Market Summary | October 2023

The Australian equity market experienced a decline in October due to higher bond yields and a contraction in PE multiples, alongside a subdued earnings outlook projecting negative EPS growth over the next year. In international markets, global equity also saw a decrease in the same month, with bond yields on the rise and geopolitical tensions contributing to the uncertainty. Emerging markets declined as well, with Chinese equities facing continued challenges despite attempts by Chinese authorities to support the market and boost infrastructure spending.

Australia

The Australian equity market lost 3.8 per cent in the month and is now down marginally for the year to date. As was the case globally, the theme was higher bond yields and a contraction in PE multiples. However, unlike the US market, the earnings outlook for Australia is very subdued with consensus EPS growth for the next 12 months around -1 per cent.

Healthcare stocks continue to be sold down, the sector off a further 7.1 per cent to be down 14.7 per cent in 2023. The financials sector was 3.7 per cent lower while REITs were down 5.7 per cent, largely on higher real bond yields. For the year REITs are down 5 per cent while financials are slightly negative.

In terms of data, the NAB survey shows that business conditions, while softer, are still well above average levels. The labour market remains tight, despite some softening in jobs growth. The focus for markets was on inflation where a higher than expected September quarter result prompted markets to price in another rate hike as soon as November. The September quarter CPI showed inflation of 1.2 per cent for both headline and core inflation, slightly above expectations. With the annual core inflation rate at 5.4 per cent (down from 6 per cent), it will be very difficult to reach the RBA’s earlier forecast of 3.9 per cent by end-2023 (last three quarters 1.2%, 1% and 1.2% per cent.

The RBA chose not to lift rates at the September and October meetings as it gave itself more time to assess the impact of the four percentage points of interest rate hikes delivered since May 2022. Market pricing implied a high probability of one more move to 4.35 per cent (subsequently delivered) with the possibility of another by June 2024.

United States & Developed Markets

Global equity markets dropped a further 2.9% per cent in October taking the year to date return to 8.2 per cent. Bond yields continued to climb, undermining valuations while the Israel-Hamas conflict added to uncertainty and risk aversion.

Bond yields moved up to 5 per cent in the US, a rise of more than 100 basis points since June. While markets seem content that the peak Fed funds rate is in they have unwound expectations of easing in 2024. While bond yields have presented headwinds to equity market valuations, the earnings picture has been better than expected. Based on FactSet data, US earnings look set to grow in Q3 by around 3-4 per cent, the first rise since Q3 2022. Earnings have been strongest in communication services, consumer discretionary and financials while energy, materials and healthcare lagged. Consensus expects earnings growth of more than 10 per cent for the next year.

Of course, the tragic developments in the Israel-Hamas conflict became the focus in early October. The initial market response, higher oil prices, a safe-haven bid for bonds and a stronger USD, was as expected but given the situation has not escalated to a broader regional conflict, it has not, as yet, had a sustained impact on markets. The situation, however, is fluid and unpredictable.

In other major developments, the Bank of Japan (BoJ) moved a step closer toward ending Yield Curve Control (YCC) and exiting negative interest rate policies. In late October, the BoJ raised the reference rate, or target bond yield to zero +/- 100 basis points, but importantly, with no commitment to defend this limit with bond purchases.

Although the rapid decline in inflation to date has led to calls that the tightening cycle is close to over, the resilient economy continues to undermine expectations for easing in 2024 and 2025. Markets expect the Fed funds rate to be 4.65 per cent by end-2024, more than 50 basis points higher than what was anticipated in June. The 4.9 per cent September quarter GDP result was a key reason for the change in projections.

On the inflation front, September saw another rise in headline CPI, largely due to higher energy costs. The core measures, particularly over the past six months, suggest core inflation is back below 3 per cent. Inflation also appears to be falling faster than anticipated in Europe (2.9 per cent in October) while in the UK inflation is now around 6.6 per cent.

Across regions, the US was the best performing major region, down 2.3 per cent while Japan was down 4.5 per cent. Europe ex-UK was off 3.6 per cent. The Hamas attacks and subsequent response from Israel prompted a 12.6 per cent decline in the MSCI Israel index. For the year to date, Italy and Denmark have been the major winners while Hong Kong, New Zealand and Israel have lagged considerably.

Emerging Markets

Emerging markets declined 3.9 per cent in USD terms in October. For the year to date, emerging markets are down 2.1 per cent, lagging global developed equities by around 10 per cent.

The Chinese equity market continued to struggle under the weight of a weak property market and a muted policy response. The MSCI China index fell a further 4.3 per cent for the month, taking the loss this year to -11.2 per cent. During the month the Chinese authorities announced plans to support the equity market and approved a 1 trillion yuan sovereign bond issue (around 0.8 per cent of GDP) partly to fund infrastructure spending in 2024. In terms of economic data, China’s GDP expanded by a better than expected 4.9 per cent in the September quarter while retail sales also exceeded expectations. PMI readings for October, however, were back below the critical 50 level.

Korean equities were down 7 per cent and Taiwan 1.7 per cent, leaving the MSCI Asia index off 4 per cent. MSCI Latin America was down 4.8 per cent with Mexico down more than 6 per cent. MSCI Europe was held up by strong performance from Poland.

Emerging markets appear to be cheap relative to developed markets but still require a catalyst for outperformance, perhaps in the way of a more dovish Fed and a weaker USD, or in terms of additional Chinese stimulus.

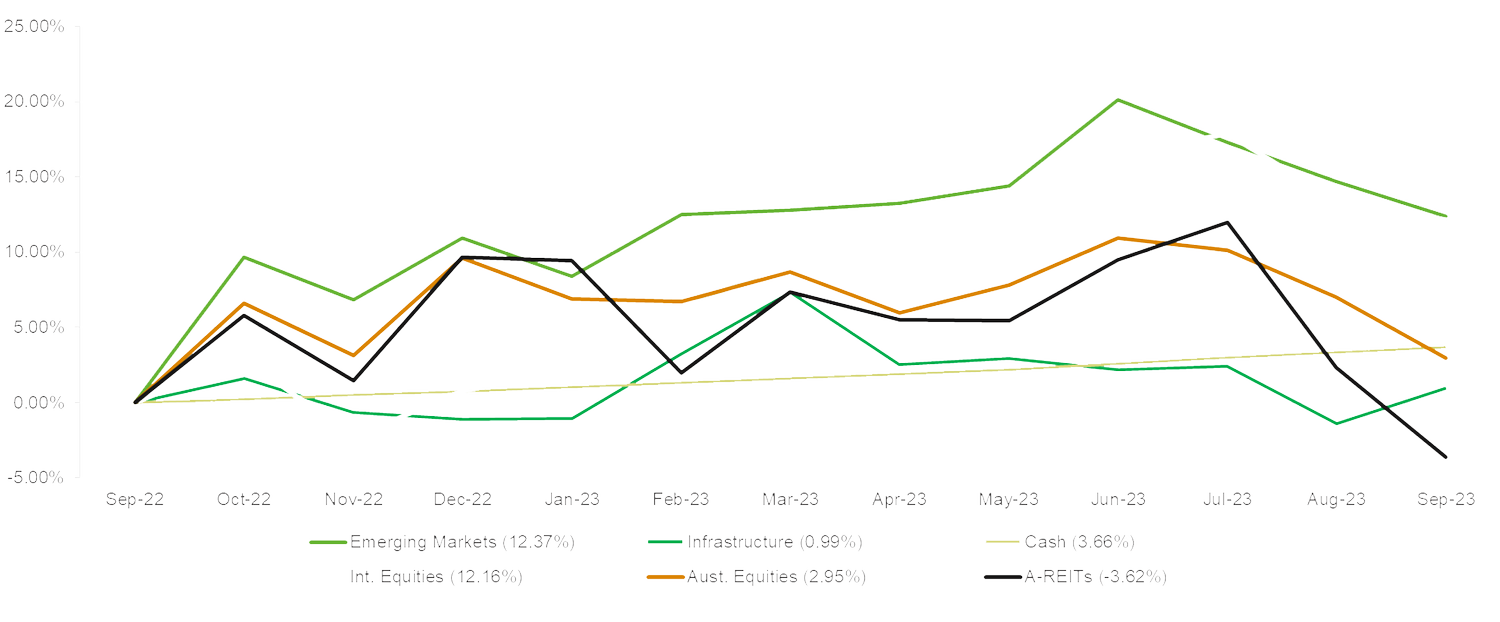

Asset Class Returns (last 12 months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners