moves by end-2024 to 4.2 per cent. Ultimately, the market has the Fed funds rate at 3 per cent in 2026. Bond yields drifted higher, reaching 4.15 per cent mid-month before ending January at just under 4 per cent. The ECB and the Bank of England also held rates steady, and with inflation declining, the prospect is for rate cuts later in the year.

On the earnings front, overall index earnings were flat over the past 12 months although according to Factset, earnings growth over the year in communications services was 44 per cent, consumer discretionary 30 per cent, IT 20 per cent while financials declined 17 per cent, healthcare 17 per cent, materials 21 per cent and energy 26 per cent. Consensus expects earnings growth of 11 per cent in the US, 8 per cent for Japan and 5 per cent for Europe. Of course, these projections reflect a favourable soft-landing view.

In terms of growth, the US economy posted a larger than expected 3.3 per cent expansion in the December quarter, following the 4.2 per cent growth in the September quarter. In Europe, growth remained weak, although manufacturing PMI readings appear to be lifting off a low base, as is the case in the US.

For the quarter, the standout market was Japan, up 4.6 per cent to take the three-month gain to 18.5 per cent. Governance reforms, evidence that the economy has finally exited deflation together with easy policy settings and a low yen have underpinned a healthy earnings outlook. The UK and German markets lost ground in January while Hong Kong was the worst performer with a decline of 9.7 per cent. It is down 25.9 per cent for the financial year to date, similar to the decline in Chinese markets, reflecting poor growth, uncertain policy and continued capital outflows.

On a sector basis, communications and IT rose more than 4 per cent during January, while REITs and materials were amongst the worst performers. In terms of factors and styles, Momentum was up 5.6 per cent, Quality 2.9 per cent, and Value stocks up only 0.3 per cent.

EMERGING MARKETS

Emerging markets were down 4.6 per cent in USD terms in January or -1.6 per cent in AUD terms. For the three months, emerging markets are up 7 per cent, or 2.5 per cent in AUD terms, lagging global developed and domestic equities by a considerable margin.

As was the case for much of 2023, Chinese equities performed poorly to start the new year. A 10.6 per cent decline saw Chinese equities off 29 per cent over the past 12 months. Further deterioration in the property market continues to present a major headwind for the country given that some measures account for more than 20 per cent of the economy. New housing starts are down 50-60 per cent from the peaks, while transaction volumes have dropped by a third. News that property giant Evergrande was placed in liquidation was of no surprise to markets after having defaulted on some loans in late 2021 but it raised broader concerns around the policy response by the authorities. The bank reserve requirement ratio was cut 0.5 per cent to 10 per cent, injecting a potential US$140 billion into the economy while the authorities announced measures to support the equity market. However, they are loathe to go down the path of traditional fiscal stimulus given already high debt levels and the acknowledgement that it is a confident household sector that is required to stem the tide in a more sustainable way. On a more positive note, China’s exports seem to be recovering, particularly in areas such as autos and renewable energy.

EM Asia was down 5.2 per cent for the month while EM Latin America was 4.8 per cent lower. India registered a solid month, up 2.4 per cent to take the annual gain to 27.5 per cent. Only Egypt, Hungary and Poland have performed better over the year.

As noted in the past, emerging markets remain relatively cheap in absolute terms and relative to developed markets but have required a catalyst for outperformance. Some EM central banks are already easing policy (Brazil, Hungary, Poland) and inflation is declining. The missing ingredients are a turn in the global cycle and a weaker USD.

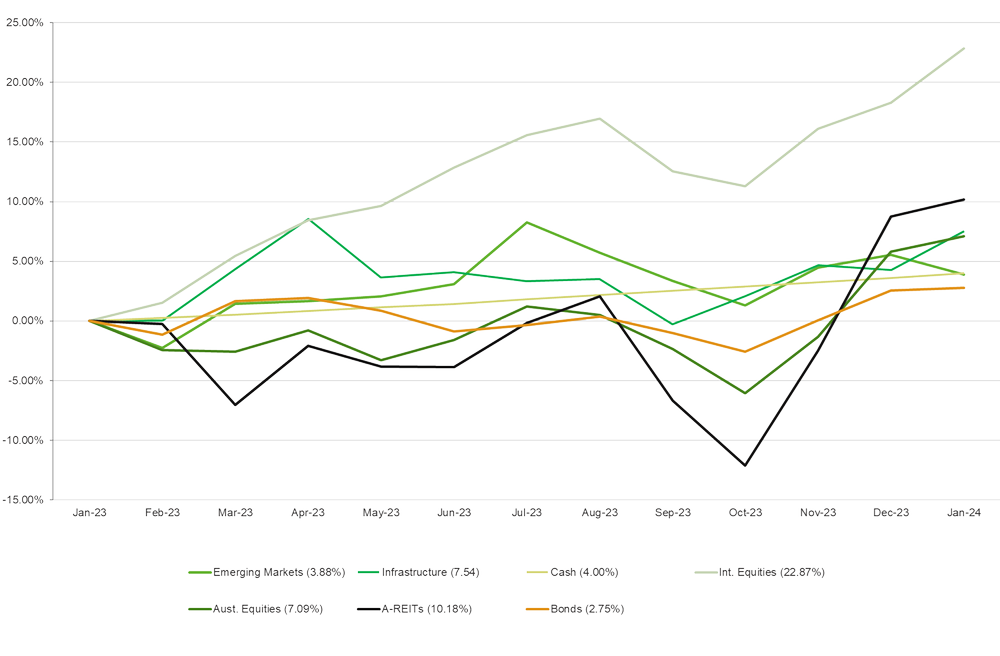

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners