Market Summary | April 2024

In April, Australian equities fell, with losses across most sectors except materials, while REITs dropped significantly due to rising bond yields. The weak performance was driven by higher-than-expected inflation data domestically and in the US, leading to a less supportive interest rate outlook and pushing bond yields higher. Meanwhile, global developed markets, led by the US, saw significant declines as higher inflation and bond yields undermined equity valuations, though emerging markets, particularly China, showed resilience with a modest gain in AUD terms.

Australia

Australian equities declined 2.9 per cent in the month after a gain of 5.3 per cent in the March quarter. The loses were broad based with only the materials sector managing to positively contribute. REITs, after a very strong quarter (16.8 per cent) succumbed to rising bond yields to be down 7.6 per cent while consumer discretionary, banks and energy were all down more than 3.5 per cent.

The weak performance can be attributed to the higher-than-expected inflation data, both domestically and in the US, which led to a less supportive interest rate outlook. Australia's inflation declined in the March quarter but was higher than expected, with the core measure rising 1 per cent to leave the annual rate at 4 per cent. Markets started to price in the possibility that the next move for the RBA would be a hike, a long way from the earlier expectations of possibly two cuts over the next 12 months. Bond yields rose towards 4.5 per cent, undermining valuations.

The higher-than-expected inflation data comes at a time when the consumer still seems to be hamstrung by concerns over rates and financial conditions. Retail spending fell a further 0.6 per cent in March and has underwhelmed expectations for the past three months. Consumer were beginning to feel a little more positive in the belief that the next move in mortgage rates was down and that the upcoming budget would lower taxes and support confidence. Those hopes, at least on interest rates, appear to have been dashed for now.

As noted above, the miners staged a recovery in the month, assisted by the almost 9 per cent gain in iron ore and the 14 per cent rise in copper prices. The expectations of further improvement in the Chinese economy also helped.

United States & Developed Markets

In the face of higher than expected inflation for the third month in succession a further repricing of the outlook for Fed policy and higher bond yields saw equity markets suffer their largest loss since October 2023. The MSCI World ex-Australia index declined by 3.7 per cent in April after gaining 9.1 per cent in the March quarter. Nevertheless, as far as corrections go, this is still a very modest outcome.

US core inflation rose another 0.4 per cent for the month, leaving the annual rate at 3.8 per cent, where it has stalled after the disinflation of 2023. As a result, markets have removed all but one or two of the six rate cuts that were pencilled in for 2024 as recently as January. US 10 year yields pushed up towards 4.7 per cent, finally undermining equity market valuations, after largely being ignored in the early part of the year due to rosy earnings and growth expectations. In short, the more optimistic soft landing and disinflation scenario has, to some extent, been supplanted by the more volatile and uncertain "no-landing" or "higher for longer" scenario.

In AUD terms the MSCI World ex Australia index was down 2.9 per cent after a 14 per cent advance in the March quarter. The US market was down 4.2 per cent as large tech companies suffered large declines. With its more defensive market structure, the UK market managed to rise 1.9 per cent in USD terms while Europe ex-UK was down 3 per cent and Japan, -4.9 per cent. Over the past 12 months the US is up 22.8 per cent, Japan 19.2 per cent and Europe 7.6 per cent.

The earnings picture remains solid, assisted by robust nominal GDP growth. With 80 per cent of S&P 500 companies reporting actual results, Factset reports that 77 per cent of S&P 500 companies have reported a positive EPS surprise while earnings growth is 5.0 per cent, the strongest earnings growth rate reported since Q2 2022.

On the economic data front the news on activity was mixed. After surging in March, the US ISM indices eased back below 50 in April. The recent payrolls data was below expectations for the first month in five while other labour market indicators such as quit rates and openings continue to soften, and consumer confidence has turned down. After a solid Q1 for domestic sourced demand in the US, the current quarter would appear to be softening, while inflation pressures remain elevated. Some commentators have raised the possibility of stagflation, something Fed chairman Jay Powell was quick to rule out, stating at the press conference following the recent FOMC meeting "I don't see the stag, or the 'flation,".

On a sector basis, only utilities and energy managed to post positive returns, supported by the rise in oil prices. The biggest losers were IT, down 5.7 per cent, REITs -7.9 per cent, construction materials -7.6 per cent and retailers, -5.7 per cent. In terms of factors and styles, defensive stocks outperformed, down just 2.1 per cent while Growth and Quality stocks both underperformed Value stocks, which were down 3.4 per cent.

Emerging Markets

Emerging markets outperformed global developed markets as Chinese equities rose. In AUD terms the MSCI Emerging markets index was up 0.9 per cent in the month, with EM Asia up 0.9 per cent, including a strong performance from China, up 6.6 per cent, and India 2.3 per cent. Korea and Taiwan were down while Latin American stocks were 3.5 per cent lower on the back of a sell-off for Brazil.

Chinese equities are now up 16.6 per cent in the past 3 months after a dramatic decline in January. Economic data seems to show a stabilisation of the economy with PMI readings above 50 and retail spending at moderate levels. Nevertheless, consumer confidence is subdued, and the authorities have not provided the big offset to the ailing property sector, undermining broader growth. Meanwhile, the economy continues to flirt with deflation. The higher for longer US interest rate scenario is not positive for Emerging markets. A case in point, Bank Indonesia raised rates unexpectedly in April and warned of deteriorating global risks, saying the rate increase was a pre-emptive move to ensure inflation remained within target. This followed attempts at intervening across several markets to support the currency. Japan and Vietnam have also intervened to support their currencies, while the central banks of Malaysia and South Korea have noted that they are willing and prepared for action.

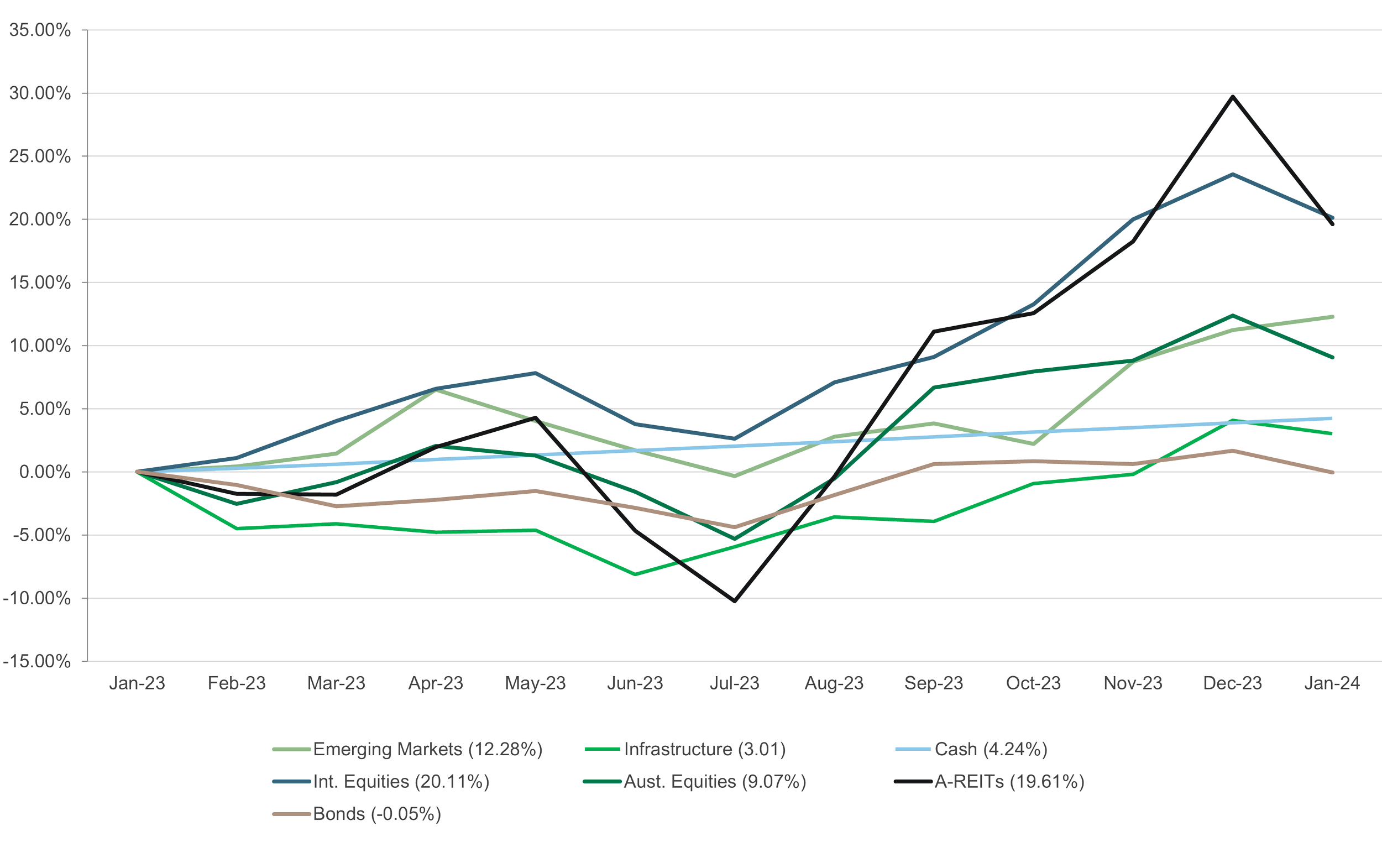

Asset Class Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners