Market Summary | August 2020

MARKET OVERVIEW

August was a strong month for equities globally as markets continued their rally throughout the month.

Globally, the economic recovery continues, following severe contractions in the first half of 2020. However, growth is uneven across countries and regions, with fears of a larger second wave dampening hopes of a sustained rebound.

UNITED STATES

The United States continued their economic recovery, the unemployment rate fell from 10.2% in July to 8.4% in August, well below the expected 9.8% and marking the fourth consecutive monthly decline since the 14.7% all-time high recorded in April.

The S&P 500 Index rose 7% in US dollar terms, ending August at record highs and fully recovered from its March low. The rebound in global equities has been led by large cap growth companies, which have benefited from the persistent low rate, low growth environment.

One of the heroes of remote work, Zoom Communications, released its June quarter results at the end of August, which included a 355% rise in revenue on the prior corresponding period, soundly beating expectations. Zoom’s share price rose 28.0% in August but fell 19.2% in the first week of September.

Turning to the upcoming US presidential election, the majority of polls put Democratic nominee Joe Biden in the lead nationally, as well as in states that Trump won in 2016 like Michigan and Wisconsin. However, the polls failed to gauge Trump’s support last time around, with some commentators claiming incumbency may favour Trump.

The S&P 500 Index (USD) returned 7.01%

The Dow Jones (USD) returned 7.57%

ASIA

With only sporadic outbreaks across the country, China is on track to be the first country to emerge from the COVID-19 crisis, and the only G20 country to post a positive GDP result in the June quarter.

Despite mismanaging the initial outbreak in Wuhan (the original epicentre of the virus), China has been successful in implementing targeted lockdowns and compulsory smartphone tracking to avoid escalating outbreaks.

Economic data shows inflation is lifting while trade figures came in strongly, with exports rising 9.5%

The Hong Kong Hang Seng PR Index (HKD) returned 2.37%

The Nikkei 225 PR Index (JPY) returned 6.59%

The Shanghai Shenzhen 300 PR Index (RMB) returned 2.58%

EUROPE

Key economic indicators suggest that Europe’s recovery is losing momentum through the September quarter. Fears of resurgent COVID-19 infection rates, most notably in Spain and Italy, is leading to greater caution from consumers, while the spectre of deflation is re-emerging for the first time since the euro crisis.

The UK’s FTSE 100 PR Index (GBP) returned 1.12%

The German Dax (EUR) returned 5.13%

AUSTRALIA

The Australian economy officially entered a recession for the first time since 1991 as the national accounts showed June quarter GDP fell 7.0% in the June quarter, following a 0.3% fall in the March quarter. The fall was weaker than the expected 6.0% fall.

Job Keeper programs will continue, but payments will be cut back, sparking fears of further economic pain. From 28 September, JobKeeper payments will fall from $1500 per fortnight to $1200, and $750 for those working less than 20 hours per week.

While the downturn has not been as severe as originally expected, the recovery will likely be uneven across the country and extended lockdowns in Victoria will take a major toll on the state’s economy. The federal government is becoming critical of Victoria’s approach, claiming contact tracing capabilities need to improve.

Australian shares rose 2.8% in August. IT and Consumer Discretionary were the top returning sectors. Once again earnings season was dominated by the dire effects of COVID-19 as companies cut dividends and increased cash holdings. Appen (-2.6%) reported 1H20 results in September, with revenue growth of 25% on the same quarter last year. Relevance was the largest contributor, with revenue growth of 24%, however Speech and Image revenue fell 20% following a breakout result in 1H19.

A2 Milk Company (-11.8%) reported revenue and EBITDA growth of 33% on the prior corresponding period. Infant formula was the main driver of the result, supported by a 65.1% increase in Chinese sales.

CSL (+5.9%) announced in September it had signed Heads of Agreements with the Australian Government and AstraZeneca to supply two potential COVID-19 vaccines within Australia following successful clinical trials, however AstraZeneca has halted the trial to investigate an adverse reaction from a study participant in the UK.

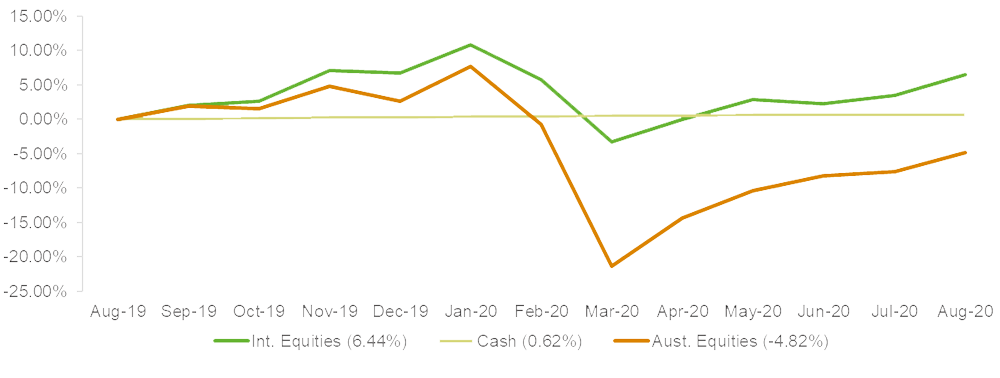

MARKET RETURNS (LAST 12 MONTHS)

International Equities have significantly outperformed domestic equities over the last 12 months largely driven by advancing technology companies which have been a big beneficiary of the COVID-19 environment.

Returns on cash and fixed income remain subdued.

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source: Lonsec Research Pty Ltd