Market Summary | September 2023

In Australia, the equity market faced losses in the month and quarter, with a subdued earnings outlook for the next 12 months, while the RBA refrained from raising interest rates. In the US and developed markets, global equity markets declined in September, mainly due to the surge in bond yields, shifting focus from economic resilience to higher Fed fund rate projections. In emerging markets, a decline occurred in September, driven by poor performance in China's equity market, where policy uncertainty and ailing property sectors contributed to a significant discount compared to global developed markets.

AUSTRALIA

The Australian equity market lost 2.8 per cent in the month, and -0.8 per cent for the quarter, slightly ahead of US markets. For the year to date, the domestic market is up just 3.7 per cent, well below global markets. As was the case globally, the theme was higher bond yields and a contraction in PE multiples. However, unlike the US market, the earnings outlook for Australia is very subdued with consensus EPS growth for the next 12 months around -2 per cent.

For the quarter the bank sector managed to rise 4.4 per cent while energy was up more than 11 per cent and insurance 1 per cent. However, REITs, materials and IT were all softer.

As was the case in the US, markets lifted the trajectory for cash rates over the course of September although much less so than in the US. Recognising the fact that the transmission of higher cash rates through to mortgage rates is much faster and more direct it should not surprise that Australian cash rates have not had to rise as much as US rates to have an impact. This has clearly been a factor behind AUD weakness.

The RBA chose not to lift rates at the September meeting, Philip Lowe’s last meeting as governor. In her first meeting as RBA governor in early October, Michele Bullock also chose to keep the cash rate steady, a nod to the fact that the bank was giving itself more time to assess the impact of the 4 percentage points of interest rate hikes delivered since May 2022. Market pricing implies a high probability of one more move to 4.35 per cent with no easing expected until late 2024 or early 2025.

On the inflation front, the August CPI data showed inflation rising 0.6 per cent for the month and 5.2 per cent for the year, up from 4.9 per cent in July. Core inflation eased to 5.5 per cent.

UNITED STATES & DEVELOPED MARKETS

Global equity markets declined 4.3% per cent in September, taking the September quarter loss to 3.5 per cent following a strong first half. The surge in bond yields was the major driver, in particular the rise in US real yields from 1.59 per cent back in June to 2.27 per cent by quarter-end.

Markets have been blindsided by the better than expected US economy which has so far coped with the 500 basis point rate hiking cycle. During the first half of the year, the focus was the positive impact of resilient growth on earnings and for a time, equity markets largely ignored the rise in bond yields. However, with a soft-landing largely priced in, markets have since turned their attention to the associated lift in Fed funds projections, incorporating the “higher for longer” interest rate narrative into valuations.

Although the rapid decline in inflation to date has led to calls that the tightening cycle is close to over, the resilient economy has prompted markets and the Fed to remove some of the easing that was being projected for 2024 and 2025. At the June FOMC meeting the dot plots implied the Fed funds rate would be at 4.6 per cent at end-2024 although by the September FOMC meeting, a lift in the growth outlook prompted a lift in the end-2024 Fed funds estimate to 5.1 per cent. Meanwhile, market pricing over the same period has moved from 4.16 per cent at end-2024 to 4.72 per cent. Although the Fed has maintained that the so-called neutral rate is probably still around 2.5 per cent, the fact that growth has not yet slowed despite current rate settings and that they are projecting a higher Fed funds rate out to 2025 suggests that the neutral rate may be higher.

At close to 4 per cent, the US equity risk premium, based on consensus earnings, is close to the lowest level since 2007. And while the rise in AI-related mega-tech stocks was largely responsible for the rise in markets in the first half, the recent surge in real yields has prompted a contraction in PE multiples.

On the inflation front, August saw a rise in headline CPI due to higher energy costs. The core measures, particularly over the past five months, suggest core inflation is back below 3 per cent. Inflation also appears to be falling faster than anticipated in Europe while in the UK inflation is now around 6 per cent while wages growth is an extraordinary 8 per cent. Unlike the US, however, activity indicators are much more muted, particularly in Germany. In Japan, activity has so far held up reasonably well and although inflation seems to be sustaining above the 3 per cent level, the Bank of Japan remains tied to its accommodative policy stance, unlike the rest of the developed world.

Across regions, the UK was the best performer in USD terms in the month, down just 0.8 per cent while Japan was down 2.1 per cent. Europe ex-UK was off 4.9 per cent, the US down 4.7 per cent. Only Norway produced positive performance, bolstered by rising oil prices. For the year to date, Italy, Ireland, and Spain have led the way.

EMERGING MARKETS

Emerging markets declined 2.6 per cent in USD terms and 2.3 per cent in AUD terms in September. For the quarter, emerging markets were flat in AUD terms, slightly outperforming developed market equities. For the year to date, emerging markets continue to lag other markets, largely due to the poor performance from China.

The ailing property sector, a subdued emergence from Covid-lockdowns, a reluctance to employ significant stimulus and policy uncertainty have all combined to undermine Chinese equity market performance. The Chinese equity market now trades on a PE multiple below 10 times, placing it at a 40 per cent discount to global developed markets, close to the lowest levels since the late 1990’s. The recent data has been weak and the policy response to date has been muted. However, credit growth lifted in August and the manufacturing PMI rose above the key 50 level for the first time since April.

Korea and Taiwan were both down more than 6 per cent in the quarter while India continued to provide some diversification, rising 2.7 per cent in the quarter. The MSCI EM Asia index dropped 2.9 per cent for the quarter while Latin America dropped 4.8 per cent.

In terms of the outlook for EM it all rests on US rates and the USD. If US rates have peaked and if markets begin to factor in modest easing, then the cyclical and USD headwinds for EM may begin to abate.

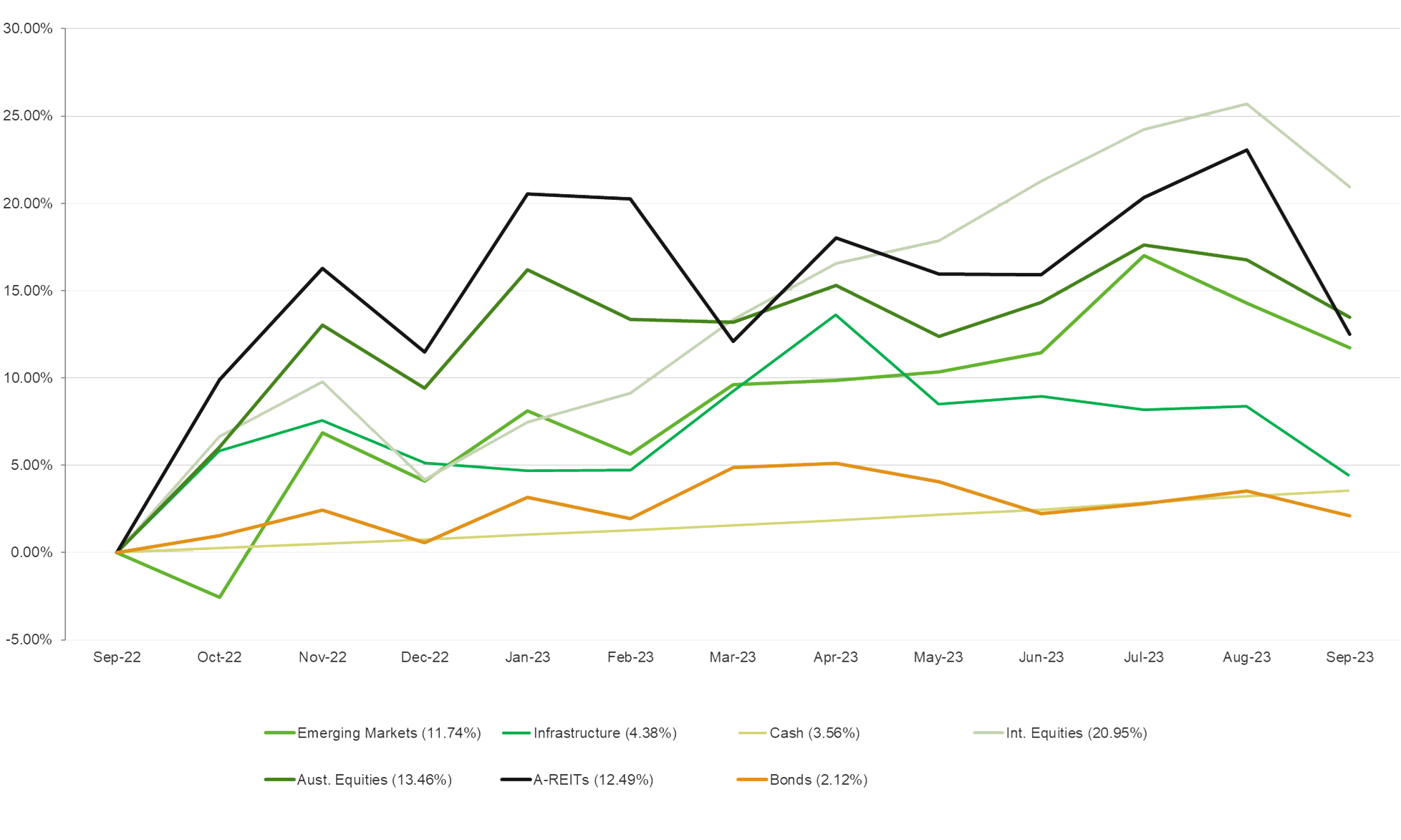

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners