Market Summary | June 2022

MARKET OVERVIEW

Global equity markets continued to weaken over the June quarter with the MSCI World ex-Australia index down 16.1% in USD terms, taking the annual decline to 14.4%. In AUD terms, the fall in the currency provided some diversification, with the index down 8.4% for the quarter and 6.5% percent for the year.

The dominant theme for markets is that central banks are now clearly focused on high inflation and are prepared to sacrifice growth in pursuit of price stability.

UNITED STATES

The US equity market tumbled to a low of 3,666.77 in mid-June, 23.5% below the early January peak, qualifying as a new “bear market”. By quarter-end the S&P500 had risen to 3,785.38 as “bad news” on the economy started to be accepted as “good news” for equities, that is, the rising risk of the recession began to be reflected in lower bond yields, and the prospect of a pivot from the Fed towards easing policy in 2023.

At the June meeting, the US Fed agreed to lift the Fed funds rate by 0.75% to 1.75%, the largest interest rate increase since 1994, and signalled it would continue lifting rates this year at the most rapid pace in decades.

On the economic data front, the news deteriorated with consumer sentiment falling to record lows, home sales rolling over and real disposable incomes weighed down by rising fuel and food costs. The Atlanta Fed GDPNow model estimate for June quarter GDP was revised to -2.1%, suggesting a technical recession was already underway. As noted above, the weaker economic data and the flow on to commodity prices prompted markets to reassess the degree of policy tightening, and to factor in Fed easing in 2023, leading to a rally in bond yields which, in turn, provided some support to equities.

ASIA

The MSCI Emerging Markets Index declined 12.4% for the quarter. In AUD terms the index was down 3.3% for the quarter as the AUD dropped in a period of risk aversion. For the 12 months, EM in AUD terms was down 18.4%.

The news from China continued to improve with the manufacturing and service sector PMI readings jumping in June to 50.2 (from 49.6) and 54.7 (from 47.8), respectively. Retail sales and production appear to be improving as the country emerges from Covid lockdowns. Low inflation, in contrast to the developed world, has allowed the authorities to ease policy settings in response to a weak economy.

The outlook for EM equities is clouded by some competing forces. Weaker global growth and a stronger USD is typically negative for EM equities. Given the Chinese economy appears to be at a different stage of the cycle and is not currently having to deal with high inflation and indeed, is easing policy, EM equities may prove more resilient. The risk is that the Chinese economy begins to feel the impact of slower global growth via weaker exports or that the authorities return to focus on industry regulation.

EUROPE

In terms of regions. Europe ex-UK was down 17 percent for the quarter, taking the 12-month loss to 23.1%. Germany was one of the worst performers, down 11.3% during the June quarter as recession fears mounted.

AUSTRALIA

For the June quarter, Australian equities have outperformed, down 11.9% compared with -15.1% for hedged global equities. Up until June, strong commodity prices had lured investors to hedge some inflation risk by investing in the materials and energy-heavy Australian equity market. The bank sector had also benefited from the rising rate outlook globally. However, with global central banks and now, the RBA, willing to sacrifice growth in the pursuit of price stability, attention turned to the rising risk of global recession and to the risks posed by rising interest rates on heavily indebted Australian households and the domestic bank sector.

For the quarter, the bank sector dropped 15.6% as investors focussed on the potential impact on house prices and households of rapid increases in mortgage rates. Indeed, house prices have dropped in the last two months after rising more than 20% over the previous year. The materials sector was down 16.1% for the quarter as declining iron ore (off 19% for the quarter) and metals (down 20-30%) undermined the earnings outlook. Consumer discretionary and REITs were also a major drag on the market as rising real and nominal rates undermined growth and valuations. For the quarter the only places to hide were insurance, utilities, infrastructure, and energy.

On the economic front, under the weight of rising mortgage rates, consumer sentiment dropped to its lowest level since the early stages of the pandemic. The labour market remains tight with a 13.8% rise in job vacancies almost matching the number of unemployed. As noted above, house prices have begun to slide and with finance approvals weakening and mortgage rates expected to rise by up to 200 basis points, further declines seem highly likely.

The RBA delivered consecutive cash rate hikes during the quarter, 0.25% in May, and a greater than expected 0.5% in June. These were the first rate hikes since 2010. The RBA noted “The resilience of the economy and the higher inflation mean that this extraordinary support is no longer needed”. Perhaps more importantly, the statement also said, “The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time”. This shift in language prompted a surge in bond yields and a realisation that the Australian economy, extremely sensitive to rising rates due to the importance of housing and the high levels of household debt, was at risk of a significant slowdown.

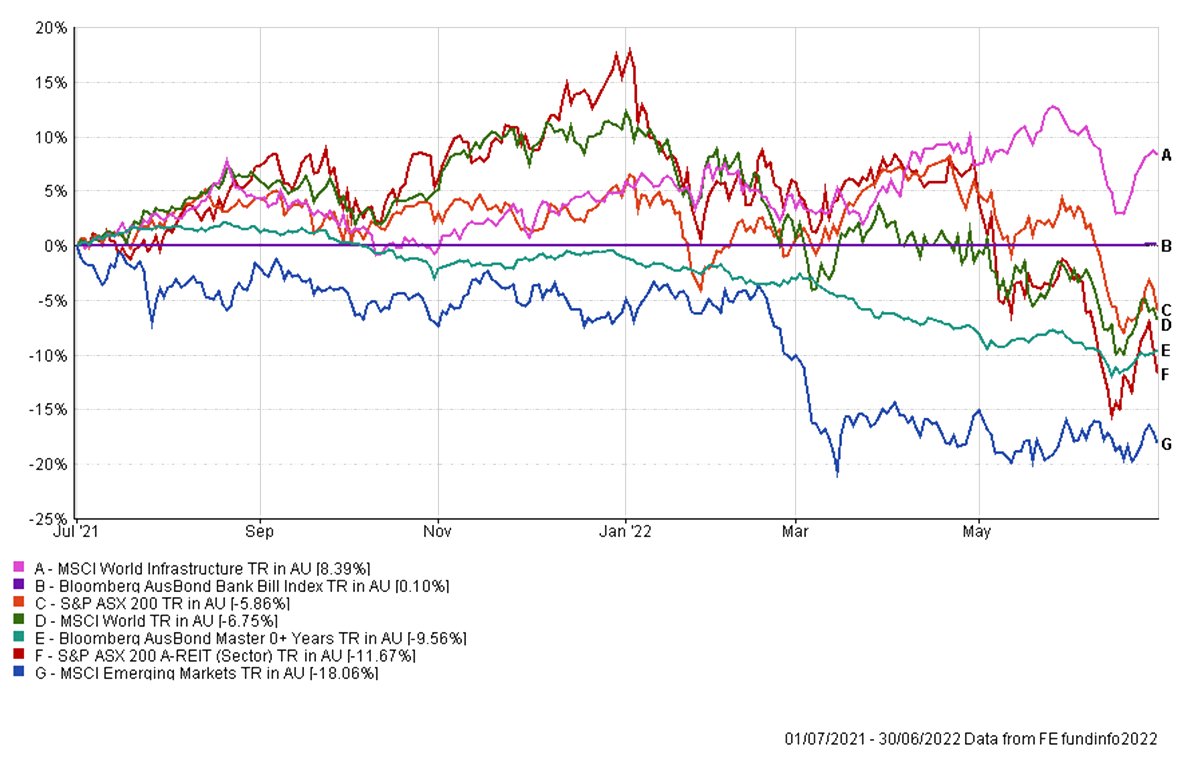

ASSET CLASS RETURNS (LAST 12 MONTHS)

The above graph summarises the performance of the major financial markets and gives you an indication of how these markets performed over the last 12 months. The graph does not reflect your actual portfolio performance.

*Source Zenith Investment Partners