Market Summary | December 2020

MARKET OVERVIEW

December saw an end to 2020 and as we are all aware it was a unique year for so many reasons. The pandemic kick-started a rapid decline in markets followed subsequently by an unparalleled policy response from governments & central banks globally which saw declines quickly reverse as more optimism was found by investors.

Nonetheless, as we enter 2021, the global economy continues to recover as investors weigh the impact of further lockdowns against the optimism of vaccine rollouts and additional fiscal support. December was a relatively tame month for Australian investors. Local markets continued to advance only outpaced by emerging markets. The US markets posted strong returns in USD, however returns for Australian investors were hindered by an appreciating Australian Dollar.

UNITED STATES

A projected victory in the two Georgia Senate runoff elections has handed Democrats control of Congress and the White House, raising the prospect of higher taxes and big spending on a third coronavirus package. President-elect Biden described the $900 billion stimulus passed in December as a “down payment”, and will call on congress to pass additional measures, including more direct payments and aid to cities and states.

The end of 2020 saw further recovery in yields, thanks in part to positive vaccine news, which has boosted equities and narrowed spreads between corporate and government yields. The US 10-year Treasury yield rose from 0.84% to 0.93% in December, before lifting above 1.0% in early January on the back of Democrat victories in the Georgia runoff. As widely expected, the US Federal Reserve left the target rate unchanged at 0.00–0.25% during its December meeting.

The US S&P 500 Index finished on a high, returning 3.7% in December and 18.4% over the year after rallying to record highs in the wake of the pandemic.

The S&P 500 Index (USD) returned 3.71%

The Dow Jones (USD) returned 3.27%

ASIA

The Chinese economy continues to power along. Industrial production was boosted by fiscal stimulus measures and improved 0.1% in November, to an annual rate of 7.0%. This was in line with expectations. Year-on-year retail sales rose 0.7% to 5.0% (versus 4.4% expected). The Caixin manufacturing PMI for December fell from 54.9 to 53.0, running below expectations of 54.8 but still posting its eighth consecutive month of expansion. The unemployment rate came in at 5.2%, below expectations of 5.5%.

Japan’s September quarter GDP was upgraded from an annualised real 21.4% to 22.9%. Private consumption, which accounts for more than half of Japan’s GDP, was revised from a drop of 4.7% to a sizeable rebound of 5.1%. According to a survey conducted by Japan’s Center for Economic Research, the world’s third largest economy is projected to grow 3.4% over the next fiscal year (running to March 2022). Japan’s government is hoping for a significant improvement in consumer spending once vaccines become widely available, boosted by fiscal incentives to get the retail economy moving.

The Hong Kong Hang Seng PR Index (HKD) returned 3.38%

The Nikkei 225 PR Index (JPY) returned 3.82%

The Shanghai Shenzhen 300 PR Index (RMB) returned 5.06%

EUROPE

The UK has been inoculating people with the Pfizer vaccine on an emergency basis and became the first country in the world to start deploying the AstraZeneca vaccine. The UK expects to have inoculated its most vulnerable groups by mid-February. The EU approved the Pfizer vaccine on 21 December and is set to approve the Moderna vaccine, however distribution efforts have been stymied by logistical issues.

The UK’s FTSE 100 PR Index (GBP) returned 3.10%

The German Dax (EUR) returned 3.22%

AUSTRALIA

NSW is on high alert following a Covid-19 outbreak in Sydney’s Northern Beaches, while a new, more infectious strain of the virus has been identified throughout the country, including four in Victoria and one case of a quarantine hotel worker in Brisbane. An agreement between the Australian government and Pfizer was finalised on Christmas Eve, with 10 million doses to be made available for a March rollout if the vaccine is approved by regulators. Australia also has vaccine agreements with Oxford-AstraZeneca and Novavax.

The RBA minutes for the December meeting revealed that the board believes it will take some time for output in Australia to reach its pre-pandemic level. Members acknowledged that “the recovery in the labour market was more advanced than expected” but noted there was still significant spare capacity that would remain a key policy challenge for some time.

The ASX 200 added a modest 1.2% in December to end the year up only 1.4% in what was a tumultuous year for all markets. The IT sector was the best performing in December, returning 9.5% over the month and 57.8% over the year. Unsurprisingly it was Afterpay that led the tech pack in 2020, tripling in value as consumers continued to flock online and ditch their credit cards. Afterpay announced that it exceeded $2 billion of monthly underlying sales in November—more than double the $1 billion of underlying sales in November 2019.

CSL announced in December that its Covid-19 vaccine, developed with the University of Queensland, will not proceed to phase 2 and 3 trials after it was discovered that antibodies produced by the vaccine can result in false HIV positive results. The AstraZeneca vaccines will be made in Australia by CSL after an initial batch arrives from overseas.

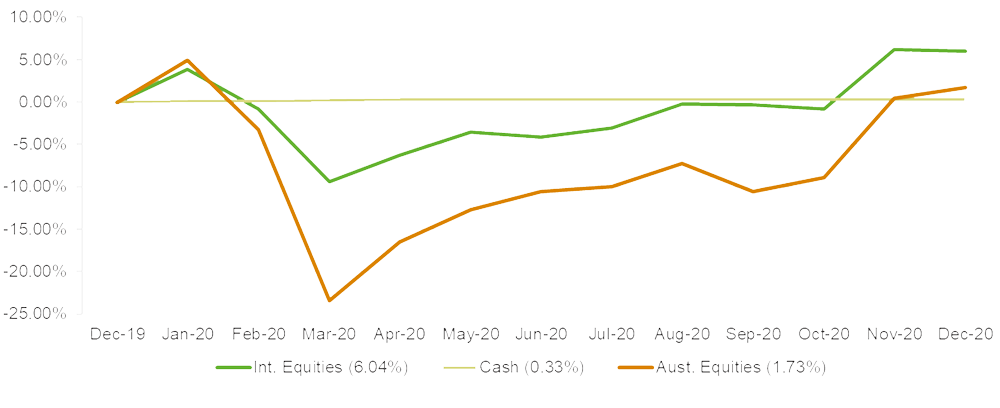

MARKET RETURNS (LAST 12 MONTHS)

International Equities have significantly outperformed domestic equities over the last 12 months largely driven by advancing technology companies which have been a big beneficiary of the COVID-19 environment.

Returns on cash and fixed income remain subdued.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd