Early Stage Tax Concessions

[VIDEO] Ryan Synnot provides an introduction to Early Stage Tax Concessions, an incentive introduced in 2016 to promote investment in innovative, high-growth potential startups.

History

Purpose: “promote investment in Australian start-ups and early-stage innovating companies”

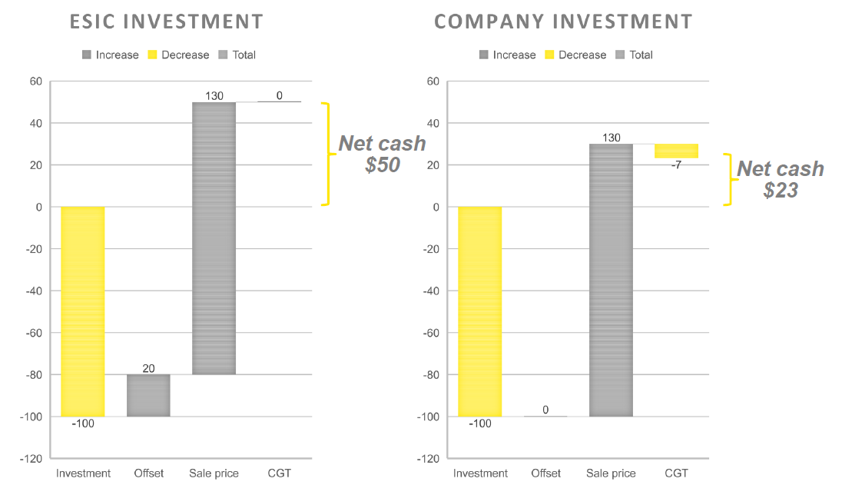

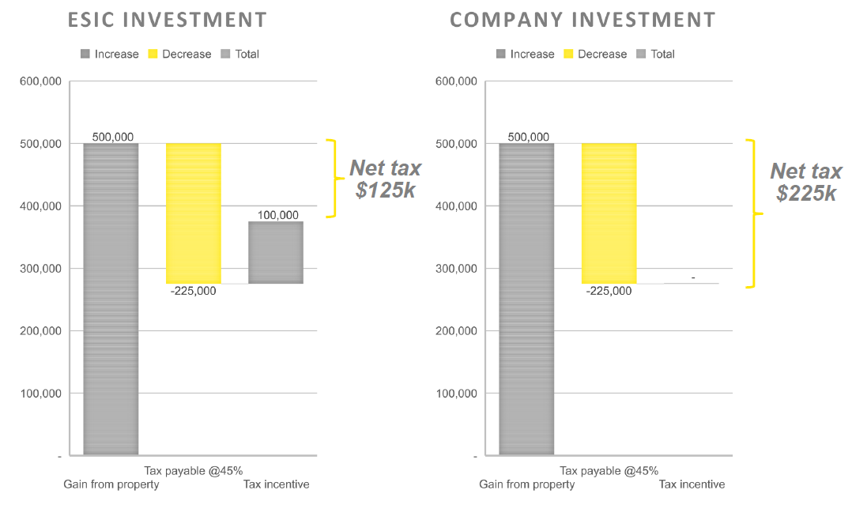

Summary: “The tax incentives include a 20 per cent carry-forward non-refundable offset on investments capped at $200,000 per year, and a 10-year exemption on capital gains tax for investments held in the form of shares in the innovation company for at least 12 months, provided that the shares held do not constitute more than a 30 per cent interest in the innovation company.”

Timing: “The tax offset will be available upon investment, not when the funds are used by the innovation company, and any sale of the shares will be taxed on a 'deemed capital account' basis.”

Eligibility

Companies must satisfy two limbs in order to be a qualifying investment:

An Early-Stage Limb

An Innovation Limb

Early-Stage Limb

The company must satisfy at least one of the following:

Incorporated in Australia within the last 3 income years

Incorporated in Australia within the last 6 income years, and across the last 3 of those years incurred total expenses of $1m or less

Registered on the ABR (Australian Business Register) within the last 3 income years

Additionally, the company must also satisfy all of the following:

Incurred total expenses of $1m or less in the income year before the current year

Had a total assessable income of $200,000 or less in the income year before the current year

Does not have shares listed on a stock exchange

Innovation Limb

One of the following must be satisfied:

100 Point Innovation Test

75 – 50% of total expenses from the previous income year were eligible R&D expenditure, or 50 points if only 15-50% of expenses

75 – Received an Accelerating Commercialisation grant

50 – Involvement in eligible competitive Accelerator Program which has operated for at least 6 months and completed one round

50 – Had third party investment for shares ≥ $50,000

50 – Has rights granted in last 5 years as a standard patent or 25 points for an innovation patent or registered design

25 – Has a written co-development/ commercialisation agreement with eligible research body or research service provider

Principles Test

An alternative to the 100-point innovation test. The company must demonstrate all of the following:

Genuinely focused on developing or commercialising, new or significantly improved products, processes, services, or marketing or organisational methods

High growth potential

Potential to successfully scale that business

Potential to address broader than local markets (such as national or overseas markets)

Potential to have a competitive advantage

Benefits for Investors

20 per cent carry-forward non-refundable tax offset on the amount paid for an eligible investment

Deemed capital gains treatment

10-year exemption on capital gains tax for investments held for at least 12 months

EARLY STAGE VENTURE CAPITAL LIMITED PARTNERSHIPS (ESVCLP’S)

The Early-Stage Venture Capital Limited Partnership program aims to stimulate the early-stage venture capital sector in Australia.

Highly favorable structure as you don’t need to seek investment opportunities yourself and instead appoint a talented team of early-stage investors to complete the research and invest capital on your behalf.

Helps fund managers attract pooled capital, so they can raise new venture capital funds of between $10 million and $200 million to invest in innovative early-stage businesses

Investors in an ESVCLP are exempt from tax on their share of:

Income and gains from eligible early-stage venture capital investments

Income and gains from disposing of eligible venture capital investments

Limited partners receive a non-refundable carry forward tax offset of up to 10% of the value of their eligible contributions.

ESVCLPs no longer have to divest an eligible venture capital investment when the investee’s value exceeds $250 million. The ATO will allow a tax concession based on the ESVCLP’s proportional interest when it does exceed that value.