Market Summary | December 2022

Market Overview

Global equity markets gave up ground in December as the two-month rally in bond yields reversed course following a relatively hawkish December FOMC meeting and a surprise change to Japanese monetary policy. The sell-off in the month was not enough to offset what was a very strong December quarter performance from global equities, built on the belief that inflation had peaked and that the end of the monetary policy tightening cycle was in sight.

United States & Developed Markets

The MSCI World ex-Australia index lost 4.3 per cent in USD terms, cutting the December quarter gain to 9.6 per cent. For the year, global markets dropped 18.4 per cent. In AUD terms, the global index was down 5.5 per cent in the month, rose 4 per cent for the quarter and declined 12.5 per cent for the year.

At the December FOMC meeting, the Fed lifted the Fed funds rate 50 basis points to 4.25-4.5 per cent, as expected, while also lifting its terminal rate expectation to 5.1 per cent (from 4.6 per cent back in September) and holding that level in 2023, with a projection of 4.1 per cent for end-2024. The FOMC also lifted its core PCE price inflation estimate to 3.5 per cent for end-2023 from 3.1 per cent. The Fed futures market disagrees, implying a peak Fed funds rate of just under 5 per cent with one to two cuts in the second half of 2023 and a further 100 basis points easing to 3.6 per cent by end-2024.

Earnings continue to be revised lower. In the US, 12-month forward EPS estimates have dropped from US$237 in June 2022 to US$226 as of late December with growth of just 4 per cent now expected for the year ahead. Slower sales growth and margin pressure is expected to result in further EPS downgrades. EPS growth in Europe is expected to be flat.

At the sector level, consumer discretionary, IT and communications fared the worst in December, down 8.6 per cent, 8 per cent and 6.4 per cent, respectively, sectors in which the US market is more heavily weighted. For the December quarter, significant gains were achieved in insurance (20 per cent), industrials (17.9 per cent) and financials (15.9 per cent). Consumer discretionary and communications were the worst performers.

As noted above, the Bank of Japan (BOJ) surprised markets, adjusting its yield curve control (YCC) policy, whereby it limits the divergence in bond yields from the prevailing cash rate. The strategy, targeted towards getting inflation up towards 2 per cent, has been in place since 2016 and has helped supress bond yields even during the large global bond sell-off in 2022. Over the course of 2022 rising energy costs, a lift in wages growth and a rapidly declining yen associated with the suppression of Japanese rates, have combined to push core inflation to 3.7 per cent by November, the highest level since 1981. Furthermore, the YCC policy had become increasingly difficult to maintain in the face of turbulent global bond markets, leading to a significant depreciation in the yen. On December 20, the BOJ widened the range of bond yields to cash to 50 basis points. This sparked a sell-off in global bond markets and although the BOJ may be just fine-tuning its policy, it reminded investors of the potential risk to global bond yields if the BOJ was to significantly withdraw its accommodative policy and bond purchase program.

The USD declined a further 2.1 per cent on a broad basis in December, taking the decline beyond 4 per cent after having rallied almost 11 per cent between February and October.

EMERGING MARKETS

After surging 14.8 per cent in November, the largest monthly gain since May 2009, emerging markets declined 1.4 per cent in USD terms in December. For the quarter emerging markets gained 9.7 per cent, reducing the 2022 loss to 20.1 per cent. In AUD terms emerging markets were up 4 per cent in the quarter and down 14.3 per cent in 2022.

The improved performance in the quarter was largely due to two key drivers, a lower USD reflecting an unwinding of Fed rate hike expectations and the dramatic removal of China’s zero-Covid policy. In November, China announced a series of measures to relax its Covid restrictions including a shortening of the quarantine period from 10 days to eight days and making secondary contacts no longer in scope for quarantine. In early December, following ongoing street protests and a build-up of discontent within the vast Communist party hierarchy as the economy floundered, youth unemployment surged and education was disrupted, President Xi Jinping made an abrupt about-face in his “war” against the virus, abandoning the zero-Covid policy.

Australia

The Australian equity market slightly outperformed global markets in December, down 3.2 per cent. For the quarter, the ASX200 rose 9.4 per cent, outperforming global equities in AUD and hedged terms. For the year, the Australian market was down just 1.1 per cent, clearly outperforming global equities in AUD terms (-12.5 per cent) and hedged terms (down 18.1 per cent).

The stronger relative performance of Australia in 2022 reflects a less aggressive policy setting, a relatively solid economic and earnings growth backdrop, and a favourable equity market structure. Its heavy weighting to banks and materials, both of which have benefited from higher commodity prices and rising bond yields, and low weighting to IT contributed to the outperformance. In the MSCI Australia index, financials have a 33.6 per cent weighting, materials 23.4 per cent and IT 2 per cent compared with the MSCI World index with a 14 per cent weighting to financials, 4 per cent to materials and 21 per cent to IT.

Earnings are being revised down for 2023 with growth now expected to be flat. Bank sector EPS is projected to expand 12 per cent while the materials sector EPS growth is projected to be -8 per cent. Given the rising rate environment and the potential impact on the housing sector and the uncertainty around global growth, there is a high degree of uncertainty in these earnings forecasts.

On the economic front, the employment data surprised to the upside with 32,600 jobs added in November for annual growth of 3.8 per cent. The unemployment rate remained at a record low 3.4 per cent. Underemployment continues to drop while wages growth continues to lift. Although inflation eased in October, falling to 6.9 per cent from 7.3 per cent, broader inflationary pressures remain. In other news, house prices continue to drop, down eight months in a succession, or 8.2 per cent off the peak. Dwelling approvals and finance also trended lower. The NAB business conditions index remains at solid levels although business and consumer confidence remain soft.

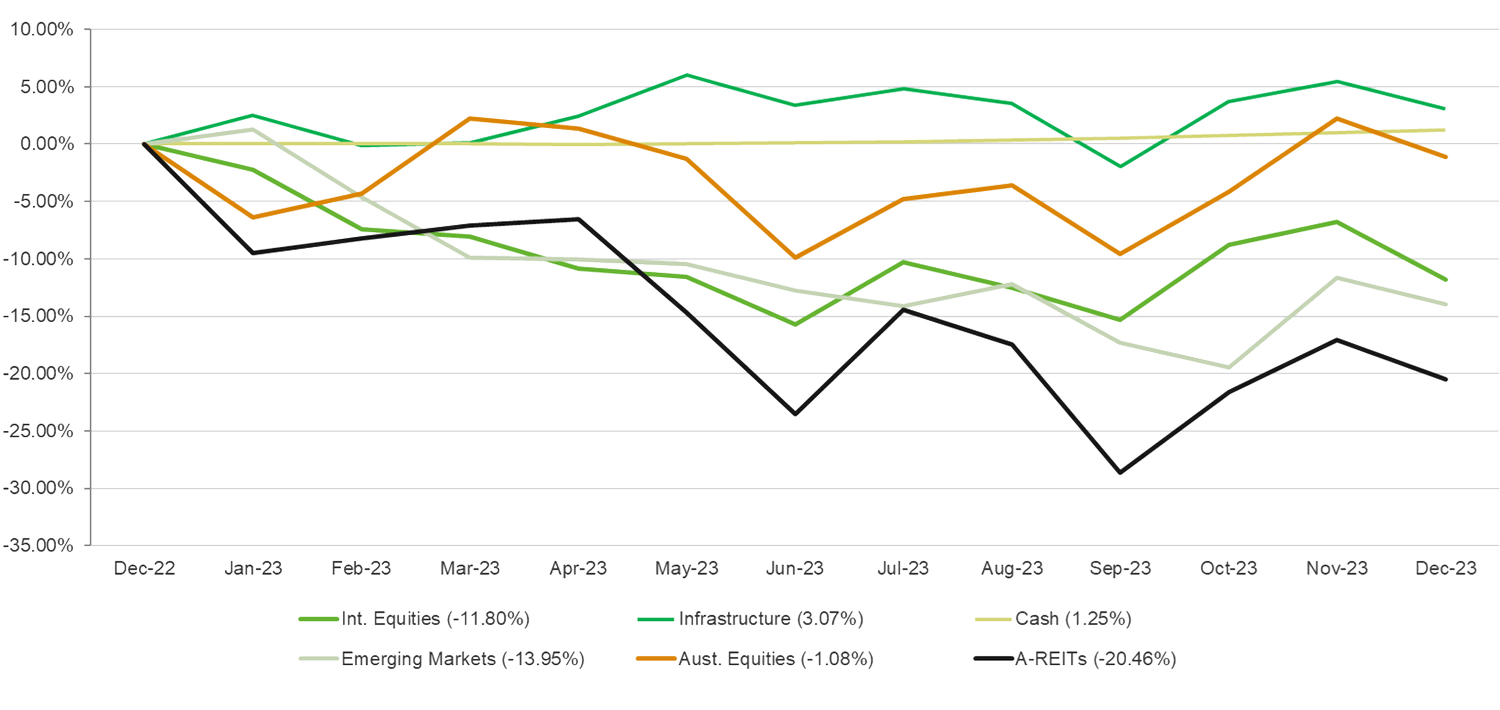

Asset Class Returns (last 12 Months)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners